AI-Driven Memory Shortage: Long-Term Investment Opportunities & Market Dynamics

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

A Reddit user initiated a discussion asking for

- Established memory producers (Samsung, SK Hynix, Micron) are preferred for decade-long holdings.

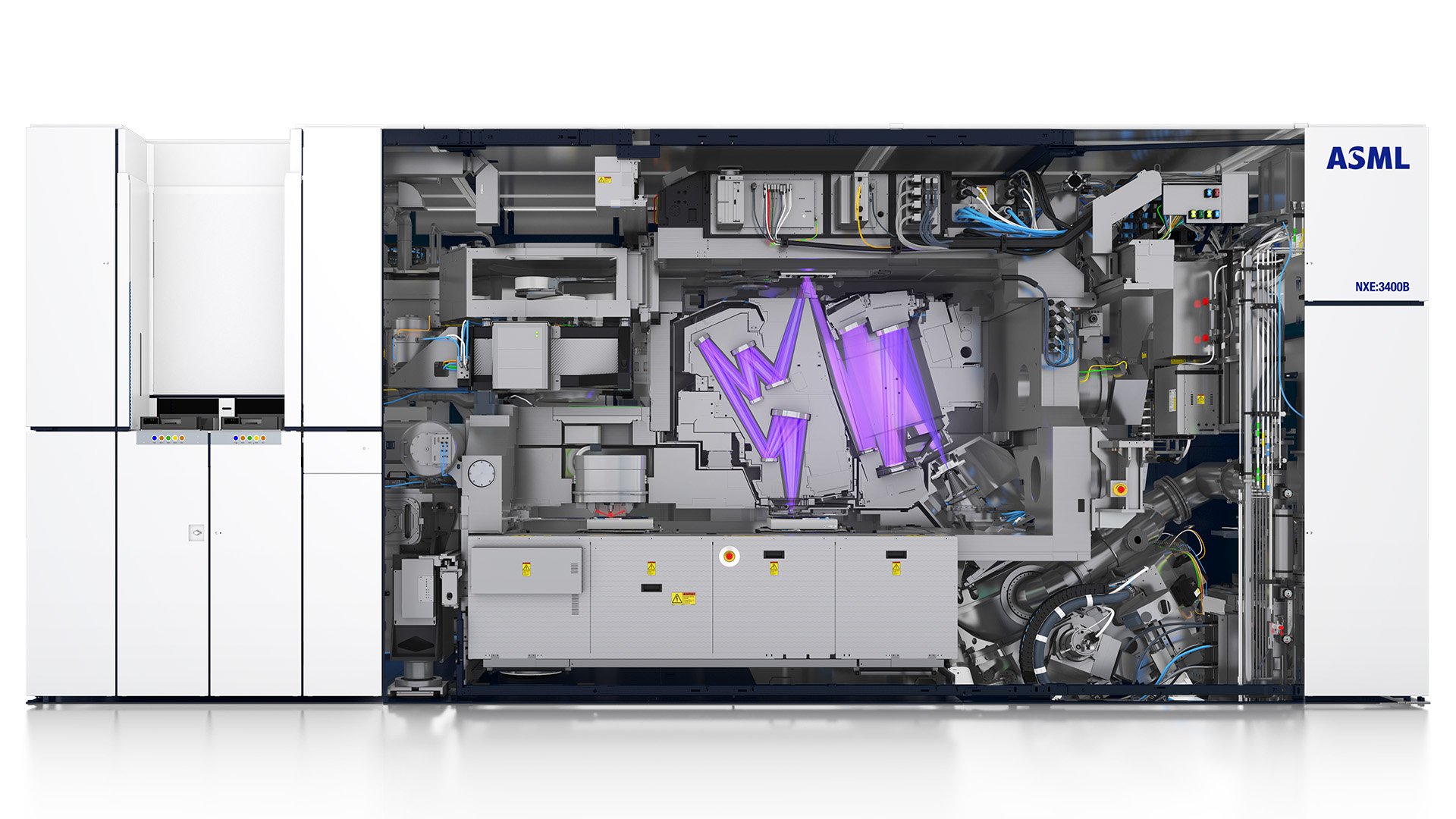

- Equipment suppliers (ASML, Applied Materials) benefit indirectly from new fab builds.

- Memory prices are cyclical but supported by long-term contracts (4+ years) and cartel-like pricing behavior.

- Speculative plays (e.g., Micron calls) were discouraged for risk-averse investors.

The discussion aligns with real-world market trends, as AI server demand has caused a severe shortage of DRAM and NAND chips, driving historic price hikes and capacity expansion plans by leading producers.

- Price Surge:DRAM contract prices rose171.8% year-over-year (YoY)in Q3 2025, outpacing gold price increases [1]. Experts project this trend will persist for at least 4 years due to multi-year supply contracts signed by AI data centers with Samsung and SK Hynix [1].

- Supply Constraints:New semiconductor fabs take2–3 yearsto ramp up production, exacerbating the shortage in the short term.

- Value Chain Effects:

- Upstream:Equipment suppliers (ASML, Applied Materials) see increased demand for lithography and fabrication tools as producers expand capacity.

- Downstream:AI data centers face higher input costs, while consumer electronics makers (smartphones, laptops) are passing on price hikes to end-users [1].

- Top Players:Samsung, SK Hynix, and Micron dominate the memory market, with Micron investing$9.6 billionin a Japan plant to produce AI-focused memory chips [0,5]. Samsung is also building a new semiconductor plant in South Korea to meet demand [1].

- Equipment Suppliers:ASML (EUV lithography leader) and Applied Materials (semiconductor systems) have strengthened their market positions—ASML’s EUV tools are critical for advanced memory chip production, and Applied Materials’ services support 73.7% of its revenue [0,4,5].

- Barriers to Entry:High capital costs (new fabs cost $10B+), technical expertise, and long lead times prevent new players from entering the market, leading to further consolidation.

- Micron’s Japan Plant:A $9.6B investment to produce AI-optimized memory chips, expected to boost capacity by 20% by 2028 [5].

- SK Hynix’s Record Quarter:The company reported its best-ever quarterly performance in Q3 2025, driven by DRAM and NAND price hikes [1].

- Long-Term Contracts:AI data centers have signed 4+ year supply contracts with memory producers, locking in demand and prices [1].

- ASML’s EUV Dominance:The company controls 100% of the EUV lithography market, a key technology for next-gen memory chips [4].

- Safe Long-Term Picks:Established memory producers (Micron, Samsung, SK Hynix) and equipment suppliers (ASML, Applied Materials) are recommended. Micron has a79.1% Buy ratingfrom analysts, with Morgan Stanley raising its price target to $325 [0,2].

- Avoid Speculation:Short-term plays (e.g., Micron calls) are discouraged due to cyclical risks.

- AI Data Centers:Lock in long-term supply contracts to mitigate price volatility.

- Consumer Electronics Makers:Pass on higher memory costs to consumers or optimize product designs to reduce memory usage.

- Expand Capacity:Invest in new fabs to meet AI demand, but balance with cyclical risk management.

- Pricing Strategies:Maintain cartel-like behavior to stabilize margins (as noted in the Reddit thread).

- AI Demand Growth:Sustained adoption of AI servers will drive long-term memory demand.

- Capacity Expansion:Speed of new fab builds (Micron, Samsung) will determine when the shortage eases.

- Cyclicality:While current prices are high, the memory market is historically cyclical—producers need to prepare for future downturns.

- Geopolitical Risks:U.S.-China tensions could impact supply chains, as ASML and Applied Materials derive ~37% of their revenue from China [4,5].

[0] Internal Company Overview Database (Micron, ASML, Applied Materials).

[1] Yahoo Finance. “DRAM prices skyrocket 171% year-over-year…” URL: https://finance.yahoo.com/news/dram-prices-skyrocket-171-over-130000544.html (2025).

[2] Investopedia. “Morgan Stanley Labels This Memory Chip Maker a ‘Top Pick’…” URL: https://www.investopedia.com/morgan-stanley-labels-this-memory-chip-maker-a-top-pick-as-shortage-drives-up-prices-11849647 (2025).

[3] Yahoo Finance. “Memory chip crunch set to drive up smartphone prices…” URL: https://finance.yahoo.com/news/memory-chip-crunch-set-drive-052600635.html (2025).

[4] Bloomberg. “Micron to Invest $9.6 Billion in Japan Memory Chip Plant…” URL: https://www.bloomberg.com/news/articles/2025-11-29/micron-to-invest-9-6-billion-in-japan-memory-chip-plant-nikkei (2025-11-29).

[5] Company Overview: Micron Technology (MU), ASML Holding (ASML), Applied Materials (AMAT) [Internal Data,2025].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.