NVIDIA (NVDA) Revenue Report Analysis: Business Fundamentals vs Price Dynamics

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

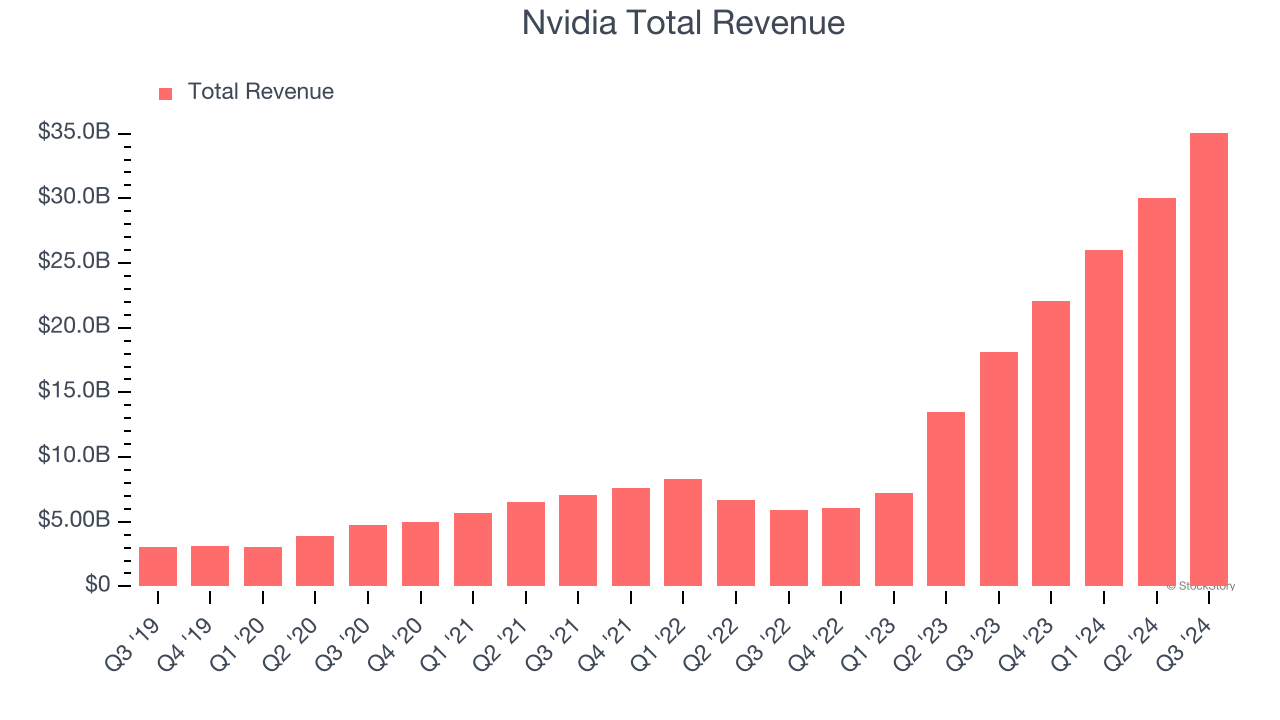

NVIDIA (NVDA) reported $57B in quarterly revenue (up62% YoY), $31.8B net income (up59%), and $1.30 EPS (up60%), with next quarter guidance of ~$65B revenue (75% gross margin) [6]. A Reddit discussion debated investing in NVDA for fundamentals vs price, highlighting forward PE (24x-26x), competition, and fiscal timing confusion [6].

- Short-term: NVDA closed at $180.26 (+1.37%) on 2025-11-26 with 4-day volatility ($169.55-$184.56) [0].

- Medium-term: 1-month return -10.33% (profit-taking) vs6-month +33.71% (AI growth) [0].

- Sentiment: 73.4% Buy ratings (target $250, +38.7% upside) [0]; Reddit mixed (bullish PE vs bearish competition) [6].

| Metric | Value |

|---|---|

| Quarterly Revenue | $57.01B |

| EPS | $1.30 |

| P/E Ratio | 44.21x |

| Net Margin | 53.01% |

| Data Center Share | 88.3% |

| Market Cap | $4.39T |

| Analyst Target | $250 |

| Sources: [0], [6] |

- Direct: NVDA [0]

- Sectors: Semiconductors, AI, data centers [2,3]

- Competitors: AMD, Intel, Google, Chinese startups [1,6]

- Verify Chinese startup chip performance (vs Blackwell) [1]

- Assess $65B guidance feasibility [6]

- Clarify fiscal timing for PE [6]

- Competition: Emerging players may erode market share [1,6]

- Valuation: High P/E (44.21x) if growth slows [0,6]

- Dependence: 88.3% revenue from data centers [0]

Next quarter earnings, competition, data center demand [1,3,6]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.