QIMC Natural Hydrogen Catalysts Analysis: Nova Scotia Staking & Minnesota Permits

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

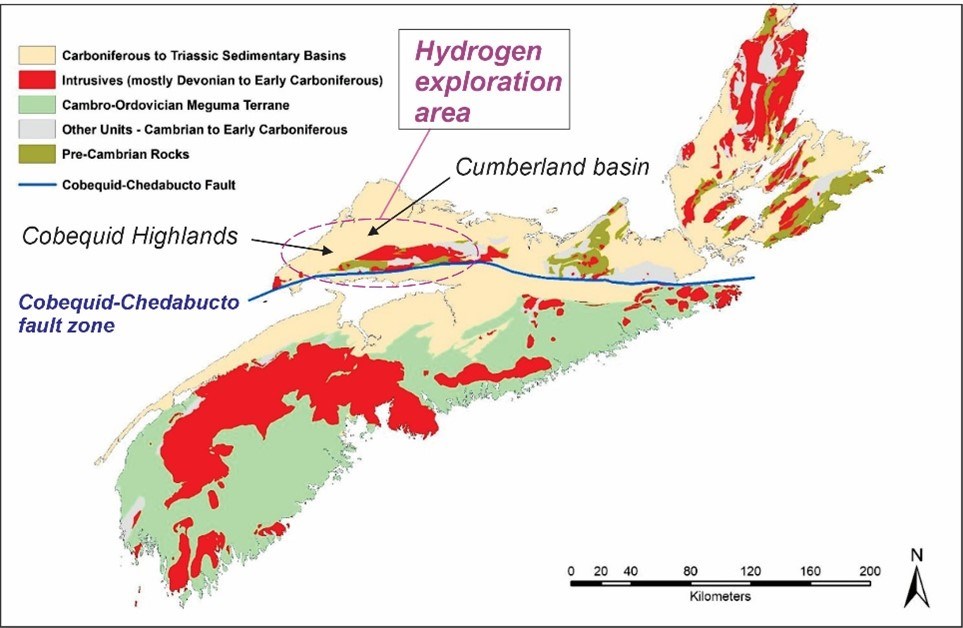

QIMC, a natural hydrogen (white hydrogen) exploration firm, has recently unveiled two key catalysts: a staking rush in Nova Scotia (with unconfirmed reports of billionaire-backed Koloma staking adjacent claims) and U.S. expansion via Minnesota Resource Exploration and Development Agreements (RGRAs) through its SPV Orvian [1][2]. Positioned as a first-mover in the nascent natural hydrogen sector using proprietary geological methods, QIMC aims to capitalize on the clean energy transition [3]. However, critical information gaps exist: no accessible price/volume data for QIMC’s tickers (CSE: QIMC, OTCQB: QIMCF, FSE:7FJ), unconfirmed Koloma staking claims, limited details on Minnesota RGRAs, undefined drill result timelines, and missing financial reports [0][1][3].

- First-Mover Advantage: QIMC’s early entry into natural hydrogen—an emerging clean energy sub-sector—aligns with global decarbonization trends, but this comes with unproven commercial viability [2][3].

- Catalyst Validation Gaps: While the Nova Scotia staking rush and Minnesota permits signal potential market validation, the lack of independent confirmation for Koloma’s adjacent staking and limited RGRA details weaken the catalysts’ credibility [0][1].

- Clean Energy Sector Alignment: Natural hydrogen’s role in reducing carbon emissions positions QIMC within a high-growth sector, though regulatory and technical uncertainties persist [4].

- Speculative Exploration Risk: Natural hydrogen is an early-stage sector with geological uncertainties; drill failures could impact project viability [3][4].

- Financial Transparency: No recent financial data to assess QIMC’s ability to fund ongoing exploration [0].

- Unconfirmed Claims: Koloma’s adjacent staking in Nova Scotia lacks independent verification [0].

- Regulatory Risk: Evolving natural hydrogen regulations may delay projects or increase costs [1][2].

- First-Mover Position: Early access to prospective natural hydrogen assets could yield competitive advantages if the sector scales [2][3].

- Clean Energy Demand: Global decarbonization efforts may drive demand for natural hydrogen, supporting long-term growth [4].

QIMC’s recent catalysts highlight its potential in the natural hydrogen sector, but decision-makers must consider significant information gaps. Key factors to monitor include Nova Scotia drill results (timeline unconfirmed), independent Koloma staking verification, Minnesota RGRA details, and financial disclosures. The analysis provides context for informed decision-making without prescriptive recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.