Meta's Potential Google TPU Adoption: Market Impact on GOOG, META, and NVDA

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

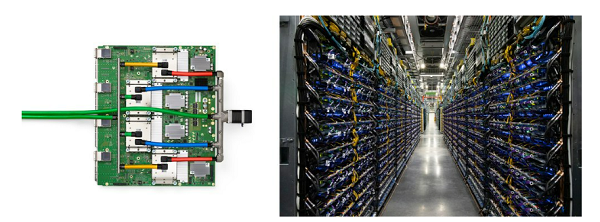

Meta Platforms (META) is negotiating to deploy Google’s Tensor Processing Units (TPUs) starting in 2027, a move that challenges NVIDIA’s (NVDA) AI chip dominance [1]. GOOG shares rose ~2% in after-hours trading on November 24, 2025, while NVDA fell ~2.05% AH [2]. GOOG has rallied ~52% since mid-September due to Gemini 3’s reception, with NVDA maintaining a $520B market cap lead over GOOG [0]. The deal’s timeline (2027 deployment) and potential billions in spending highlight Google’s TPU credibility [5]. Meta’s interest in TPUs stems from cost savings, which could boost EPS [2].

- Cross-Domain Validation: Meta’s consideration of TPUs validates Google’s AI chip tech, opening doors to other large tech customers [3].

- NVDA Resilience: NVDA’s recovery post-AH dip underscores CUDA ecosystem lock-in, limiting TPU adoption to few players [0].

- META’s Dual Impact: Cost savings from TPUs may boost EPS, but transition costs could offset short-term gains [6].

- GOOG: Opportunity to expand TPU revenue via large tech clients; risk of limited adoption due to CUDA lock-in [3].

- NVDA: Risk of competitive erosion from TPUs; opportunity to retain market share via ecosystem strength [6].

- META: Opportunity for cost savings; risk of infrastructure transition challenges [1].

- Price Movements: GOOG closed at $320.28 (-0.16% Nov 26), META at $633.61 (-0.64%), NVDA at $180.26 (-0.75%) [0].

- Market Caps: GOOG ($3.87T), META ($1.60T), NVDA ($4.39T) [0].

- Timeline: Meta’s TPU deployment expected in 2027, with potential Google Cloud rentals in 2026 [1].

This summary provides objective context for decision-making without prescriptive recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.