AI-Driven Memory Shortage: Industry Impact & Long-Term Investment Opportunities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

A Reddit user (Nov 25, 2025) asked about capitalizing on the AI-driven memory shortage, prioritizing safe, long-term (decade) investments. Key discussion points included:

- Safe Bets:Established memory producers (Samsung, SK Hynix, Micron) and equipment suppliers (ASML, Applied Materials) are preferred over speculative plays.

- Cyclicality:High memory prices are temporary, but oligopoly behavior (cartel-like price fixing) ensures consistent profits.

- Speculation:Short-term plays (e.g., Micron calls) are not advised for long-term investors.

The event reflects growing investor interest in AI’s impact on the memory sector, amid reports of supply constraints and price spikes.

AI is driving unprecedented memory demand:

- High-Bandwidth Memory (HBM):70% year-over-year (YoY) growth (TechInsights via [4]), critical for AI accelerators (e.g., Nvidia GPUs).

- Datacenter NAND:30% YoY growth (TechInsights via [4]) as AI datacenters expand.

- Supply Squeeze:Dell/HP warn of memory chip shortages (Bloomberg, Nov26 via [4]), with TrendForce predicting an upward pricing cycle (CNBC, Nov17 via [4]).

- Temporary Spikes:Memory prices are spiking due to supply-demand imbalance, but are cyclical (Reddit post; XDA Developers via [4]).

- Oligopoly Influence:Three players (Samsung, SK Hynix, Micron) control ~95% of DRAM market share, leading to accusations of price gouging (XDA via [4]) and stable profits (Reddit post).

- Priority Allocation:AI projects get priority over consumer electronics (Oscoo via [4]), leading to shortages in phones/cars (CNBC via [4]).

- Micron (MU):Strong growth (YTD +170.79% [1]), 77% revenue from DRAM (AI’s key memory), and 79.1% analyst Buy ratings ([1]). Market cap: $263.91B ([1]).

- Oligopoly Dominance:Samsung/SK Hynix (private or non-US listed) are equally critical but less accessible to US investors; Micron is the largest US-listed memory player.

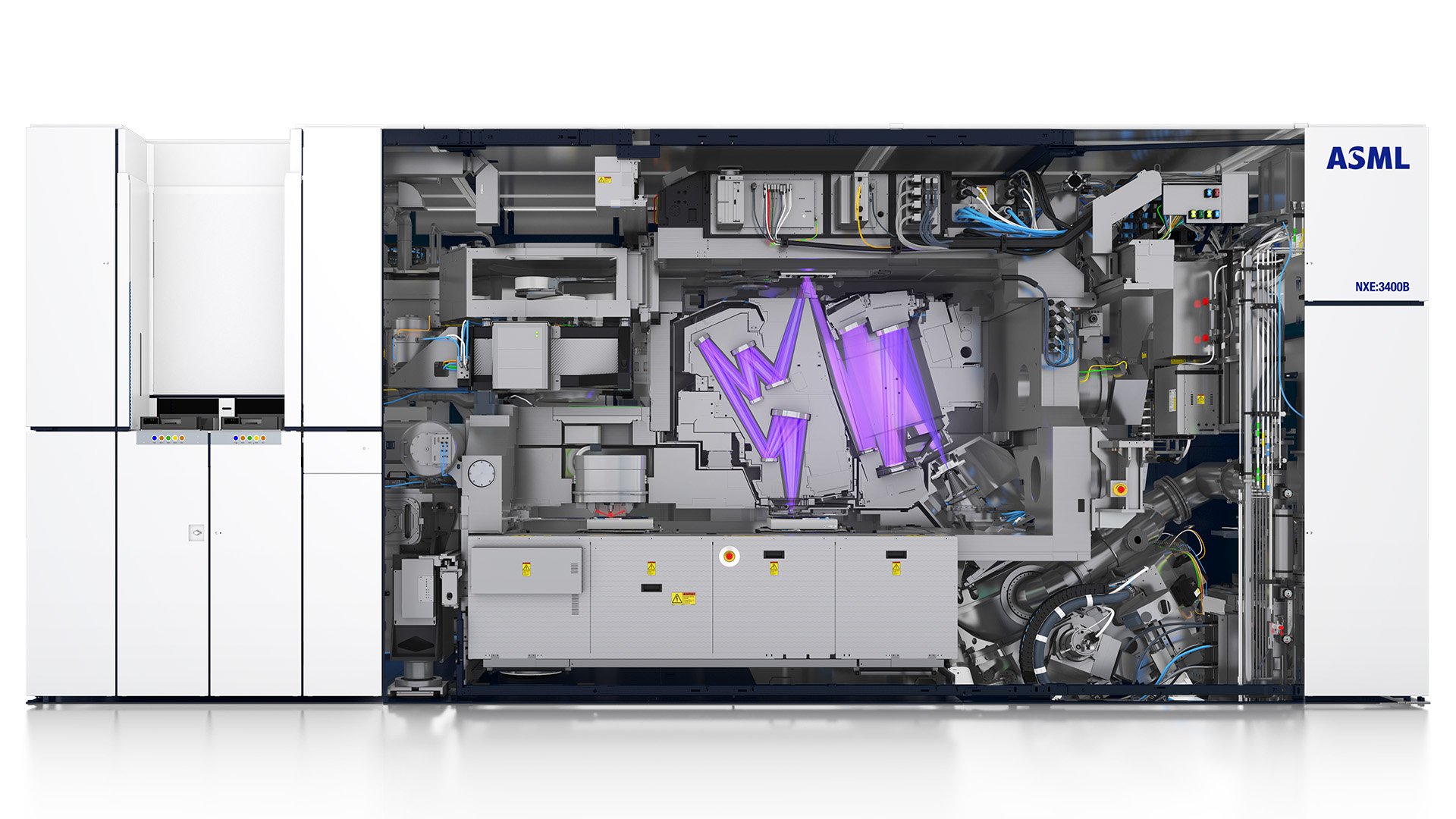

- ASML:Lithography leader (critical for memory fab expansion), market cap $410.83B ([2]), YTD +51.33% ([2]), ROE of 54% ([2]). Consensus target: $1140 (+7.6% upside [2]).

- Applied Materials (AMAT):Semiconductor tool supplier (73.7% revenue from Semiconductor Systems [3]), YTD +53.97% ([3]), and 69.8% analyst Buy ratings ([3]). Market cap: $201B ([3]).

High capital (new fab costs ~$10B), technology (lithography expertise), and scale barriers prevent new players from disrupting the market (Reddit post; ASML/AMAT’s market positions).

- Structural Demand Shift:HBM is becoming the standard for AI accelerators, replacing traditional DRAM in high-performance applications (TechInsights via [4]).

- Equipment Bottlenecks:ASML’s EUV lithography tools are a bottleneck for new fab builds (Reddit post; ASML [2]).

- Long-Term Growth:AI’s memory demand is expected to persist beyond the current cycle (TechInsights via [4]).

- Safe Bets:Choose established players:

- Memory:Micron (MU) ([1])—direct exposure to AI memory.

- Equipment:ASML ([2]) or AMAT ([3])—indirect exposure via fab expansion.

- Rationale:Scale, market position, and alignment with AI’s long-term growth (Reddit post; Tool1-3 data).

- Caution:Cyclicality and potential price corrections (Reddit post; XDA via [4]). Avoid speculative plays (e.g., MU calls) for long-term safety.

- Higher Costs:PC/phone makers face increased memory costs and supply delays (Bloomberg via [4]).

- AI Demand Sustainability:Will AI growth continue to drive memory demand? (TechInsights via [4] suggests yes, but cyclical risks exist).

- Regulatory Scrutiny:Oligopoly behavior (price fixing) may attract regulatory attention (XDA via [4]).

- Equipment Availability:ASML’s ability to scale EUV tool production will determine memory supply growth (ASML [2]).

- Cyclical Market:Memory prices are expected to peak in 2026, then decline (TrendForce via [4]).

[0] Internal Data (Sector Performance Tool)

[1] Micron Technology Overview (Tool1)

[2] ASML Holding Overview (Tool2)

[3] Applied Materials Overview (Tool3)

[4] Web Search Results (Tool4): TechInsights, Bloomberg, CNBC, XDA Developers

[5] Reddit Post (Nov25,2025): “With the memory shortage thanks to AI, how do we best capitalize?”

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.