Meta Mulls Google TPU Adoption: Impact on GOOG, NVDA, and META Market Dynamics

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On

- Alphabet Inc. (GOOG) rose ~2% in after-hours trading to $327 following reports Meta Platforms (META) is considering Google’s Tensor Processing Units (TPUs) for its data centers.

- User arguments included GOOG’s 100% 6-month rally, concerns about report reliability, and FOMO to buy GOOG shares.

Verified news sources confirmed:

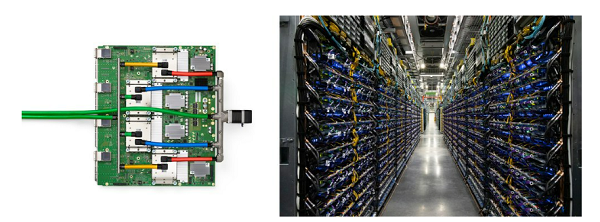

- Meta is in talks to adopt Google’s TPUs starting in 2027, diversifying from NVIDIA (NVDA) GPUs [1][2].

- Broadcom (AVGO) designs TPUs for Google, so Meta’s adoption would benefit AVGO [2].

- NVDA issued a rare statement to reassure investors, emphasizing its “generation ahead” GPU platform [3].

- GOOG: After-hours gain of ~2% (event day) → Real-time price (11/28): $319.86 (-0.13% intraday) [0][Reddit].

- NVDA: After-hours drop of ~2.05% → Real-time price (11/28): $176.60 (-2.03% intraday) [0][Reddit].

- META: Real-time price (11/28): $647.69 (+2.22% intraday), aligning with cost-savings arguments [0].

- GOOG: Surge of29.91%(mid-Sept to Nov24: $245.14 → $318.47) driven by Gemini3 and TPU adoption news [0].

- NVDA: Modest +3.92% gain over the same period, underperforming GOOG [0].

- Sector: Technology up +0.56% (11/24), Communication Services (GOOG/META) up +0.81% [0].

| Metric | GOOG | NVDA | META |

|---|---|---|---|

| Market Cap | $3.86T | $4.30T | $1.63T |

| P/E Ratio (TTM) | 31.61 | 43.71 | 28.63 |

| Period Change (9/15-11/24) | +29.91% | +3.92% | N/A |

| Intraday Change (11/28) | -0.13% | -2.03% | +2.22% |

Key Observations:

- Valuation: GOOG’s lower P/E ratio suggests it is more attractively valued than NVDA post-rally [0].

- Market Cap: NVDA ($4.30T) still leads GOOG ($3.86T), so Reddit’s “GOOG surpassing NVDA by year-end” claim is unsubstantiated [0].

- Meta’s Gain: META’s rise supports cost-savings arguments from TPU adoption [0].

Further investigation needed:

- Meta’s TPU Budget: Exact investment amount and portion of AI spending.

- NVDA’s Meta Revenue: What percentage of NVDA’s revenue comes from Meta?

- TPU Production: Can Google scale to meet Meta’s demand?

- Adoption Timeline: Are there earlier pilot programs before 2027? [1][2]

- Diversification Risk: Meta’s TPU talks could reduce NVDA’s revenue. Users should monitor this trend [3][4].

- Execution Risk: Scaling TPU production may be challenging. This raises concerns about Google’s ability to deliver on expansion plans [4].

- FOMO Risk: Reddit users mentioned FOMO to buy GOOG. Historical patterns show hype-driven purchases often lead to suboptimal outcomes [Reddit].

Key Factors to Monitor:

- Meta’s official TPU announcement,

- NVDA’s quarterly earnings (Meta revenue impact),

- Google’s TPU production updates,

- Competitor responses (e.g., NVDA’s next-gen GPUs).

[0] Ginlix Analytical Database

[1] Korea Herald: Google’s AI chip push spurs hope for Samsung, SK hynix → https://www.koreaherald.com/article/10625943

[2] Ynet News: Google’s Gemini3 challenges Nvidia’s AI chip dominance → https://www.ynetnews.com/tech-and-digital/article/bj7q1nr11zx

[3] InvestorsObserver: Nvidia panics? Rare statement triggers selloff → https://investorsobserver.com/stocks/nvidia-panics-rare-statement-triggers-selloff-as-meta-turns-to-googles-tpus/

[4] Yahoo Finance: Meta Throws Billions at Google AI Chips → https://finance.yahoo.com/news/meta-throws-billions-google-ai-143323406.html

[5] Times of India: Nvidia responds to losing $250B to Google deal → https://timesofindia.indiatimes.com/technology/tech-news/nvidia-publicly-responds-to-losing-250-billion-to-google-deal-declares-we-are/articleshow/125580817.cms

[Reddit] Reddit discussion on GOOG (2025-11-24 EST) → Tier3 source (use with caution).

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.