NVIDIA Q3 FY26 Earnings: Mixed Sentiment on Strong Results, Valuation, and Concentration Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

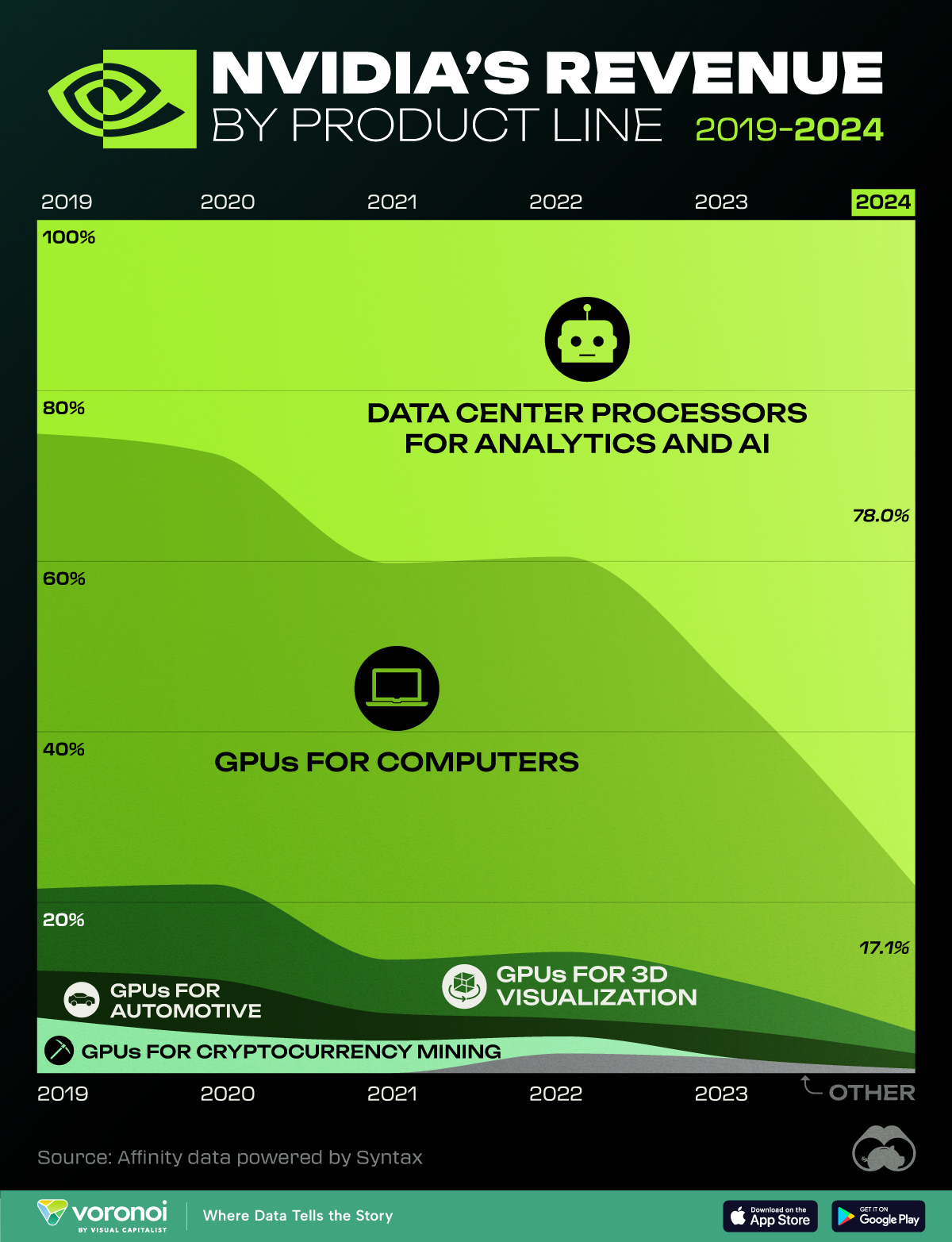

NVIDIA’s Q3 FY26 results showed exceptional financial performance with $57.01B revenue (+62% YoY) and a 53.01% net margin [0]. The data center segment dominated revenue (88.3%), driving growth but also exposing the company to customer concentration risk [0]. Despite strong results, the stock fell 7.81% post-earnings, reflecting investor skepticism over valuation (44.21x P/E) and macroeconomic headwinds [0]. The Reddit discussion highlighted mixed sentiment: bullish long-term on AI leadership and profitability, bearish short-term on valuation, concentration, and potential accounting concerns [1].

- Dual Sentiment Drivers: Long-term bullishness stems from NVIDIA’s dominant AI GPU position and strong Q4 guidance ($65B ±2%), while short-term bearishness centers on high valuation and customer concentration.

- Segment Dependency: The 88.3% data center revenue share underscores vulnerability to major customer spending changes.

- Market Reaction: Post-earnings volatility (7.81% drop) indicates a disconnect between financial results and investor perception of value.

- Valuation Risk: 44.21x P/E ratio is high relative to industry averages [0].

- Customer Concentration: Heavy reliance on data center clients (88% revenue) poses significant risk if key customers reduce spending [0,1].

- Macroeconomic Risks: High interest rates may curb enterprise GPU investments [1].

- AI Growth: NVIDIA’s leadership in AI GPUs positions it for long-term growth as AI adoption accelerates [0,1].

- Strong Guidance: Q4 FY26 guidance ($65B ±2%) signals continued momentum in data center demand [1].

NVIDIA’s Q3 FY26 results demonstrate strong operational performance, but mixed sentiment reflects concerns over valuation, concentration, and macro factors. Investors should balance these risks with the company’s long-term AI growth potential. Key metrics: revenue $57.01B (+62% YoY), net margin 53.01%, data center revenue 88.3%, P/E 44.21x [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.