AI-Driven Memory Shortage: Industry Impact & Capitalization Opportunities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The event is a Reddit thread asking how to capitalize on AI-driven memory shortages, with a focus on “safe” long-term investments (10-year holds). Key discussion points:

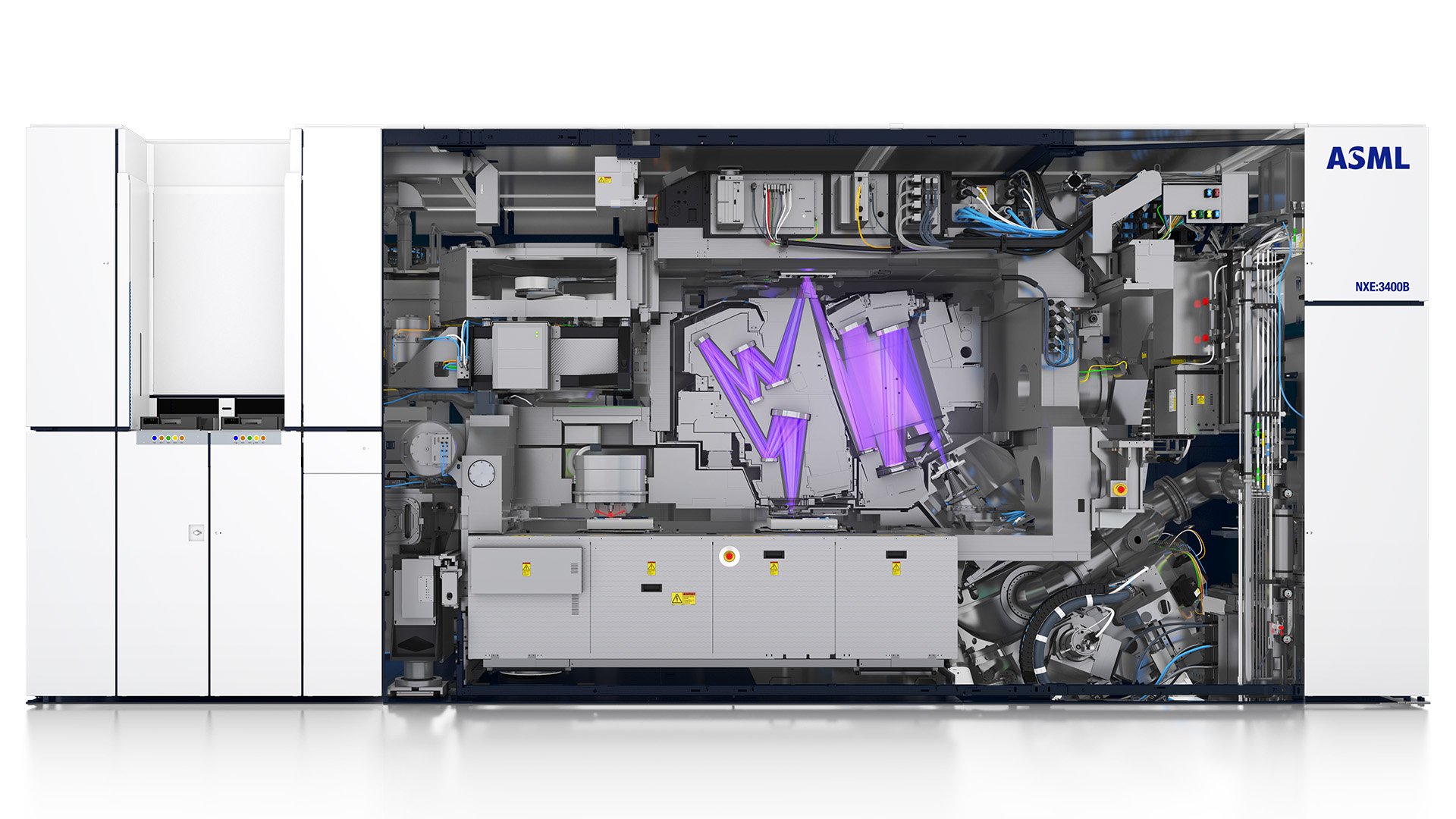

- Preference for established memory producers (Samsung, SK Hynix, Micron) and equipment suppliers (ASML, Applied Materials) over speculative plays.

- Concerns about cyclical market dynamics and temporary high prices.

- Skepticism toward short-term speculative strategies (e.g., Micron call options).

The AI boom has created unprecedented demand for high-bandwidth memory (HBM), leading to:

- Price Hikes:Samsung raised DRAM/NAND prices by 30–60% in Q4 2025 due to constrained supply [3].

- Supply Tightness:Micron and SK Hynix sold out their 2026 memory capacity, with supply constraints expected to persist until late 2026 [1,5].

- Capacity Reallocation:Manufacturers are shifting production to high-margin AI-focused products (like HBM), causing shortages of common memory types [5].

- Downstream Impacts:Tech firms (Dell, HP, Xiaomi) warn of production limits for consumer/automotive electronics in 2026 due to memory shortages [2,5].

- Top Memory Producers:Micron’s stock surged +88.74% in 3 months (to $230.26) due to HBM market share expansion plans [0,2].

- Equipment Suppliers:ASML (+36.35% in 3 months) and Applied Materials (+51.25% in 3 months) outperform the broader Technology sector (+0.15% recent day) [0,1,3,4].

- Market Dominance:The top 3 memory producers (Samsung, SK Hynix, Micron) control ~90% of the global DRAM market, enabling cartel-like price stabilization [Reddit,3].

- HBM Innovation:SK Hynix plans to launch 16-stack HBM4 in 2026, with HBM5/5E by 2029–2031 [3].

- Market Share Expansion:Micron aims to grow its HBM market share from <10% (2022) to 20–25% by 2026 [1].

- AI Customer Prioritization:Manufacturers are prioritizing AI giants like Nvidia over traditional customers, shifting supply chains [5].

- Long-Term Investors:Established producers (Micron) and equipment suppliers (ASML, Applied Materials) are preferred for their scale and infrastructure [1, Reddit].

- Downstream Manufacturers:Adjust supply chains or pricing to mitigate higher memory costs (e.g., Dell’s warning of squeeze [2]).

- Speculators:Avoid short-term plays (e.g., call options) due to cyclical risks [Reddit].

- Capacity Expansion:New fabs take 2–3 years to build, limiting short-term supply [4].

- Cyclical Dynamics:High prices are temporary; market corrections are likely [Reddit,4].

- AI Demand Sustainability:Long-term growth depends on continued AI infrastructure investment [1,5].

- Geopolitical Risks:China accounts for ~37% of ASML/Applied Materials revenue, exposing firms to trade tensions [3,4].

[0] Internal Industry Data (Sector Performance & Company Overviews)

[1] Nasdaq. “Is This the Most Underrated AI Infrastructure Play of the Decade?” URL: https://www.nasdaq.com/articles/most-underrated-ai-infrastructure-play-of-the-decade

[2] Bloomberg. “Tech Firms From Dell to HP Warn of Memory Chip Squeeze From AI.” URL: https://www.bloomberg.com/news/articles/2025-11-26/tech-firms-from-dell-to-hp-warn-of-memory-chip-squeeze-from-ai

[3] SemiEngineering. “Samsung Reportedly Hiking Memory Chip Prices by 30% to 60%.” URL: https://semiengineering.com/category/news/

[4] PC Gamer. “This is Why Memory and Storage Is So Expensive.” URL: https://www.pcgamer.com/hardware/memory/ram-and-storage-is-ridiculously-expensive-right-now-because-of-drumroll-ai-of-course-and-theres-little-reason-to-think-prices-will-drop-any-time-soon/

[5] Longbridge. “From Xiaomi to HP, Multiple Tech Companies Warn of Memory Shortage.” URL: https://longbridge.com/news/267602481

Disclaimer: This report is for informational purposes only and does not constitute investment advice. All data is sourced from publicly available tools and discussions.

Prepared By: Industry Research Expert

Version: 1.0

Last Updated: 2025-11-28

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.