Tesla (TSLA) Stock Movement Analysis: Melius 'Must Own' Call & AI Chip Progress Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

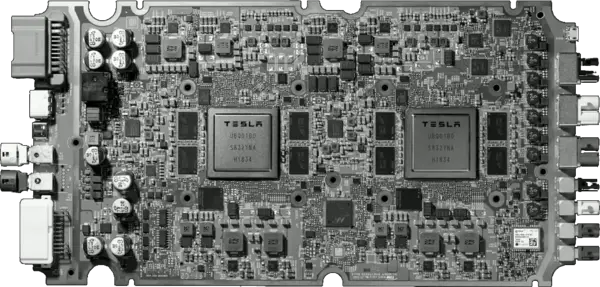

This analysis is based on a Yahoo News article linked via Reddit [1], where Melius Research called Tesla (TSLA) a “must own” due to Full Self-Driving (FSD) and AI chip progress, alongside Elon Musk’s AI chip comments. The event was reported to lead to a 7% stock pop, though internal data shows TSLA gained 3.88% on Nov 24 (event date) with elevated volume (96.81M) [0]. The 5-day performance was +6.03% [0]. Bullish sentiments focus on FSD and AI chips as long-term revenue drivers [1][2], while bearish views highlight overvaluation (P/E ratio of 259.24x [0]), unfulfilled promises (Optimus robots, robotaxi deployment [3]), and FSD competition from Waymo.

Cross-domain connections emerge: AI chip progress directly ties to FSD’s value proposition, central to Melius’ bullish call. The stock’s reaction underscores investor sensitivity to AI-related news, even amid persistent bearish concerns. The divide between bullish long-term potential and bearish execution gaps creates mixed market sentiment.

- Risks: High valuation (P/E 259.24x) leaves little room for disappointment [0]; execution risks for unfulfilled product promises [3]; regulatory scrutiny of FSD [4]; competition from Waymo.

- Opportunities: FSD and AI chips as transformative revenue streams [1][2]; potential robotaxi fleet expansion (Austin teased [3]).

Tesla’s stock reacted positively to Melius’ call and Musk’s AI comments, with internal data showing a 3.88% gain on Nov24. Key metrics include a 259.24x P/E ratio, 96.81M volume on event day, and +6.03% 5-day performance. Investors should monitor FSD regulatory approvals [4], AI chip milestones [1], and execution of product promises [3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.