2026 S&P500 Price Targets: Wall Street Bullish Projections vs. Market Cycle Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Wall Street firms have released bullish 2026 S&P500 price targets, including Deutsche Bank’s 8000, JPMorgan’s7500+, and Morgan Stanley’s7800 [1]. These projections are supported by expectations of robust earnings growth (driven by AI investment cycles), Federal Reserve rate cuts, and policy support [1]. As of November26,2025, the S&P500 index closed at 6812.60, up1.85% over the past30 days [0]. Sector performance shows Energy leading with +1.76% gains, while Technology (a key AI sector) saw a modest +0.15% increase—indicating mixed sentiment toward the AI narrative [0]. Rate cut expectations are high: the CME FedWatch tool implies a98% probability of a25bp cut this week [2], which aligns with the bullish outlook as lower rates typically boost equity valuations. However, Reddit users critique Wall Street’s inconsistent stance on AI bubbles (shifting from doom warnings to bullish targets) and question the reliability of moving price goalposts.

- AI Narrative vs. Sector Performance: The modest Tech sector growth (+0.15%) contrasts with the strong AI-driven bullish targets, suggesting investors may be cautious about unproven AI earnings [0].

- Rate Cut Pricing: The98% rate cut probability [2] indicates most of the expected policy easing is already priced into current index levels—leaving limited upside if cuts materialize as expected.

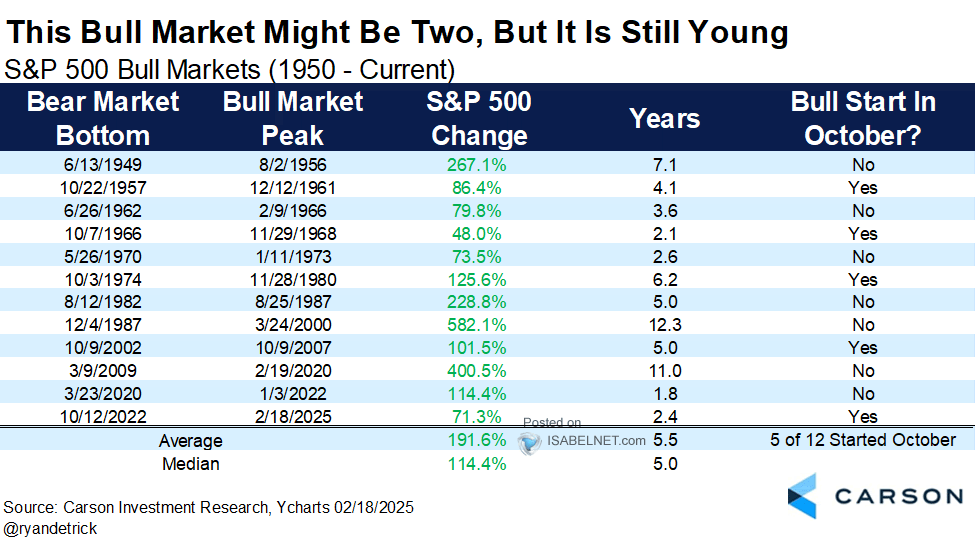

- Historical Cycle Gap: Reddit users’ focus on historical tech boom corrections (e.g.,2000 dot-com crash) highlights a disconnect between Wall Street’s “new bull market” narrative and long-term cycle risks.

- Historical Correction Risk: Tech-driven booms have historically led to significant corrections—investors should be aware of this cycle risk.

- Rate Cut Disappointment: Any deviation from expected rate cuts (e.g., no cut or smaller cut) could trigger volatility and push the index lower [2].

- Unreliable Targets: Wall Street’s shift from AI bubble warnings to bullish targets raises concerns about the credibility of long-term projections.

- Earnings Growth: If AI investments translate into sustained earnings growth, the index could meet or exceed the8000 target [1].

- Rate Cut Tailwinds: Confirmation of rate cuts may provide short-term support to equity valuations [2].

- Current S&P500 Level:6812.60 (up1.85% over30 days) [0].

- 2026 Target Range:7500–8000 (Wall Street firms) [1].

- Required Annualized Gain:~17.4% to reach 8000 from current levels.

- Rate Cut Probability:98% for 25bp cut this week [2].

- Top Sector: Energy (+1.76%) [0]; Tech sector (+0.15%) lags despite AI narrative.

Note: Reddit post content is user-generated and should be interpreted with caution.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.