Innolight (300308.SZ) Hot Analysis: Leading Performance and International Layout Driven by AI Computing Power

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

As a global leader in the optical module industry, Innolight (300308.SZ) focuses on high-end optical communication transceivers (400G/800G/1.6T), whose products are applied in cloud computing data centers, 5G networks, and AI computing power infrastructure [0]. In 2025, the company’s stock price performed strongly: on November 26, it hit a record high of 556.88 yuan per share, closed at 543.22 yuan per share, with market capitalization exceeding 600 billion yuan and a cumulative annual increase of 339.82% [0][1].

- Explosion in AI Computing Power Demand: The global expansion of AI infrastructure has driven a surge in demand for optical modules, and the company, as a core supplier, has benefited significantly [4][7].

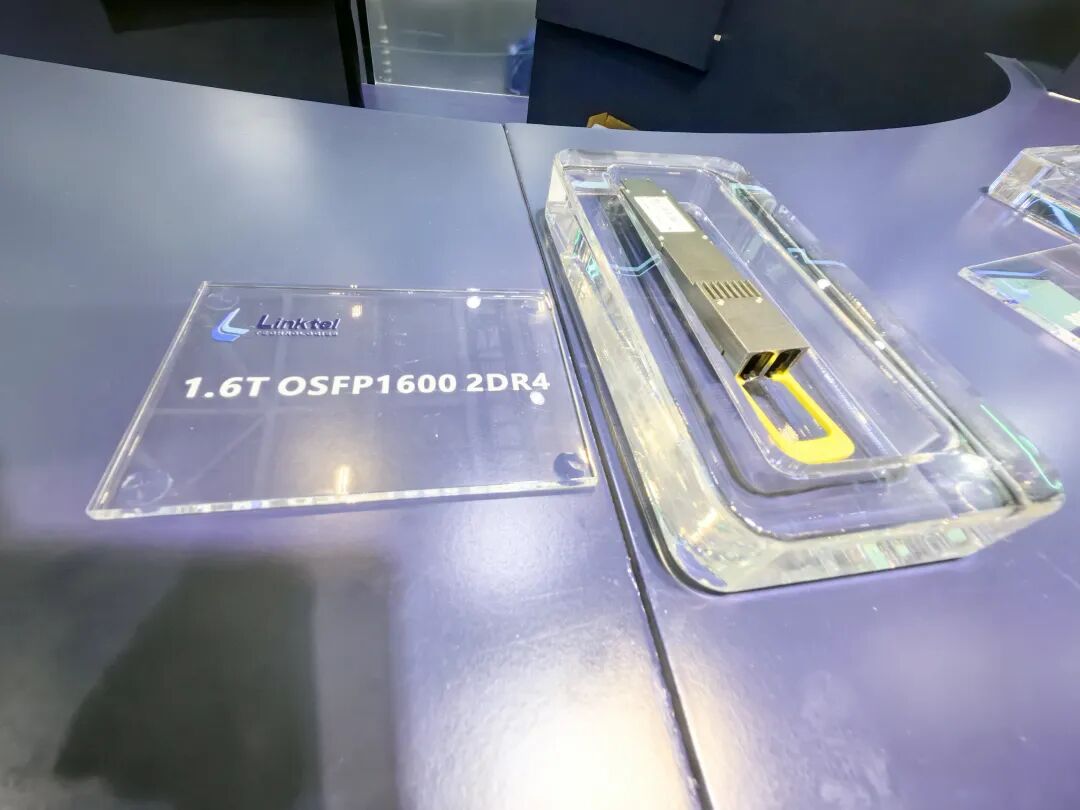

- Deep Cooperation with Google: The company is a core optical module supplier for Google, with an 800G product share exceeding 50%, and its 1.6T product has entered the joint testing phase [2][4].

- International Layout: In November 2025, it announced plans to list on the Hong Kong H-share market to promote global strategic layout [3].

- Technological Leading Edge: The 1.6T optical module has started small-batch shipments and is expected to achieve mass production in 2025, seizing the first-mover advantage in the next-generation product market [0][8].

In H1 2025, the company’s revenue was 14.789 billion yuan (+36.95% YoY), net profit was 3.995 billion yuan (+69.4% YoY), gross profit margin increased to 39.96%, and global market share remained in the range of 25%-30% [0]. JPMorgan raised the company’s profit forecast for 2026-2027 and maintained the ‘Overweight’ rating [8].

- Strong Correlation Between AI and Optical Modules: The exponential growth in AI computing power demand directly drives the demand for high-end optical modules (especially 800G/1.6T), and as an industry leader, the company fully benefits from the industry dividend [4][7].

- Global Customer Cooperation Builds Moat: Deep cooperation with North American cloud giants like Google not only brings stable orders but also enhances the company’s leading position in technological R&D [2][4].

- Strategic Significance of 1.6T Products: As the next-generation mainstream product, the company’s first-mover advantage in 1.6T optical modules will consolidate its market position and become the core engine for future growth [0][8].

- Long-Term Value of International Layout: The Hong Kong listing plan will help the company expand global financing channels and further increase its international market share [3].

- Intensified Market Competition: Other optical module manufacturers are accelerating technological R&D, which may divert market share [0].

- Technology Iteration Risk: Although JPMorgan predicts that CPO (Co-Packaged Optics) technology will delay its market impact until 2027, long-term attention to technology substitution risk is still needed [8].

- Supply Chain Fluctuations: Uncertainties in the global semiconductor supply chain may affect the progress of capacity expansion [0].

- Sustained Expansion of AI Computing Power: The global boom in AI data center construction will continue to drive demand for high-end optical modules [4][7].

- Volume Release of 1.6T Products: The mass production of the company’s 1.6T products will open up new growth space [0][8].

- Accelerated Internationalization Process: After listing in Hong Kong, the company is expected to attract more international capital attention and enhance brand influence [3].

As a global leader in the optical module industry, Innolight has achieved significant growth in stock price and market capitalization since 2025, driven by multiple favorable factors such as the explosion in AI computing power demand, core customer cooperation, technological leadership, and international layout. The company has strong financial performance with steadily improving gross profit margin and stable global market share. In the future, the mass production of 1.6T products and the Hong Kong listing plan will be key factors driving the company’s long-term development. Investors should pay attention to the progress of the company’s technological R&D, customer cooperation dynamics, and the advancement of international layout.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.