Tesla Stock Movement Analysis: Melius 'Must Own' Call vs Bearish Reddit Sentiment (Nov 24, 2025)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

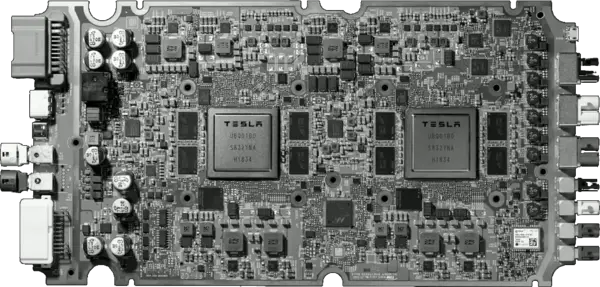

On November 24, 2025, Tesla (TSLA) stock closed up 3.88% [0] after Melius Research labeled it a ‘must own’ citing Full Self-Driving (FSD) potential and Elon Musk’s AI chip progress [1]. Musk announced Tesla is near tape-out of its AI5 chip and starting work on AI6 [2], though AI5 production is delayed to mid-2027 [3]. Reddit users criticized the move, claiming an unverified 7% jump and labeling FSD overhyped compared to Waymo [10]. Waymo launched a fully autonomous highway robotaxi service on November12 [4], while Tesla’s FSD remains supervised [5]. Financials show Q3 2025 revenue beat ($28.1B) but EPS declined37% YoY [6], with energy storage revenue growing50% YoY [7]. Legal risks include NHTSA probes into door handles and a fatal crash lawsuit [8,9].

- Discrepancy in Stock Jump: Reddit’s 7% claim contrasts with actual 3.88% close [0,10].

- AI Chip Delays Impact Robotaxi: AI5 production delay to mid-2027 may push robotaxi profitability timelines [3].

- Energy Storage Offset: 50% YoY growth in energy storage mitigates some EV sales decline [7].

- FSD Gap: Waymo’s fully autonomous service highlights Tesla’s lag in unsupervised driving [4,5].

- Stock: TSLA closed +3.88% (Nov24) [0].

- Financials: Q3 revenue beat ($28.1B), EPS down37% YoY, energy storage up50% YoY [6,7].

- Competition: Waymo leads in fully autonomous driving [4].

- Legal: Ongoing NHTSA probes and crash lawsuit [8,9].

This analysis provides objective context for decision-making without investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.