Analysis Report: Meta-Google TPU Talks Impact on GOOG and NVDA Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On

- GOOG: The AH jump to $327 reflected investor optimism about Google’s expanding AI chip market share, though subsequent trading saw a partial reversal to $320.28 (-1.04% from previous close) [0].

- NVDA: The AH decline of ~2.05% signaled concerns over potential loss of Meta’s GPU orders, but NVDA rebounded 1.37% to $180.26 in subsequent sessions [0].

- GOOG: From September 15 to November 24, GOOG rallied29.91%(from $245.14 to $318.47), driven by AI momentum (e.g., Gemini 3 reception) and the Meta TPU news [0].

- NVDA: Over the same period, NVDA’s gain was muted at3.92%(from $175.67 to $182.55), indicating growing competition pressure [0].

- Bullish for GOOG: The Meta TPU talks validate Google’s AI chip capabilities and open new revenue streams beyond cloud services [1].

- Cautious for NVDA: Investors are re-evaluating NVDA’s dominance in AI chips, with Google emerging as a credible competitor [2].

| Metric | GOOG | NVDA | Source |

|---|---|---|---|

Period Change (Sep15-Nov24) |

+29.91% | +3.92% | [0] |

Current Market Cap |

$3.87T | $4.39T | [0] |

Average Daily Volume |

23.12M | 193.53M | [0] |

P/E Ratio |

31.65 | 44.62 | [0] |

52-Week High |

$328.67 | $212.19 | [0] |

Notable Observations:

- GOOG’s rally outpaces NVDA’s, reflecting shifting investor preference toward Google’s AI chip strategy.

- NVDA’s higher P/E ratio suggests investors still price it at a premium, but competition risks are mounting [2].

-

Directly Impacted Stocks:

- GOOG: Beneficiary of potential Meta TPU orders.

- NVDA: At risk of losing Meta’s GPU business.

-

Related Sectors:

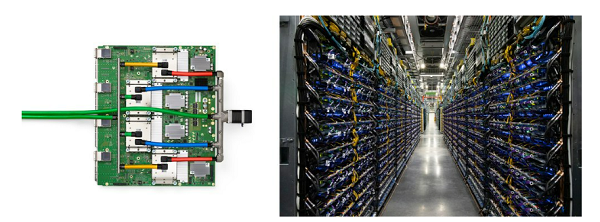

- AI Chipmakers: Competitive dynamics between Google (TPUs) and NVDA (GPUs) intensify.

- Cloud Computing: Google Cloud’s TPU offerings gain traction.

- Social Media: Meta’s cost savings from TPUs could boost profitability [1].

-

Supply Chain:

- Upstream: Google’s TPU manufacturing partners (e.g., TSMC) may see increased demand.

- Downstream: Meta’s data centers could reduce NVDA GPU procurement if the deal is finalized.

- Deal Validity: Confirm the stage of Meta-Google negotiations and potential order size [1].

- Meta’s GPU Reliance: Quantify Meta’s current NVDA GPU usage to assess impact of a switch to TPUs [3].

- Google’s TPU Capacity: Determine if Google can scale production to meet Meta’s demands [1].

- Deal Finalization: Track formal agreements and terms (volume, pricing) [1].

- NVDA’s Response: Observe efforts to retain Meta (e.g., discounts, newer chips like Blackwell) [2].

- GOOG’s Valuation: Monitor if the rally is sustained or faces a pullback [0].

-

Competition Risk for NVDA:

Users should be aware that Google’s TPU expansion could erode NVDA’s market share over time [2]. -

Overvaluation Risk for GOOG:

GOOG’s 29.91% rally raises concerns about overvaluation if the Meta deal does not materialize [0]. -

FOMO Behavior:

Reddit users mention FOMO to buy GOOG shares—investors should avoid impulsive decisions, as rumor-driven spikes can reverse quickly [original event context].

[0] Ginlix Analytical Database (Market Data Tools: get_stock_realtime_quote, get_stock_daily_prices)

[1] Wall Street Journal: Meta Is in Talks to Use Google’s Chips in Challenge to Nvidia (URL: https://www.wsj.com/articles/SB10001424127887324183204578567410469034722?gaa_at=eafs…).

[2] GuruFocus: Nvidia Declares Its GPUs ‘A Generation Ahead’ After Google TPU Shockwave (URL: https://www.gurufocus.com/news/3225771/nvidia-declares-its-gpus-a-generation-ahead-after-google-tpu-shockwave).

[3] Business Insider: Nvidia’s Bumpy November (URL: https://www.businessinsider.com/nvidia-november-challenges-google-michael-burry-ai-bubble-fears-2025-11).

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.