Analysis of Insider Dip Buying Strategy Performance and Market Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

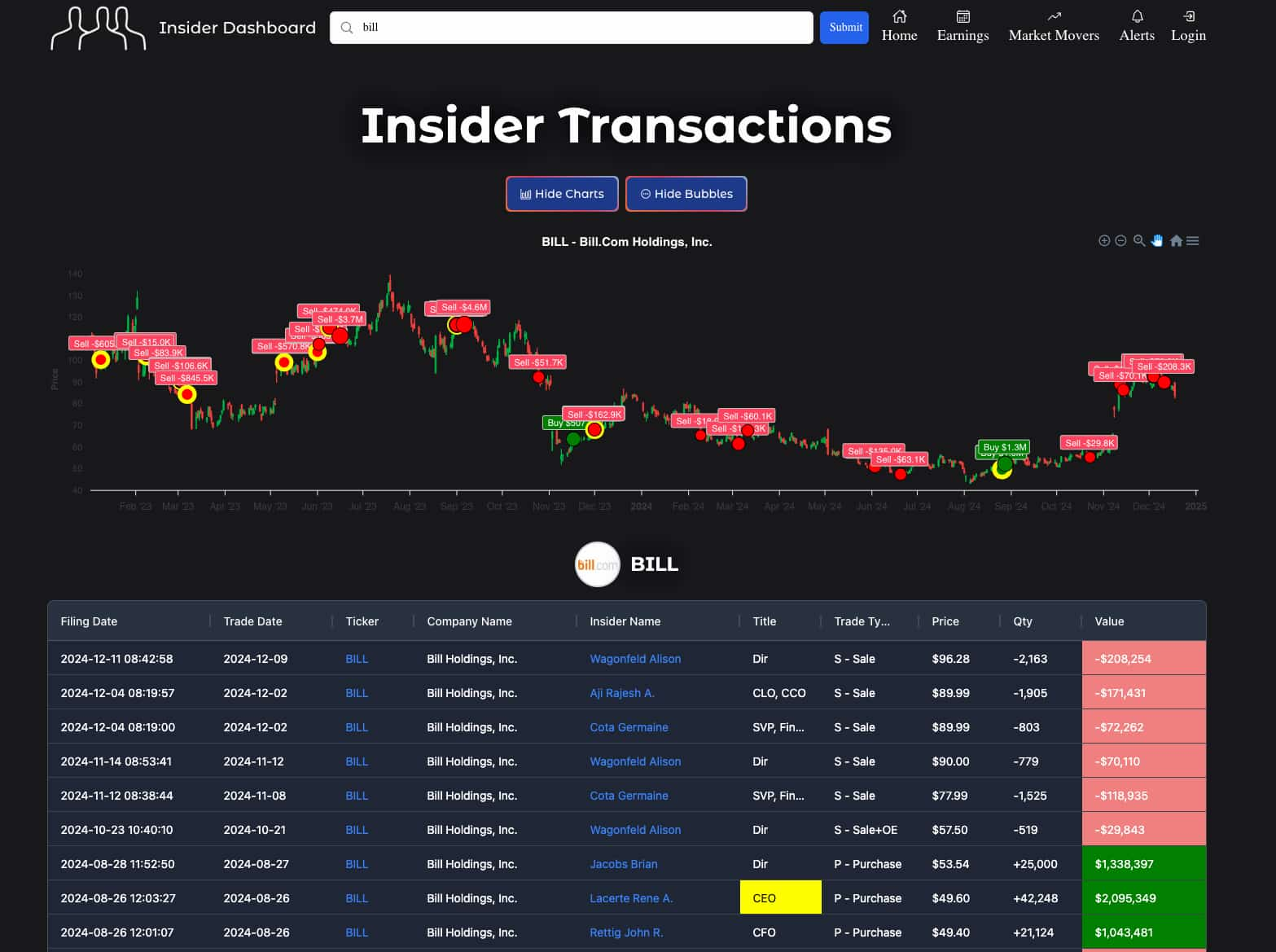

This analysis is based on a Reddit post [7] published on 2025-11-25 investigating whether stocks outperform when insiders buy the dip, combined with market data and academic studies. The Reddit post found that insider purchases during 10-30% stock drawdowns significantly outperform the S&P500 over the subsequent year but exhibit higher volatility and lower win rates compared to the index. Concurrent with this analysis, corporate insiders were buying the dip at the fastest pace since May 2025 amid a 2.9% November decline in the S&P500 [1][3].

Historical data from an Elon University study [2] shows that stocks with insider buys had mean returns of 3.97% (1mo),21.10% (6mo),49.08% (1y) versus the S&P500’s3.24%,16.91%,36.65%—though these returns were not statistically significant. Insider portfolios also had higher volatility (7.70% 1mo std dev vs. S&P’s3.34% [2]). A 2025 ScienceDirect study [4] highlighted scalability issues: while percentage returns are positive, USD returns can turn negative due to liquidity constraints for large positions.

The Reddit discussion presented three key perspectives: bearish (lower win rate than S&P makes the strategy unattractive), bullish (higher upside justifies risk as insiders have fundamental insights), and neutral (S&P is safer for risk-averse investors [7]).

- Risk-Reward Trade-off: Insider dip buying offers higher long-term returns but requires tolerance for increased volatility and lower win rates.

- Scalability Limitation: The strategy is not viable for large portfolios due to liquidity issues [4].

- Statistical Validity: Outperformance may not be statistically significant, suggesting potential random variation [2].

- Sentiment Indicator: Recent surge in insider buying could signal a market floor but does not guarantee immediate recovery [1][3].

- Volatility risk: Higher std dev increases short-term loss likelihood [2]

- Win rate risk: More frequent losing positions despite higher long-term returns [7]

- Statistical significance risk: Outperformance may be due to chance [2]

- Scalability risk: Liquidity issues for large portfolios [4]

- Market timing risk: Insiders lack market timing expertise [1][3]

- Potential outperformance for risk-tolerant investors (2-3x S&P returns [7])

- Recent insider buying as a sentiment indicator to monitor for market recovery signals [1][3]

Insider dip buying strategy shows higher long-term returns (per Elon study [2]) but with higher volatility and lower win rates compared to the S&P500. Recent surge in insider buying (fastest since May [1][3]) amid 2025 market pullback is a notable sentiment indicator. However, the strategy faces scalability constraints and possible statistical insignificance. Investors should consider their risk tolerance and portfolio size when evaluating this strategy, monitoring insider activity via SEC Form4 filings [6] and liquidity metrics [4].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.