Analysis of Basis & Carry Trade Unwind Risks Impacting SPY (2025-11-26)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

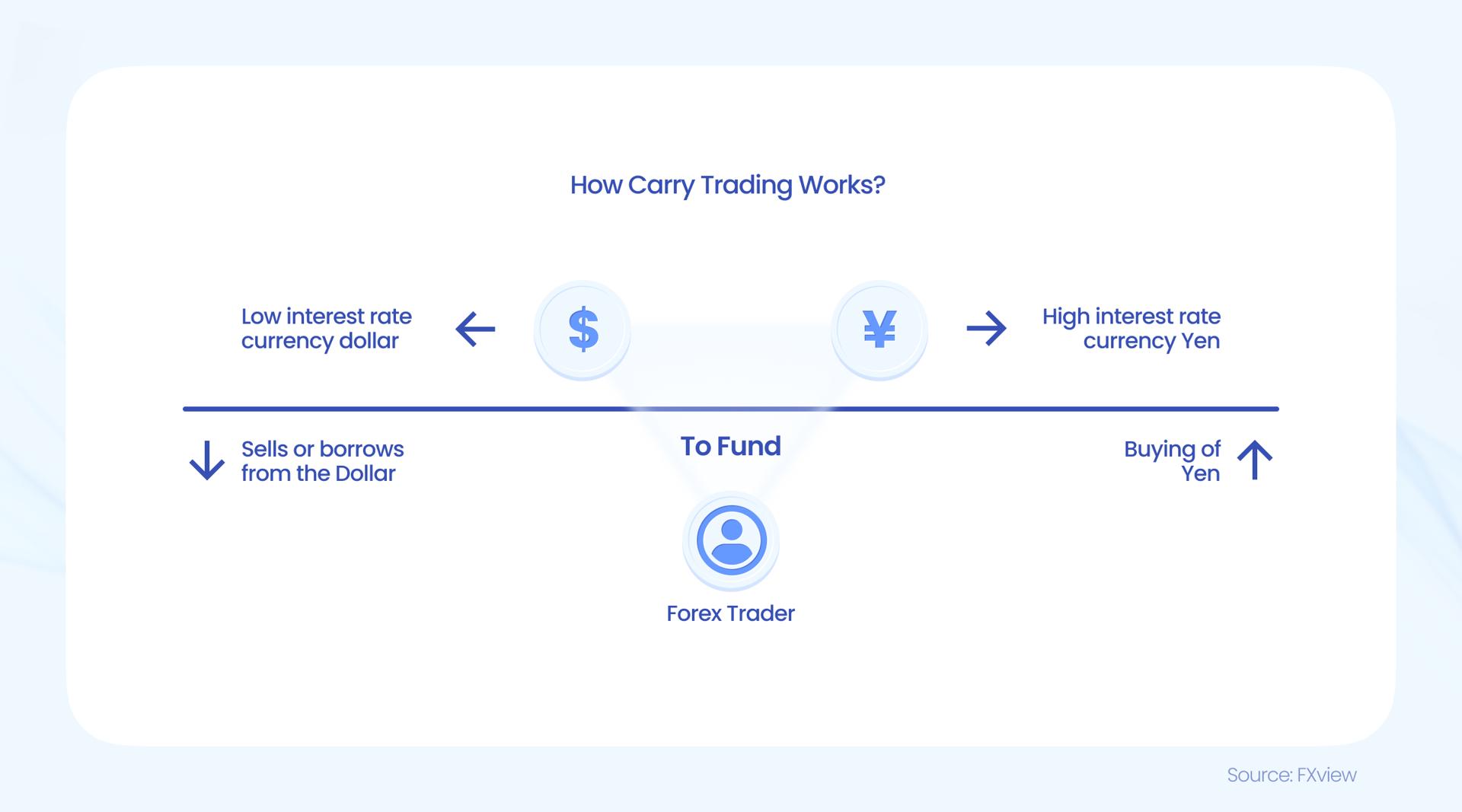

On November 26, 2025, a Reddit discussion highlighted concerns over basis and carry trade unwinds impacting SPY [0]. SPY experienced a sharp -3.03% drop on Nov20 (volume:165.29M, highest in 10 days) followed by partial recovery (+0.30% Nov26), indicating sensitivity to liquidity and trade risks [0]. Defensive sectors like Energy (+1.77%) outperformed, reflecting investor risk aversion [4]. Carry trade profitability is declining due to narrowing US-BOJ spreads (~425bps July2025), increasing unwind risks [2]. Fed officials flagged leveraged basis trades as a threat to the $30T Treasury market [3].

- Cross-Domain Impact: BOJ rate hike expectations link to US Treasury volatility and SPY performance.

- Defensive Rotation: Energy sector outperformance signals early risk aversion amid liquidity concerns.

- Data Gaps: Exact repo injection size and current basis trade positions remain unverified, limiting full risk assessment.

- Systemic Risk: Abrupt basis trade unwind could destabilize Treasuries and trigger SPY declines [3].

- Liquidity Stress: Thin holiday trading may amplify volatility if liquidity tightens [1].

- Carry Trade Unwind: BOJ policy shifts could lead to Japanese investors selling US Treasuries [2].

- Defensive Exposure: Energy and Consumer Defensive sectors offer relative safety [4].

- Fed Intervention: Potential liquidity measures may stabilize markets during stress [1].

SPY volatility spiked on Nov20 with high volume [0]. Defensive sectors outperformed [4]. Carry trade spreads are narrowing [2], and basis trade risks are flagged by Fed officials [3]. Data gaps include repo injection size and current trade positions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.