Meta's Potential Google TPU Deployment: Impact on GOOG, NVDA, and META Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

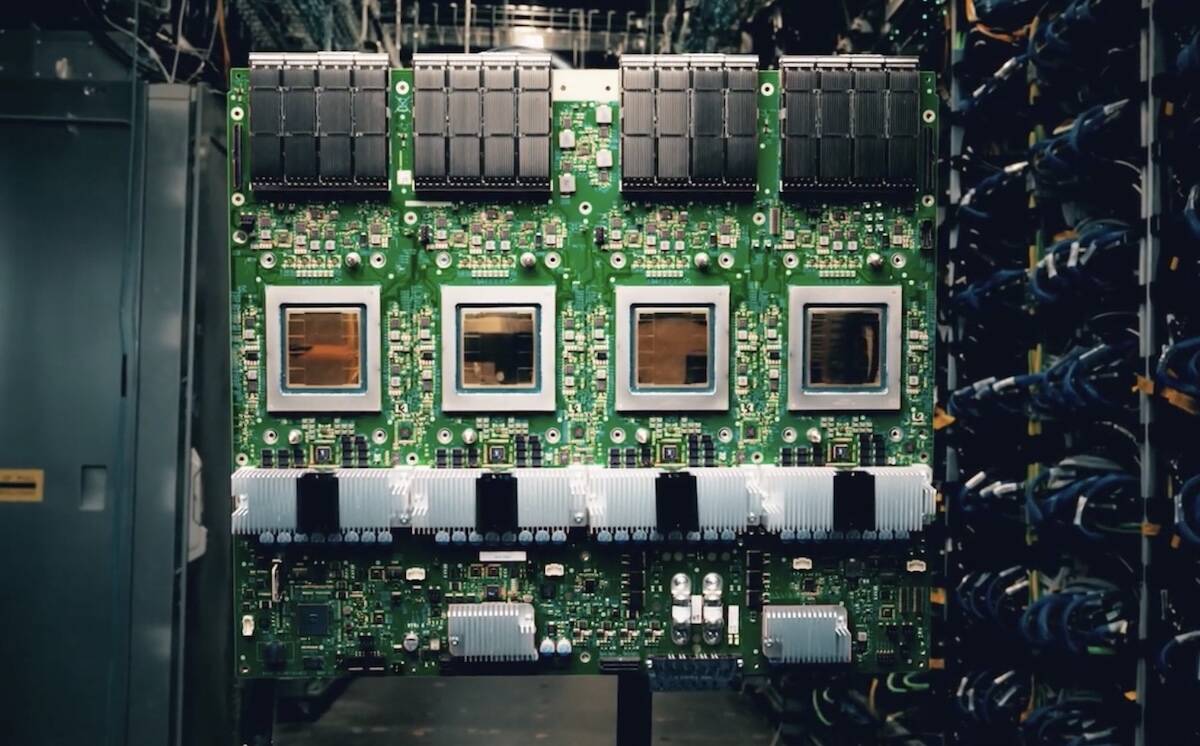

This analysis synthesizes findings from internal market data [0] and a Reddit post [1] about Meta’s potential TPU deployment. GOOG shares rose ~2% in after-hours trading following the news, while NVDA fell ~2.05%. GOOG’s ~2.5-month gain (Sept-Nov) of 29.91% [0] contrasts with the original claim of a 100% 6-month rally, indicating potential exaggeration. NVDA’s market cap ($4.35T) remains higher than GOOG’s ($3.93T) [0], debunking the claim of GOOG surpassing NVDA by year-end. The Technology sector saw moderate gains (0.14951%), highlighting company-specific rather than sector-wide impacts [0].

- Discrepancy in Rally Claims: The original event’s 100% 6-month gain claim for GOOG is unsupported by internal data showing a 29.91% rise over ~2.5 months [0].

- Market Cap Reality: NVDA maintains a market cap lead over GOOG, contradicting the year-end surpassing claim [0].

- Company-Specific Impact: The news affected individual stocks (GOOG up, NVDA down) rather than the broader Technology sector [0].

- Critical Information Gaps: Unconfirmed adoption details, revenue impact on NVDA/GOOG, and technical feasibility of TPUs for Meta’s workloads are key unknowns [0].

- NVDA: Potential loss of Meta as a customer could impact revenue growth; monitor Meta’s procurement announcements [0].

- GOOG: Overvaluation risk if stock price outpaces fundamental improvements from TPU adoption [0].

- META: Integration costs and performance risks associated with switching from NVDA GPUs to Google TPUs [0].

- GOOG: Potential TPU sales growth if Meta and other customers adopt the technology [0].

- META: Cost savings and EPS boost if TPU deployment is successful and feasible [0].

Critical data points include GOOG’s ~2.5-month gain of 29.91% [0], NVDA’s market cap lead ($4.35T vs GOOG’s $3.93T) [0], unconfirmed Meta-Google TPU talks, and information gaps around adoption scale and revenue impacts. The analysis provides objective context for decision-making without prescriptive recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.