Analysis of Nvidia (NVDA) Recent Sell-Off and AI Hardware Demand Dynamics

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

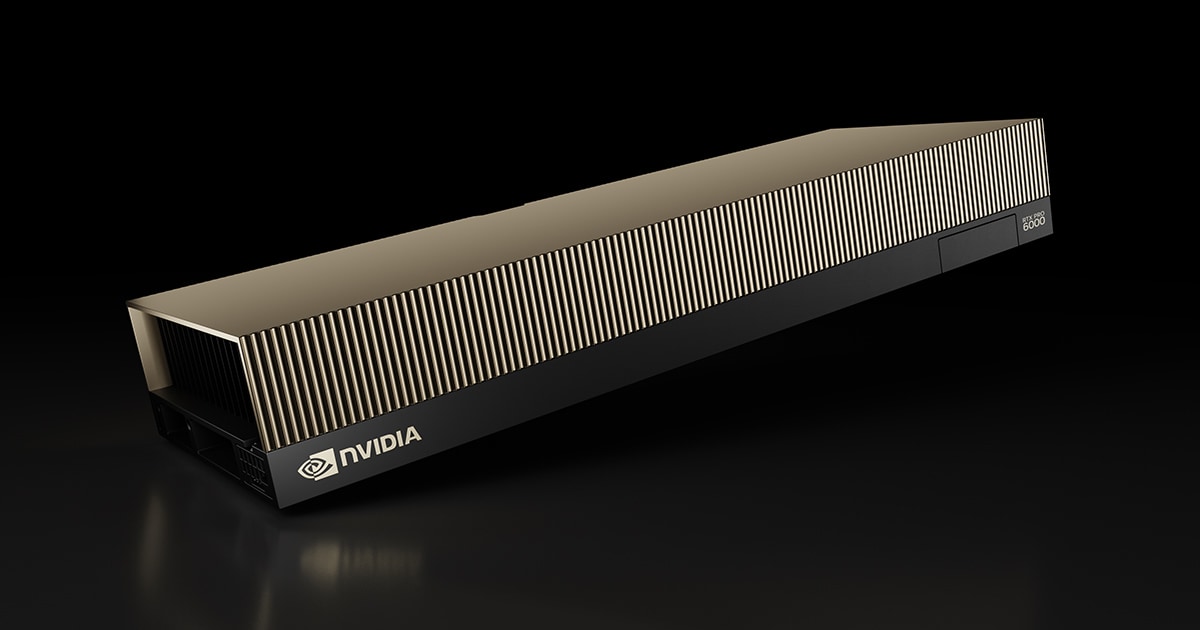

On November 26, 2025, a Reddit discussion highlighted Google DeepMind researcher Amir Yazdan’s statement that the recent NVDA sell-off stems from investor ignorance of AI hardware demand. Yazdan emphasized companies buy high-end GPUs like B200 for AI model operations, where demand remains strong.

- Macroeconomic Risks: Poor economic conditions reducing AI service demand.

- Competition: China developing domestic AI chips and Meta considering Google chips.

- Investor Herd Mentality: Lack of understanding of AI hardware among investors.

- Hidden B2B Demand: Unseen use cases (e.g., fraud detection) driving sustained GPU purchases.

- NVDA dropped 7.81% on Nov 20, 2025, with volume above average.

- Analyst consensus: 73.4% Buy rating, target price $250.

NVDA faces mixed sentiment with ongoing debates over demand sustainability amid competitive and macro risks.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.