Meta's Potential Google TPU Adoption: Impact on GOOG, NVDA, and AI Chip Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

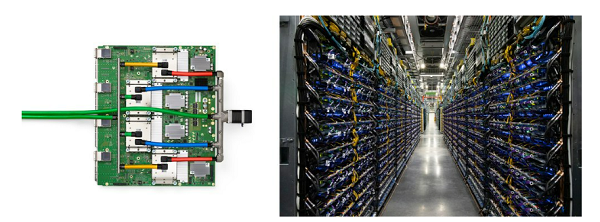

On November 24, 2025, reports emerged that Meta Platforms (META) is in talks to deploy Google’s Tensor Processing Units (TPUs) in its data centers, marking a significant shift in AI chip competition [1][2][3][4]. Alphabet (GOOG) shares rose ~2% in after-hours trading, extending a 29.91% rally from mid-September to November 24 [0]. Nvidia (NVDA) shares fell ~2% post-report, reflecting investor concerns over growing competition to its AI chip dominance [1][4].

The potential deal would expand Google’s TPU reach beyond its cloud services to enterprise customers, challenging NVDA’s 80%+ AI chip market share [3]. Meta stands to gain cost savings from TPU adoption, which could boost its EPS [5].

- AI Chip Competition: Google’s TPUs are emerging as a viable alternative to NVDA’s GPUs, signaling a shift from NVDA’s near-monopoly to a more competitive landscape.

- GOOG’s Growth: The deal (if finalized) would open a new revenue stream for Google, diversifying its AI business beyond cloud rentals.

- Meta’s Strategy: Meta’s move to consider TPUs indicates a focus on cost optimization and reducing reliance on NVDA’s expensive GPUs.

- NVDA: Increasing competition from Google’s TPUs and custom AI chips could erode market share and revenue growth [1][3].

- GOOG: The recent rally includes FOMO elements [5], which may lead to volatility if the Meta deal fails to materialize.

- Deal Uncertainty: The partnership is still in negotiations, with no guarantee of finalization [1][4].

- GOOG: Expansion into enterprise AI chip sales could drive long-term growth.

- Meta: Cost savings from TPUs may improve profitability if the deal is successful.

- GOOG: 29.91% gain (Sept-Nov 24) [0], after-hours rise (~2%) post-report [5].

- NVDA: ~2% drop post-report [1][4], facing competition from Google’s TPUs.

- Meta: Negotiating TPU adoption for cost savings, with potential EPS benefits [5].

- Deal Status: In talks, no final agreement yet [1][4].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.