Analysis of Tongyu Communication (002792)'s Strong Performance: Satellite Internet Layout and Market Drivers

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

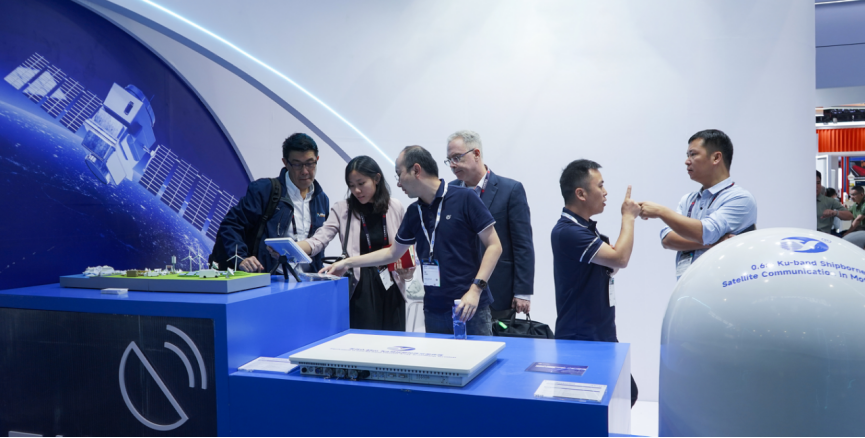

Tongyu Communication (002792), a leading enterprise in the field of communication antennas and RF devices, has strategically transformed to expand its satellite internet business in recent years, forming a ‘ground + satellite’ dual-drive model [0]. The company invested 100 million yuan to acquire shares in Shanghai Yuanxin, deeply binding with leading satellite enterprises [0][3], and became one of the few global suppliers to simultaneously enter four satellite internet projects, with its unique competitive advantages recognized by the market [0][5]. In the first half of 2025, its overseas revenue exceeded domestic revenue for the first time, becoming the core engine for performance growth [0][1]. Recently, its stock price has performed strongly, achieving consecutive daily limit ups on November 27-28, with a maximum 4-day gain of 29.8% [0][7]. The driving factors include satellite internet breakthroughs, favorable policies such as the Beijing Space Data Center plan [6], and capital inflow [5].

- Technical Synergy Advantage: The company’s accumulation in 5.5G/6G antenna technology forms synergy with satellite internet business, enhancing the competitiveness of its ‘satellite-ground-terminal’ layout [0][2];

- Scarce Market Position: Participating in multiple satellite internet projects simultaneously, it occupies a first-mover advantage in the rapid development of commercial aerospace [0][5];

- International Breakthrough: Overseas revenue exceeding domestic revenue marks the effectiveness of its internationalization strategy, laying a foundation for long-term growth [0][1].

- Risks: Long technology verification cycle for satellite projects and intensified industry competition; short-term large stock price gains may face correction pressure [0][4];

- Opportunities: Policy support for the space industry (such as the Beijing Space Data Center [6]), winning bids for low-altitude economy projects as a new growth point [0]; the expansion of the satellite communication industry brings long-term growth space [5].

Tongyu Communication (002792)'s strong performance stems from satellite internet strategic breakthroughs and optimistic expectations for the commercial aerospace industry. The company builds differentiated advantages through binding leading enterprises, overseas expansion, and technological innovation. While short-term volatility risks exist, its long-term potential driven by policies and the industry is worth attention [0][1][2][3][5][6].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.