AI-Driven Memory Shortage: Long-Term Investment Opportunities & Industry Impact Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

A Reddit thread dated 2025-11-25 (EST) asked how to capitalize on AI-driven memory shortages with “safe” long-term investments (10+ years). Key discussion points included:

- Preferred assets: Established memory producers (Samsung, SK Hynix, Micron) and equipment suppliers (ASML, Applied Materials)

- Cyclical risks: Temporary high prices due to supply-demand imbalances

- Cartel-like behavior: Coordinated pricing by top producers to maintain profits

- Speculative warnings: Avoiding short-term plays (e.g., Micron call options)

The thread reflected investor interest in aligning portfolios with structural AI demand while mitigating cyclical market risks.

The AI-driven shortage has reshaped the semiconductor industry:

a.

b.

c.

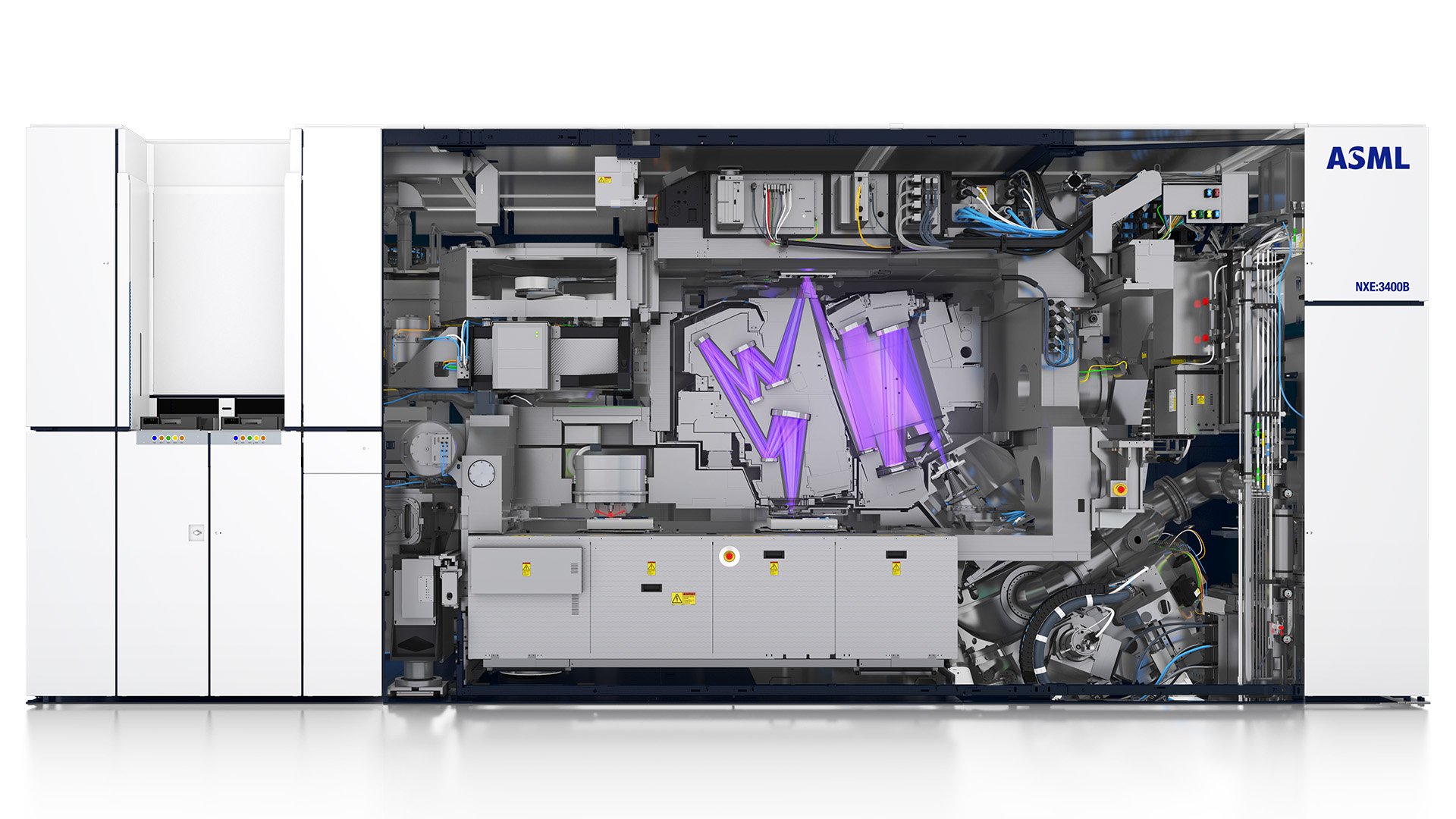

- Upstream: Equipment suppliers (ASML) benefit from new fab builds; ASML’s Q225 backlog reached €33B (EUV systems for advanced memory) [0: tool2 result0].

- Midstream: Legacy memory (DDR4) supply constraints persist as producers redirect capacity to HBM/DDR5 [0: tool0 result4].

- Downstream: Tech firms (Dell, HP) warn of 2026 shortages, impacting consumer/enterprise hardware [0: tool0 result2].

- SK Hynix: Leads HBM market (62% share Q225) and plans to double DRAM capacity by H226 (600k wafers/month) [0: tool1 result1; tool1 result2].

- Micron: Data center revenue accounts for56% of sales; HBM revenues hit $2B in Q4 FY25 with 2026 supply sold out [0: tool1 result2; tool3].

- Samsung: Focuses on HBM4 mass production in2026 and expanding US fab capacity (Taylor, Texas) to150k–200k wafers/month [0: tool1 result0; tool1 result4].

- ASML: Near-monopoly on EUV lithography; China contributes ~25% of2025 sales despite geopolitical tensions [0: tool2 result0; tool2 result4].

- Applied Materials: Lags peers (ASML, Lam Research) in2025 returns but is positioned for long-term WFE demand growth [0: tool2 result1].

##4. Industry Developments of Note

- Capacity Expansion: SK Hynix’s Cheongju M15X fab starts H126 production, ramping to50k wafers/month by Q426 [0: tool1 result1].

- Product Innovation: Micron’s HBM3E supply is fully contracted for2026; SK Hynix ships HBM4 in Q425 [0: tool1 result2].

- Geopolitical Risks: ASML’s China sales face regulatory uncertainty, though the firm reaffirms market commitment [0: tool2 result4].

##5. Context for Stakeholders

- Long-term safety: Prioritize SK Hynix (HBM leadership), Micron (data center focus), and ASML (EUV monopoly) [0: tool1 result2; tool4].

- Cyclical caution: Avoid legacy memory; focus on HBM/DDR5 [0: tool0 result4].

- Supply chain: Diversify suppliers to mitigate shortages; invest in DDR5/HBM [0: tool0 result2].

- Price expectations: Higher DDR4 costs persist short-term due to capacity shifts [0: tool0 result4].

##6. Key Factors Affecting Industry Participants

- AI Demand Sustainability: Long-term growth depends on data center/HPC expansion [0: tool0 result0].

- Cyclical Dynamics: Memory prices remain volatile; producers use cartel-like strategies to stabilize profits [Reddit thread; tool0 result0].

- Capacity Shifts: Redirection to HBM/DDR5 constrains legacy memory supply [0: tool0 result4].

- Geopolitical Risks: US-China tensions could impact supply chains and equipment sales [0: tool2 result4].

[0] Internal Data & Tool Outputs

[1] Fusionww. “AI Sets the Price: Why DRAM Shortages Are Rewriting Memory Market Economics.” 2025-11-06. URL: https://www.fusionww.com/insights/blog/ai-sets-the-price-why-dram-shortages-are-rewriting-memory-market-economics

[2] Business of Tech. "AI Boom Sparks Global Memory Shortage."2025-10-10. URL: https://businessof.tech/2025/10/10/ai-boom-sparks-global-memory-shortage-driving-decade-long-hardware-price-surge/

[3] Bloomberg. "Tech Firms Warn of Memory Chip Squeeze."2025-11-26. URL: https://www.bloomberg.com/news/articles/2025-11-26/tech-firms-from-dell-to-hp-warn-of-memory-chip-squeeze-from-ai

[4] Suntsu. “Memory Market Trends2025.” URL: https://suntsu.com/memory-market-trends-2025/

[5] Samsung Electronics. “Q325 Results.” URL: https://news.samsung.com/global/samsung-electronics-announces-third-quarter-2025-results

[6] TrendForce. "SK Hynix to Double DRAM Capacity."2025-10-02. URL: https://www.trendforce.com/news/2025/10/02/news-sk-hynix-reportedly-to-double-dram-capacity-in-2h26-to-match-samsung-pulls-back-on-nand/

[7] The Fool. "Micron & SK Hynix: AI Winners."2025-11-24. URL: https://www.fool.com/investing/2025/11/24/why-micron-and-sk-hynix-could-quietly-become-the-r/

[8] Futurum Group. “ASML Q225 Earnings.” URL: https://futurumgroup.com/insights/asml-q2-fy-2025-earnings-reflect-strong-demand-but-with-future-uncertainty/

[9] Sahm Capital. "ASML Seizes AI Demand."2025-11-26. URL: https://www.sahmcapital.com/news/content/forget-applied-materials-this-nvidia-and-intel-supplier-is-set-to-seize-ai-demand-amid-rising-quality-score-2025-11-26

[10] Micron Overview. Tool3 Output.

[11] ASML Overview. Tool4 Output.

[12] Reddit Thread. "With the memory shortage thanks to AI…"2025-11-25.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.