Tesla Stock Rally Analysis: Melius 'Must Own' Call, AI Chip Progress, and Bearish Sentiment Contrasts

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

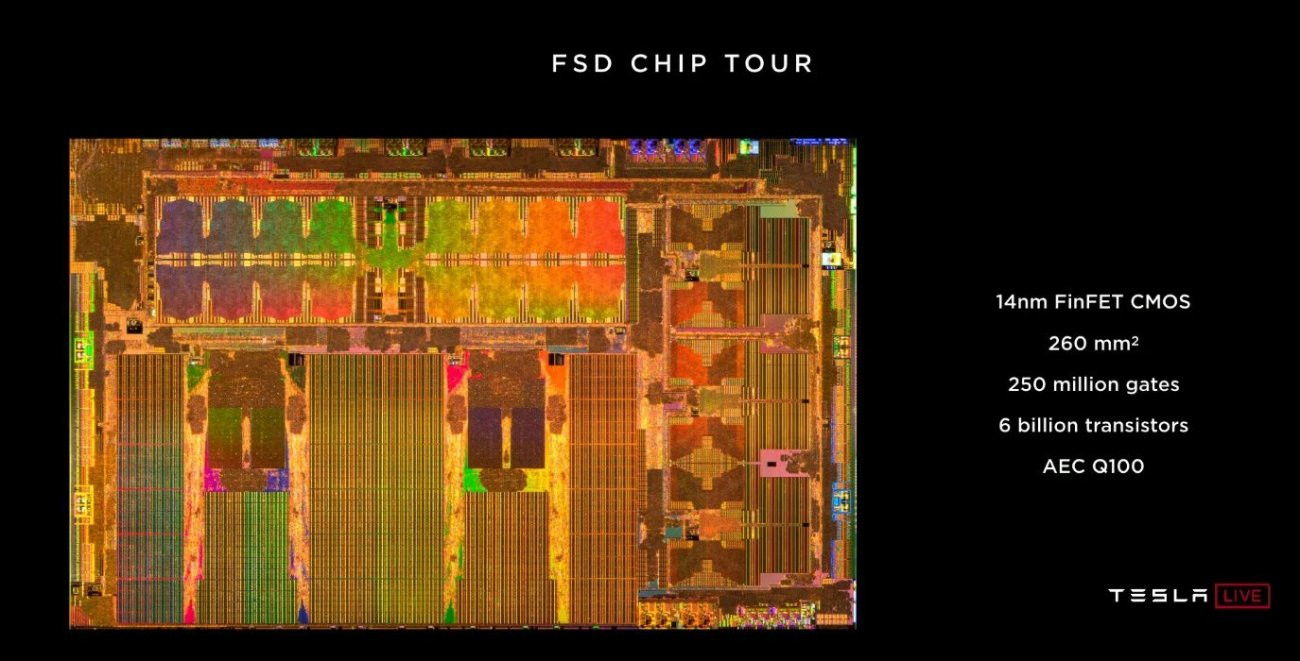

On November 24, 2025, Tesla (TSLA) experienced a 7% intraday stock pop following a bullish “must own” call from Melius Research, which highlighted Full Self-Driving (FSD) technology and AI chip progress as key catalysts [1]. Musk’s comments on Tesla’s in-house AI chips—current AI4 deployment and AI5 nearing tape-out—further fueled the rally [2,11]. However, the daily close saw a more modest 3.88% gain, with trading volume spiking to 96.81M shares (above the 30-day average of 89.79M) [3].

Contrasting this bullish movement, Reddit users expressed strong bearish sentiment, citing four main concerns: (1) FSD is overhyped and lags competitors like Waymo (which operates fully driverless rides in 5 U.S. cities) [5,6]; (2) declining financial performance (Q3 2025 EPS down 30% YoY to $0.50) [8,9]; (3) the stock jump is based on dubious or repetitive positive news [5]; and (4) investors are buying into the same narrative repeatedly [5].

- Narrative Disconnect: Short-term stock volatility (7% intraday pop) driven by analyst calls and AI chip updates contrasts with long-term bearish concerns about FSD execution and profitability.

- AI vs. FSD Focus: Melius’ call shifts focus from Tesla’s traditional automotive revenue to software/AI monetization (FSD subscriptions and AI chips), which could redefine the company’s valuation if executed [1,11].

- Competitive Gap: Waymo’s lead in fully driverless city deployments (expanding to 4 more cities in 2026) raises questions about Tesla’s ability to capture autonomy market share [6,7].

- Sentiment Divide: Analyst consensus remains “Hold” (38.8% Buy, 40% Hold, 21.2% Sell) with a $455 target (6.7% upside), reflecting uncertainty between bullish AI potential and bearish execution risks [0].

- FSD Lag: Tesla’s robotaxi program (targeting 8-10 cities by 2025 end) trails Waymo’s current footprint, delaying potential autonomy revenue [6,10].

- Profitability: Declining gross margins (18% YoY from 19.8%) and EPS (down 30% YoY) raise operational efficiency concerns [8,9].

- Regulatory Hurdles: EU’s strict safety standards may delay FSD approval until February 2026 [6].

- Sentiment Risk: Repetitive positive news cycles could lead to a market pullback if execution fails to meet expectations [5].

- AI Chip Vertical Integration: Tesla’s in-house AI chip development reduces reliance on external suppliers, creating a competitive moat [11,13].

- Long-Term Monetization: FSD subscriptions and robotaxi services could unlock a $7T autonomous driving market [1].

- Stock Performance: TSLA closed at $417.78 on November 24, 2025 (3.88% gain), with a 5-day performance of +6.03% [3,0].

- Financials: Q3 2025 revenue beat estimates ($28.1B, +12% YoY) but EPS missed ($0.50 vs. consensus $0.53) [8,9].

- AI Chip Progress: AI5 chip near tape-out, sample production in 2026, mass production in 2027 [11,13].

- Analyst Consensus: Hold with a $455 target (6.7% upside) [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.