Driving Factors and Risk Analysis of Guosheng Technology (603778.SH) Becoming a Hot Stock

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Guosheng Technology (603778.SH) is a high-tech enterprise focusing on the photovoltaic new energy field, whose main business covers the R&D, production and sales of large-size high-efficiency heterojunction (HJT) photovoltaic cells and modules [2]. In 2025, against the backdrop of the photovoltaic industry winter, the company actively sought transformation and laid out emerging fields such as solid-state batteries [2].

Recent core driving factors for becoming a hot stock include:

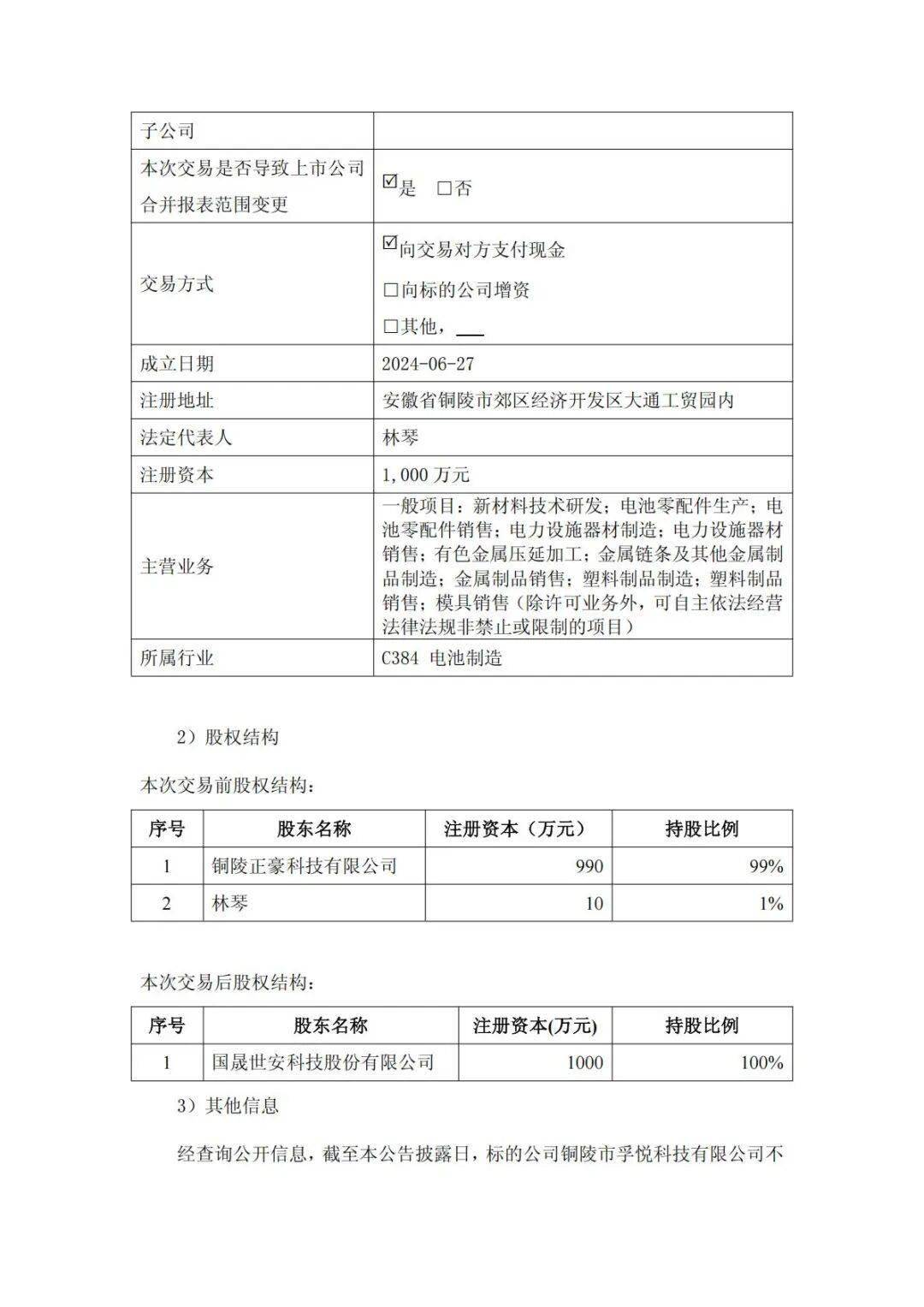

- Acquisition to Expand Business: Plans to acquire 100% equity of Fuyue Technology for RMB 240.6 million, entering the lithium battery shell material field to enrich its business lines [4][5];

- Technology and Cooperation Advantages: As one of the world’s top three heterojunction product manufacturers, it maintains in-depth cooperation with central state-owned enterprises such as CGN New Energy [2];

- Abnormal Stock Price Fluctuation: It hit the daily limit for two consecutive trading days on November 24-25, with a cumulative deviation of more than 20%, attracting widespread market attention [1][6];

- Order Reserve: Holds 7 large orders with a total scale of over 7 GW and a total amount of RMB 4.362 billion [2].

However, the company’s performance in the first three quarters of 2025 was poor, with revenue dropping 57.8% year-on-year to RMB 450 million, net profit attributable to parent company losing RMB 151 million, and a price-to-book ratio (P/B) of 7.30, significantly higher than the industry average of 3.09 [3][6].

- Contradiction Between Transformation and Performance: While continuing to lose money, the company promotes acquisitions and solid-state battery layout, reflecting the urgent need for transformation under pressure from the photovoltaic main business, but short-term profitability still faces challenges [2][3];

- Regulatory Inquiry Risk: The acquisition of Fuyue Technology has an evaluation value-added rate of up to 1167%, triggering inquiries from the Shanghai Stock Exchange on transaction fairness and related-party relationships, which may affect the acquisition process and market confidence [4];

- Technical Route Competition: As an important participant in the heterojunction technology route, it needs to cope with competition from other technical routes such as TOPCON [2].

- Sustained Performance Losses: Net profit in the first three quarters of 2025 lost RMB 151 million, and it is difficult to make profits in the main business under the industry winter [3][6];

- Regulatory Uncertainty: The high value-added rate of the acquisition has attracted regulatory attention; if the inquiry cannot be properly responded to, it may lead to delay or termination of the acquisition [4];

- High Valuation: The current P/B ratio of 7.30 is higher than the industry average, with the risk of valuation correction [3][6].

- Transformation Layout: Plans to build an annual 10 GWh solid-state battery industry chain project, which is expected to enter a high-growth track [2];

- New Business Expansion: The acquisition of Fuyue Technology can achieve a breakthrough in the lithium battery material field and diversify the business structure [4][5];

- Order Support: The existing order scale is large, providing certain guarantees for future revenue [2].

Guosheng Technology (603778.SH) has become a hot stock due to its acquisition plan, technical advantages and stock price fluctuations, but it is necessary to pay attention to its sustained loss performance, uncertainty brought by regulatory inquiries and high valuation risks. The company’s transformation layout (solid-state batteries, lithium battery materials) provides possibilities for long-term development, but it still faces multiple challenges in the short term. Investors should comprehensively evaluate the impact of the company’s fundamentals and market sentiment based on their own risk tolerance.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.