Tesla Stock Movement Analysis: Melius 'Must Own' Call, AI Chip Progress, and Bearish Counterarguments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

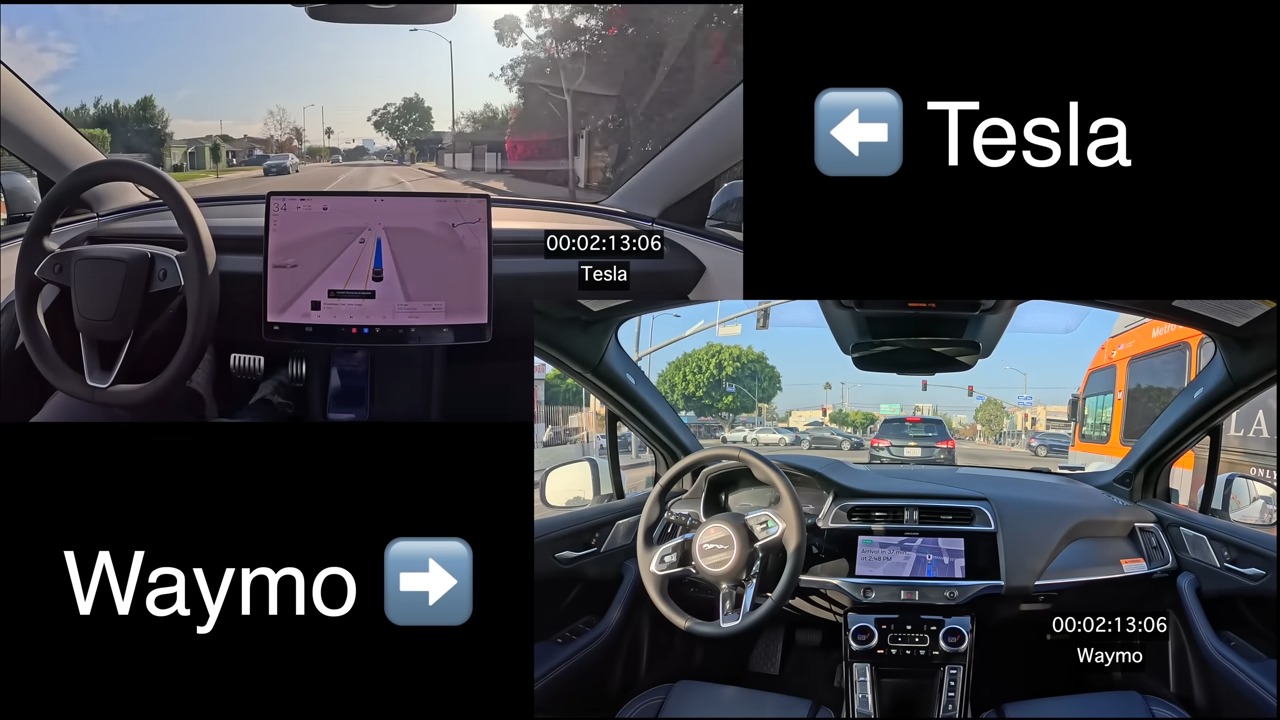

The event centers on a Reddit post [1] linking to a Yahoo News article where Melius Research called Tesla (TSLA) a ‘must own’ due to Full Self-Driving (FSD) and AI chip progress, leading to a 3.88% daily gain and 6% 5-day performance [2][3]. Tesla’s FSD has logged 6 billion miles (62x Waymo’s ~100M) with ~800k users, but Waymo operates fully driverless in 5 U.S. cities [4]. Musk announced AI5 chip nearing tape-out and AI6 in development [5]. Financials show a stretched P/E ratio of 259x and net margin of 5.55% [3], though energy storage revenue surged by 80% YoY [6]. Sales trends include an 8.4% YTD decline in China [7] and Volkswagen’s tripled EV sales in Europe [8]. Bearish Reddit arguments highlight FSD overhyped vs Waymo, financial decline claims, 7% pop skepticism, and repetitive narratives.

Cross-domain connections emerge: AI chip progress is critical for FSD advancement, while Tesla’s large FSD user base provides data advantage but lags Waymo’s regulatory edge. Energy storage growth diversifies Tesla beyond EVs amid sales declines. Mixed sentiment reflects Reddit’s bearish concerns vs bullish catalysts from Melius and AI chip progress.

Tesla’s stock gained 3.88% on Nov24 and6% over 5 days. FSD has 6B miles vs Waymo’s100M, but Waymo operates driverless in5 cities. AI5 chip is near tape-out. Financials: P/E 259x, net margin 5.55%, energy storage up 80% YoY. Sales: China down 8.4% YTD, Europe VW tripled sales. Bearish Reddit arguments include FSD overhyped, 7% pop skepticism, repetitive narratives.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.