AI-Driven Memory Shortage: Investment Opportunities and Industry Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

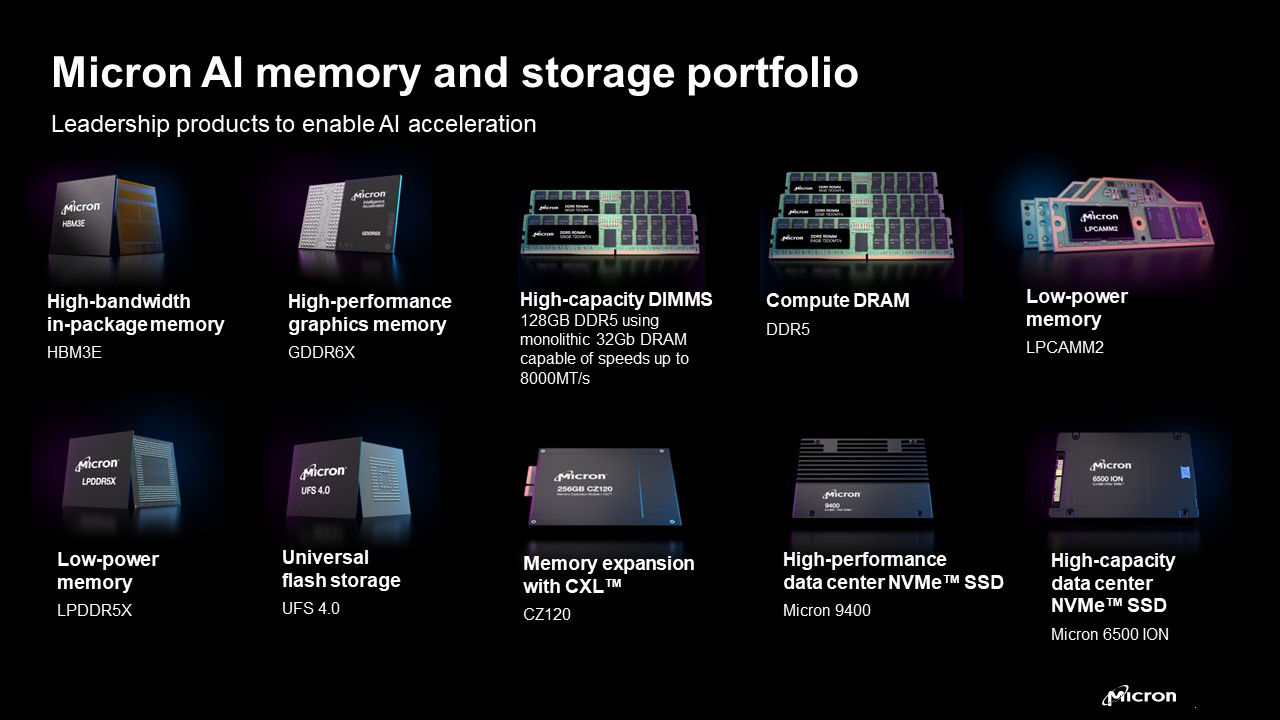

The AI-driven memory shortage has created significant market dynamics, with demand surging due to AI server requirements (Dell/HP warning of supply squeezes [1], Morgan Stanley estimating record memory chip earnings [2]). Established producers like Micron (MU), ASML, and Applied Materials (AMAT) are positioned as safe long-term bets due to their scale, infrastructure, and customer base [0]. Equipment suppliers such as ASML benefit indirectly from fab expansions, as their machines are essential for memory production [0]. Emerging competition from China’s CXMT (with its DDR5 launch targeting AI servers) challenges incumbents, though its market share remains small (~3% in DRAM) [3]. The Reddit community highlights cyclical risks, noting that high memory prices are temporary [4].

Cross-domain correlations include equipment suppliers’ growth tied to fab builds, CXMT’s technical progress forcing incumbents to innovate, and the balance between long-term safety (established players) and short-term speculative gains (e.g., MU options). The AI demand trajectory is a structural driver, but cyclical market dynamics require careful monitoring [1][2][4].

Safe long-term investments include Micron (MU YTD +163.67%), ASML (market cap $403B, YTD +48.62%), and AMAT (recent UBS upgrade to Buy [0]). Recent developments: CXMT’s DDR5 launch [3], Morgan Stanley’s top pick on Micron (target $325 [2]), and Dell/HP’s supply squeeze warning [1]. Cartel claims are unsubstantiated and reflect community sentiment [4].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.