The Calm Before the Storm Part 3: Contrasting Market Perspectives

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

- According to StoneX, the current market calm may be fleeting amid a potential volatile economic backdrop [4].

- Fixed income volatility has fallen to a three-year low, with the VIX index in a vigilance range and State Street Risk Appetite Index positive [8].

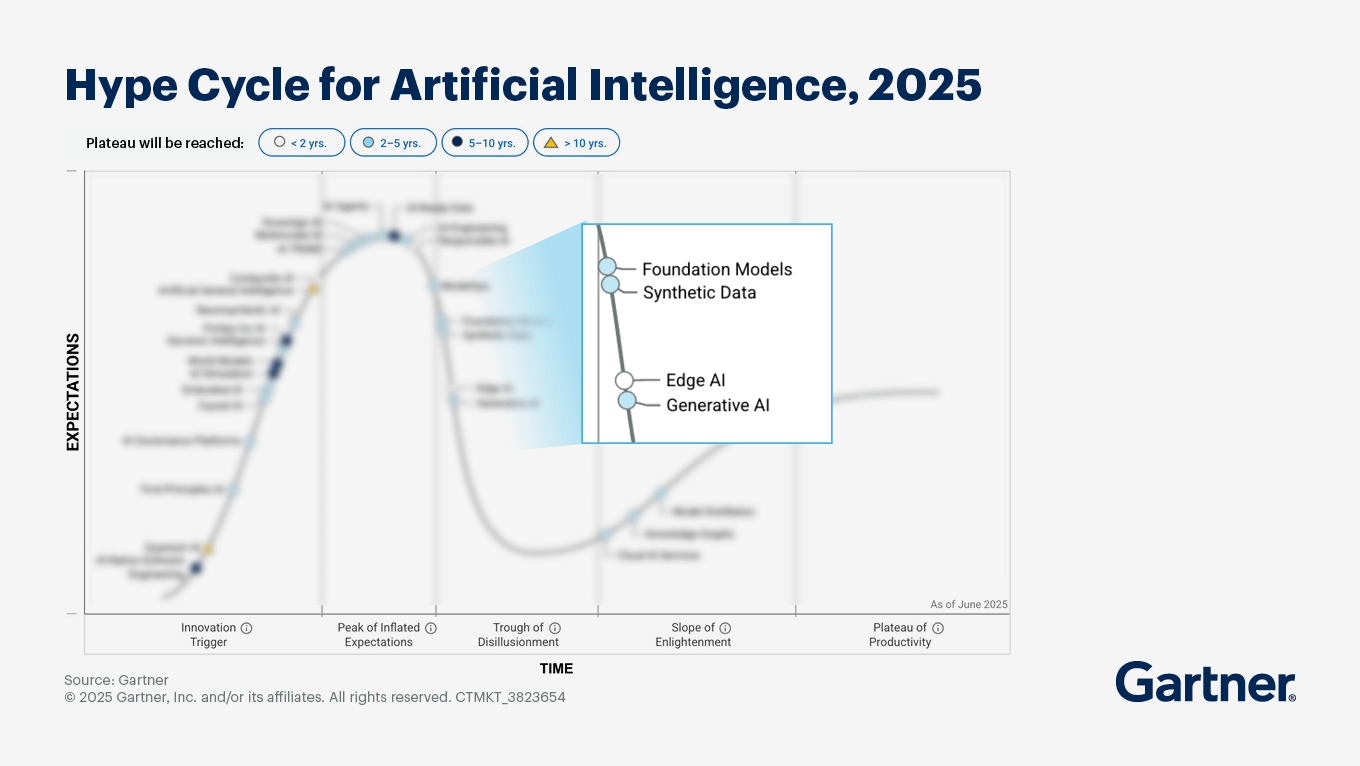

- Morgan Stanley highlights high yield municipal markets anticipating policy changes and economic stimulus [1], while Hugging Face warns of an AI market hype bubble [2].

- Experts like Buffett emphasize that market volatility is normal, and successful investors rely on patience and sound principles [9].

- Reddit user: Bearish posts like this indicate the market bottom was reached last week, as seen in past patterns [11].

- Long-term investor: “I’ve got 25 years left to retire, so I’ll just keep buying” despite market noise [11].

- AI advocate: AI drives innovation across sectors (hyperscalers, pharma) and is a long-term positive trend [11].

- Critic: The post lacks macro data, making it uninformative for data-driven investors [11].

Research and social media agree on AI’s long-term potential but diverge on near-term market direction: research warns of transient calm and AI hype, while social media signals a possible bottom and advocates long-term buying. Investors should balance research insights (data on volatility, policy changes) with social media sentiment (market psychology) but prioritize data-driven decisions (as critics note). The key takeaway is to adhere to long-term principles amid conflicting signals, as emphasized by both experts and long-term investors.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.