Jereh Corporation (002353) Limit-Up Analysis: Driven by Major Contracts and Industry Recovery

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

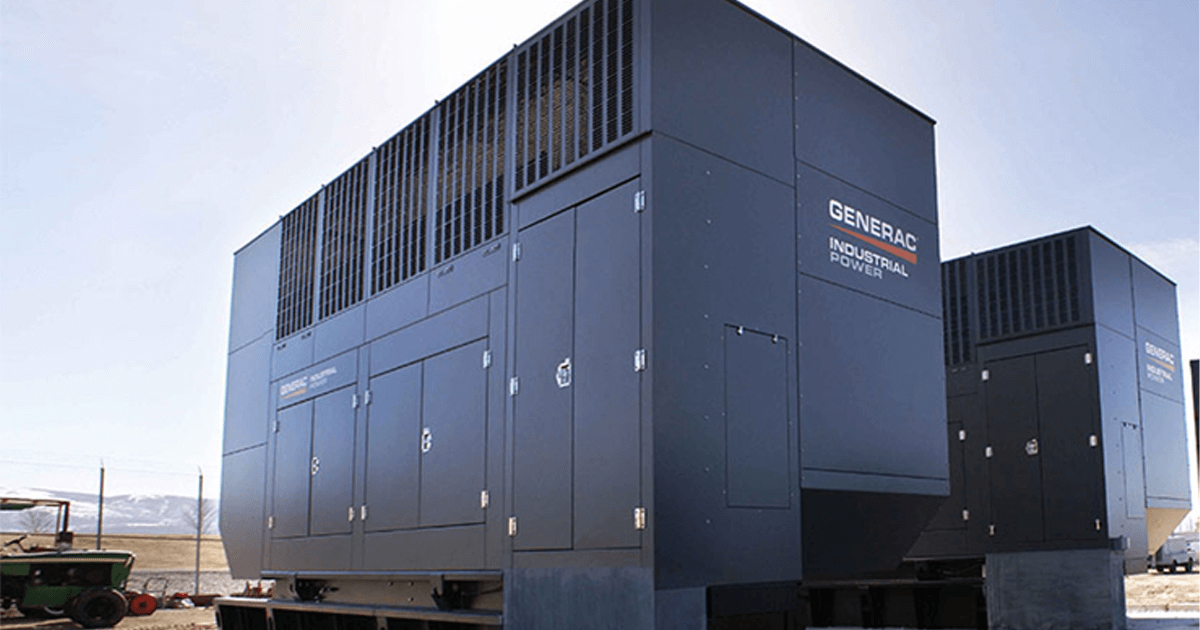

Jereh Corporation (002353) is a leading domestic integrated oil and gas field service enterprise, covering high-end equipment manufacturing, oil and gas engineering, new energy and other fields [0]. This limit-up mainly comes from two core positive factors: first, signing an over $100 million sales contract for generator sets for North American data centers, marking its successful expansion of non-oil business into a high-growth field [2]; second, reaching a global strategic cooperation on gas turbines with Baker Hughes, strengthening its technical and market competitiveness [0]. At the industry level, rising global oil prices have promoted the recovery of investment in the oil service industry, and the company, as a leader, directly benefits [0]. Market data shows that the company’s stock price has shown an upward trend recently, and the attention to the energy sector has increased significantly [1,4].

- Diversification Breakthrough: The North American data center contract indicates that the company is gradually reducing its dependence on traditional oil service business, and the new business is expected to become a long-term growth engine [2];

- Global Layout: Cooperation with Baker Hughes will help the company enter the global high-end oil and gas equipment market and enhance its international influence [0];

- Market Sentiment Resonance: The heat of the energy sector coupled with the company’s own positive factors forms a double catalyst for the stock price rise [3].

- Opportunities: The continuous recovery of the global oil service industry brings growth in traditional business orders; expansion into data center and new energy fields opens up new growth space [0,2];

- Risks: Fluctuations in international oil prices may affect the profitability of traditional businesses; the North American data center market is highly competitive, so it is necessary to pay attention to contract execution and profit margins [0,6].

Jereh Corporation (002353)'s limit-up reflects the market’s recognition of its diversification strategy and industry position. Investors should focus on oil price trends, the progress of new contract implementation, and the advancement of global cooperation to evaluate the company’s long-term growth potential.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.