Meta’s Consideration of Google TPUs: Market Impact on GOOG, NVDA, and META

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

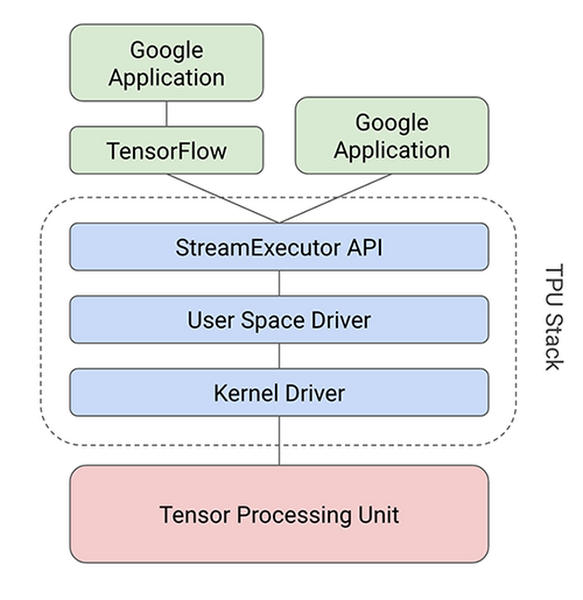

On November 24, 2025, Meta Platforms (META) announced talks to deploy Google’s TPUs in its data centers, leading to immediate market reactions: GOOG rose ~2% in after-hours trading, NVDA fell ~2.05%, and META gained ~2.26% [0,1,2,3]. GOOG’s 6-month rally of 85.91% (from $171.30 to $318.47) reflects growing confidence in its AI chip capabilities [0]. NVDA’s 80% market share in AI accelerators is challenged by custom chips like GOOG’s TPUs, though NVDA maintains a 5x tokens-per-dollar advantage over TPU v6e [5]. Meta’s potential shift could reduce demand for NVDA’s H100/B200 chips and AMD’s MI300X (AMD dropped 9% on the news) [4].

- GOOG’s AI Credibility: The Meta talks solidify GOOG as a viable alternative to NVDA in AI chips, supporting long-term growth.

- NVDA’s Competitive Risk: Custom chips from cloud providers (GOOG, AWS) pose a long-term threat to NVDA’s market share.

- Meta’s Cost-Benefit Tradeoff: TPUs could boost Meta’s EPS via cost savings, but transitioning from NVDA’s CUDA ecosystem may incur significant costs [4].

- FOMO Dynamics: Reddit users reported FOMO to buy GOOG shares, highlighting potential overvaluation if the deal fails [6].

- GOOG: Opportunity to expand AI chip revenue, but risk of overvaluation from FOMO-driven buying [0,6].

- NVDA: Risk of market share erosion from custom chips; need to innovate to maintain edge [5].

- META: Opportunity for cost savings, but transition risk from CUDA to TPU architecture [4].

- Investor Risks: Unconfirmed deal status and unclear deployment volume mean caution is advised [6].

Critical data points:

- GOOG market cap: $3.86T; NVDA: $4.30T; META: $1.63T [0].

- GOOG’s 6-month gain:85.91% [0].

- NVDA’s 1-day loss:2.08% [2].

- Key uncertainties: Deal confirmation, deployment volume, transition costs [4,6].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.