Meta's TPU Talks with Google: Impact on GOOG, NVDA, and META Market Dynamics

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

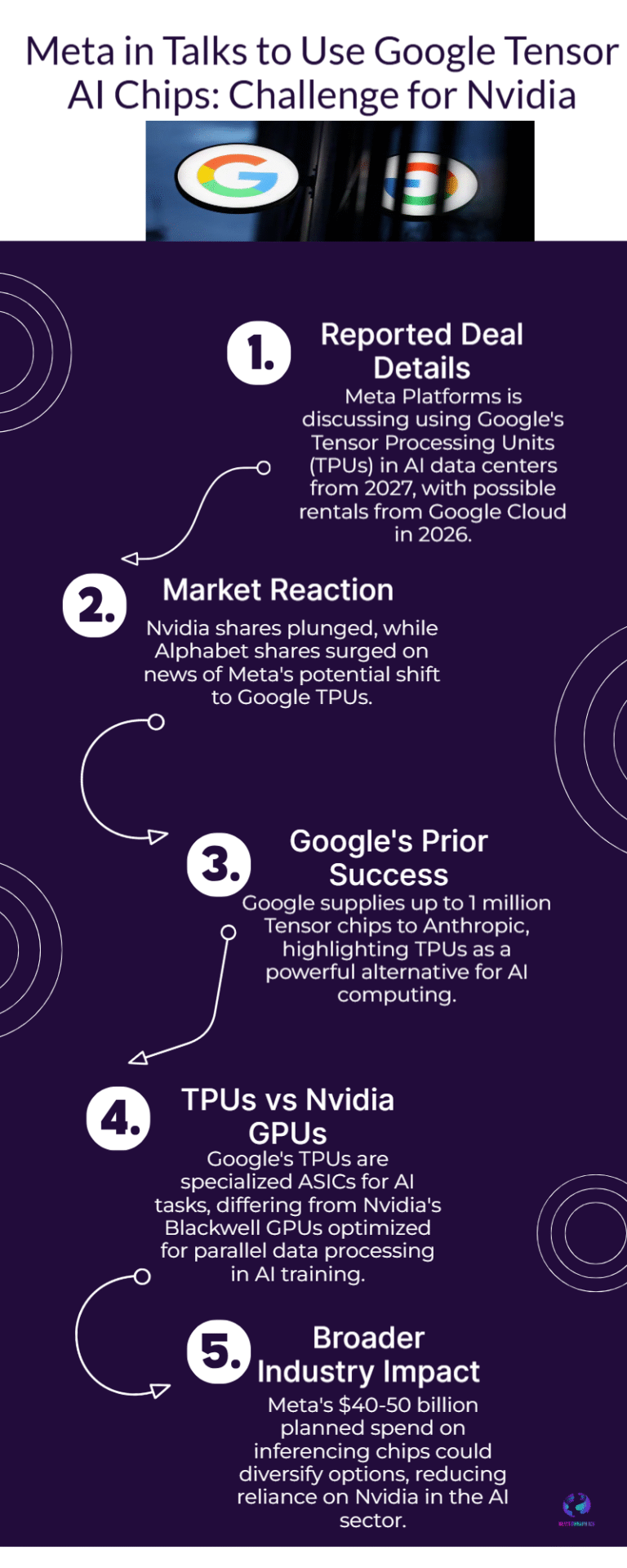

The event centers on Meta Platforms (META) in talks to deploy Google’s Tensor Processing Units (TPUs) in its data centers, challenging NVIDIA (NVDA)’s dominance in AI chips [1][2]. This has immediate market implications: GOOG rose ~2% in after-hours trading, while NVDA fell ~2.05% [3].

Short-term impact includes GOOG’s 6-month rally of 84.09% (May-November 2025) driven by AI advancements (Gemini 3) and TPU adoption [0]. NVDA retains a market cap lead ($4.39T vs GOOG’s $3.87T), so claims of GOOG surpassing NVDA by year-end are unsupported [0]. The tech sector saw moderate growth (0.15% on November 28) amid this competition [0].

Medium-term, a Meta-Google deal would validate Google’s TPU strategy and expand its AI chip customer base, while NVDA risks eroding market share if it loses Meta as a client [1][2]. Meta could benefit from cost savings, though transition costs may offset short-term gains [0][1].

- AI Chip Competition: The talks underscore intensifying rivalry in AI chips, linking cloud services (Google Cloud) and social media (Meta) sectors.

- GOOG’s TPU Validation: Meta’s consideration marks a significant step in Google’s effort to challenge NVDA’s AI accelerator dominance.

- Market Cap Dynamics: NVDA’s current lead ($4.39T) indicates its resilience despite competitive threats, while GOOG’s rally reflects investor confidence in its AI strategy.

- NVDA: Potential loss of Meta as a client could erode market share [2].

- GOOG: If the Meta deal fails to materialize, the stock may correct after its recent rally [0].

- META: Transitioning to TPUs may involve technical challenges and integration costs [1].

- GOOG: Expanding its AI chip customer base beyond Anthropic to Meta could drive sustained growth in cloud and AI segments [1].

- META: Long-term cost savings from TPUs could boost profitability [1].

- GOOG’s 6-month gain: 84.09% (May-November 2025) [0].

- NVDA’s market cap: $4.39T (vs GOOG’s $3.87T) [0].

- Meta’s potential cost savings from TPUs: Unquantified but cited as a key driver [1].

- Tech sector growth: 0.15% on November 28 [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.