AI-Driven Memory Shortage: Long-Term Investment Opportunities and Industry Dynamics

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

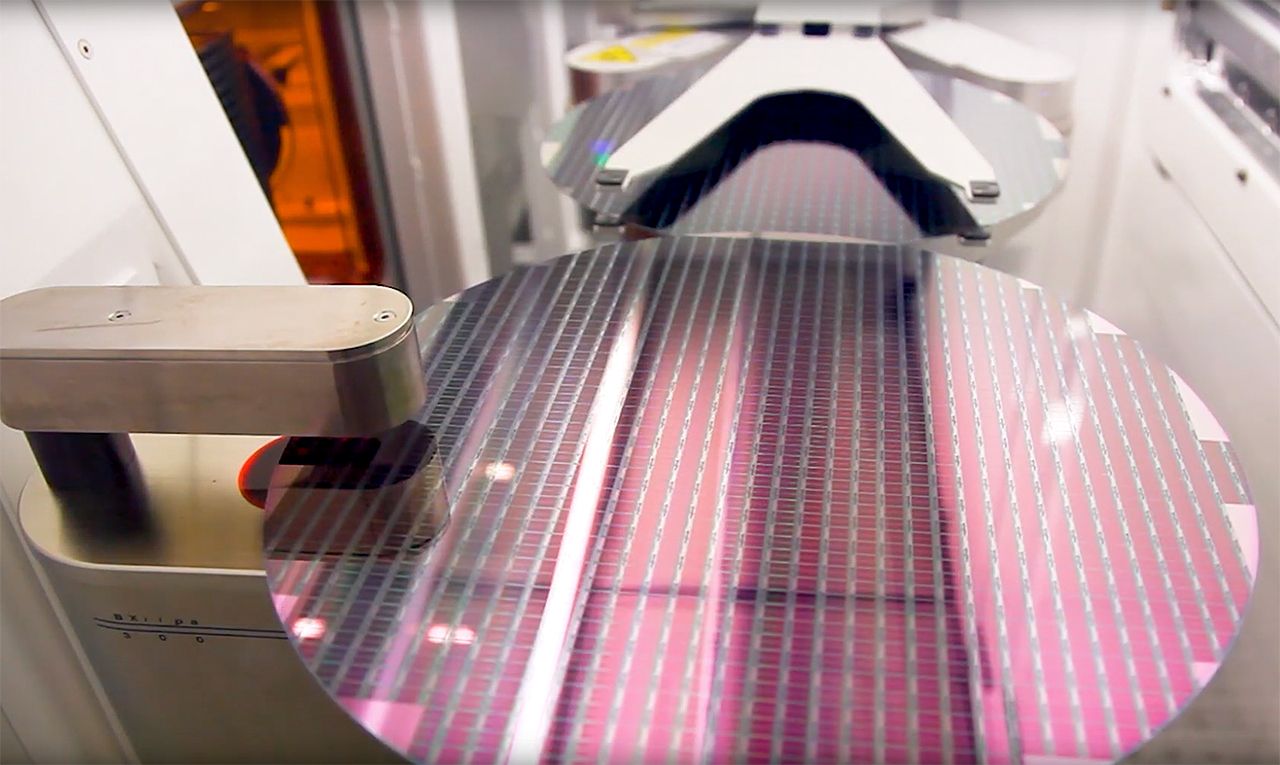

The AI-driven memory shortage has triggered structural changes in the semiconductor sector. DRAM prices rose 171.8% YoY in Q3 2025 [1], with High Bandwidth Memory (HBM)—critical for AI—seeing explosive growth (Samsung’s HBM shipments up 85% QoQ [2]). The market remains concentrated: SK Hynix (33.2%), Samsung (32.6%), and Micron (25.7%) control ~91.5% of global DRAM [2], enabling supply control (Samsung hiked prices by 60% since September 2025 [4]). Equipment suppliers like ASML (EUV monopoly [3]) and Applied Materials (DRAM revenues up >50% in 2025 [3]) benefit from fab expansions.

- Cycle Shift: The traditional 3.5–4.5 year memory cycle is stretched to 4+ years due to AI infrastructure demand [4].

- Concentration Advantage: Top producers’ dominance ensures consistent profitability via supply control [2,4].

- Equipment Moats: ASML’s EUV monopoly and Applied Materials’ leading-edge customer base create durable advantages [3].

- Cyclical volatility persists despite stretched cycles [4].

- Mid-2026 fab expansions may moderate price increases [1].

- Long-term positions in established producers (MU, SSNGY, HXSCL) and equipment suppliers (ASML, AMAT) [1,2,3].

- HBM growth benefits Samsung and SK Hynix [2].

- Market Share: Top 3 DRAM producers hold ~91.5% (Q3 2025) [2].

- Price Trends: DRAM up 171.8% YoY; 30% rise projected by end 2025 [1,4].

- Equipment Market: $224.4B by 2033 [3].

- Shortage Duration: At least four years [4].

Note: This summary provides informational context, not investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.