Meta's Potential Adoption of Google TPUs: Impact on GOOG, NVDA, and META

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 24, 2025 (EST), a Reddit discussion highlighted key market claims related to Alphabet Inc. (GOOG), NVIDIA Corporation (NVDA), and Meta Platforms (META) [Original Event Source: Reddit Discussion, 2025-11-24 EST]. The discussion centered on:

- GOOG’s impressive 6-month rally (~100% gain) and potential continuation;

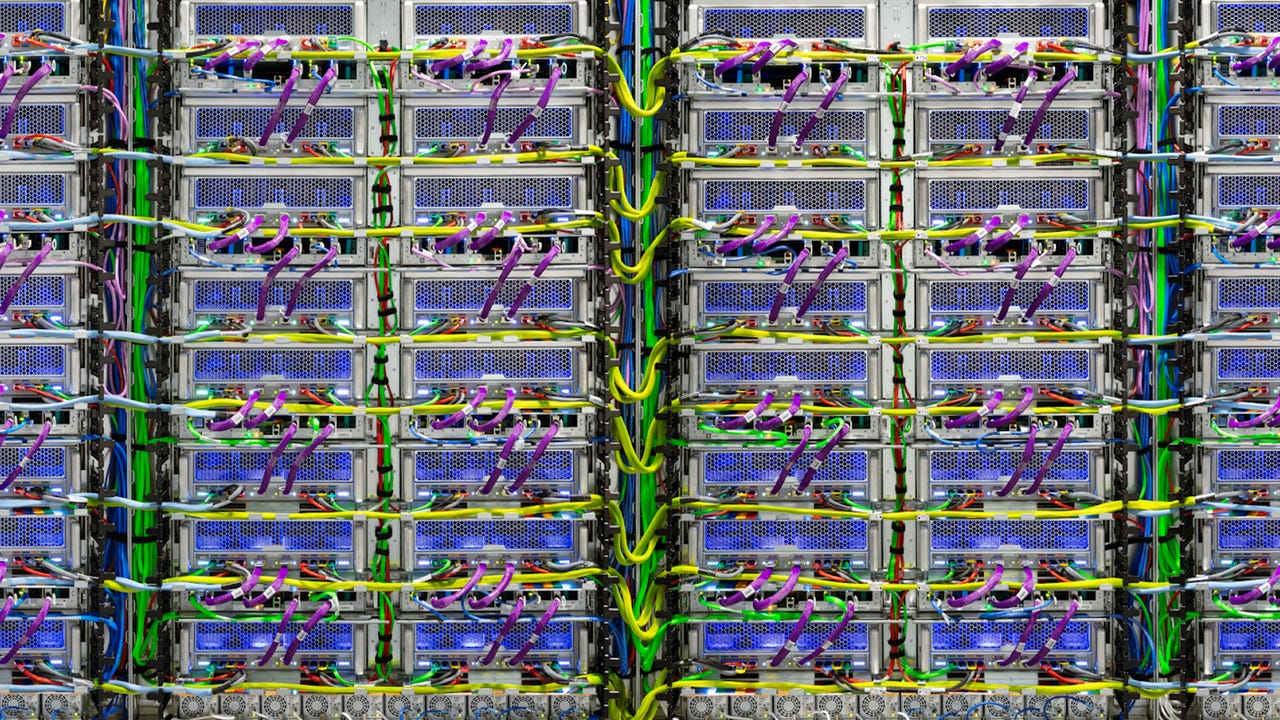

- Meta’s consideration of deploying Google’s Tensor Processing Units (TPUs) in its data centers, which could reduce its reliance on NVIDIA GPUs;

- GOOG’s after-hours (AH) surge to $327 on November 24 due to this news, and bearish implications for NVDA.

External verification from Wall Street Journal reports confirms Meta is in talks to use Google’s TPUs as a competitive alternative to NVIDIA’s chips [1][2]. The potential deal could impact Meta’s cost structure and shift market share in the AI hardware sector.

On the event day (November 24, 2025), all three stocks posted gains in regular trading:

- GOOG closed at $318.47, up 2.40% [0];

- NVDA closed at $182.55, up 1.70% [0];

- META closed at $613.05, up 2.39% [0].

The Reddit summary noted GOOG’s AH surge to $327 (~2.4% gain post-market), aligning with bullish sentiment around the TPU deal [Original Event Source]. NVDA’s AH decline (~2.05%) was cited as a bearish reaction to potential customer loss [Original Event Source].

If Meta proceeds with Google’s TPUs:

- GOOG: Could gain significant revenue from Meta’s data center chip orders, expanding its AI hardware market share beyond cloud services.

- NVDA: Risk of losing a major customer (Meta) if the transition reduces its GPU purchases.

- META: Potential cost savings (as per Reddit claims of “massive EPS boost”) from lower chip costs compared to NVIDIA’s GPUs [Original Event Source].

Recent price movements (November 26 close) show mixed trends: GOOG (-1.04% to $320.28), NVDA (+1.37% to $180.26), and META (-0.41% to $633.61) [0], indicating market uncertainty about the deal’s finalization.

| Metric | GOOG | NVDA | META |

|---|---|---|---|

| Nov24 Close Change | +2.40% | +1.70% | +2.39% |

| Nov26 Close Price | $320.28 | $180.26 | $633.61 |

| Market Cap (Nov26) | $3.87T | $4.39T | $1.60T |

| 52-Week High | $328.67 | $212.19 | $796.25 |

| 52-Week Low | $142.66 | $86.62 | $479.80 |

Source: [0] (Internal Market Data Tools)

- Directly Impacted Stocks: GOOG (Alphabet), NVDA (NVIDIA), META (Meta Platforms).

- Related Sectors:

- AI Hardware: Competitive shift between Google’s TPUs and NVIDIA’s GPUs.

- Cloud Computing: Google Cloud benefits from TPU adoption by Meta.

- Social Media: Meta’s cost optimization could improve profitability.

- Supply Chain: Potential reduction in demand for NVIDIA’s GPUs from Meta, affecting upstream component suppliers.

- Deal Status: Is the Meta-Google TPU deal confirmed, or still in talks?

- Order Size: How much of Meta’s chip budget would shift to Google’s TPUs?

- Cost Savings: What is the exact EPS impact for Meta from switching to TPUs?

- NVIDIA’s Response: Will NVIDIA adjust pricing or offer custom solutions to retain Meta as a customer?

- NVDA: Customer concentration risk—losing Meta could reduce revenue growth. Users should monitor NVIDIA’s customer retention strategies [Risk Warning].

- GOOG: Deal execution risk—delays or cancellation of the Meta partnership could reverse recent gains.

- META: Transition risk—switching to TPUs may require significant data center reconfiguration costs, offsetting short-term savings.

- Official announcements from Meta or Google regarding the TPU deal.

- NVIDIA’s earnings calls for updates on customer relationships.

- Meta’s quarterly reports for cost structure changes related to AI chips.

- Long-term price trends for GOOG, NVDA, and META to gauge market sentiment.

[0] Internal Market Data Tools (Real-Time Quotes and Daily Price Data).

[1] Wall Street Journal: “Meta Is in Talks to Use Google’s Chips in Challenge to Nvidia” (2025). URL: https://www.wsj.com/business/autos/trump-metal-tariffs-auto-industry-c964a59a?page=1.

[2] Wall Street Journal: “Ford, GM Step Into Chip Business” (2025). URL: https://www.wsj.com/business/autos/ford-enters-semiconductor-business-amid-chip-shortage-impact-11637242202.

Original Event Source: Reddit Discussion (Ticker: GOOG), 2025-11-24 EST.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.