NVIDIA (NVDA) vs Google TPUs: Investment Context Amid Competition

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The analysis is based on a Reddit discussion (user-provided) dated 2025-11-28 (EST) exploring whether NVIDIA remains a viable investment amid competition from Google’s Tensor Processing Units (TPUs). Key arguments include:

- Pro-NVIDIA: Undervalued due to ecosystem leadership; Blackwell/Rubin chips are more cost-effective than TPUs; CEO Jensen Huang’s track record of innovation.

- Anti-NVIDIA: PE ratio (~50x) is overvalued for a mature company; TPUs could reduce margins from 80% to 30%; TPUs are more power-efficient (2x performance per watt).

- Alternative: AMD is a better option due to its early growth cycle [0].

- NVIDIA’s stock closed at $176.51 (-2.08% day-over-day) on 2025-11-29, underperforming the Technology sector (+0.53% day-over-day) [0]. This may reflect investor concerns about Meta’s exploration of TPUs [6].

- AMD’s stock rose 1.53% day-over-day, outperforming NVDA, but its PE ratio (106.98x) is more than double NVDA’s (43.29x) [0].

- NVIDIA’s 1-month return is -14.75%, but YTD returns remain strong (+27.62%) [0]. Bank of America projects NVDA’s market share will decline from 85% to 75% due to TPU competition, but it will still dominate the AI chip market [6].

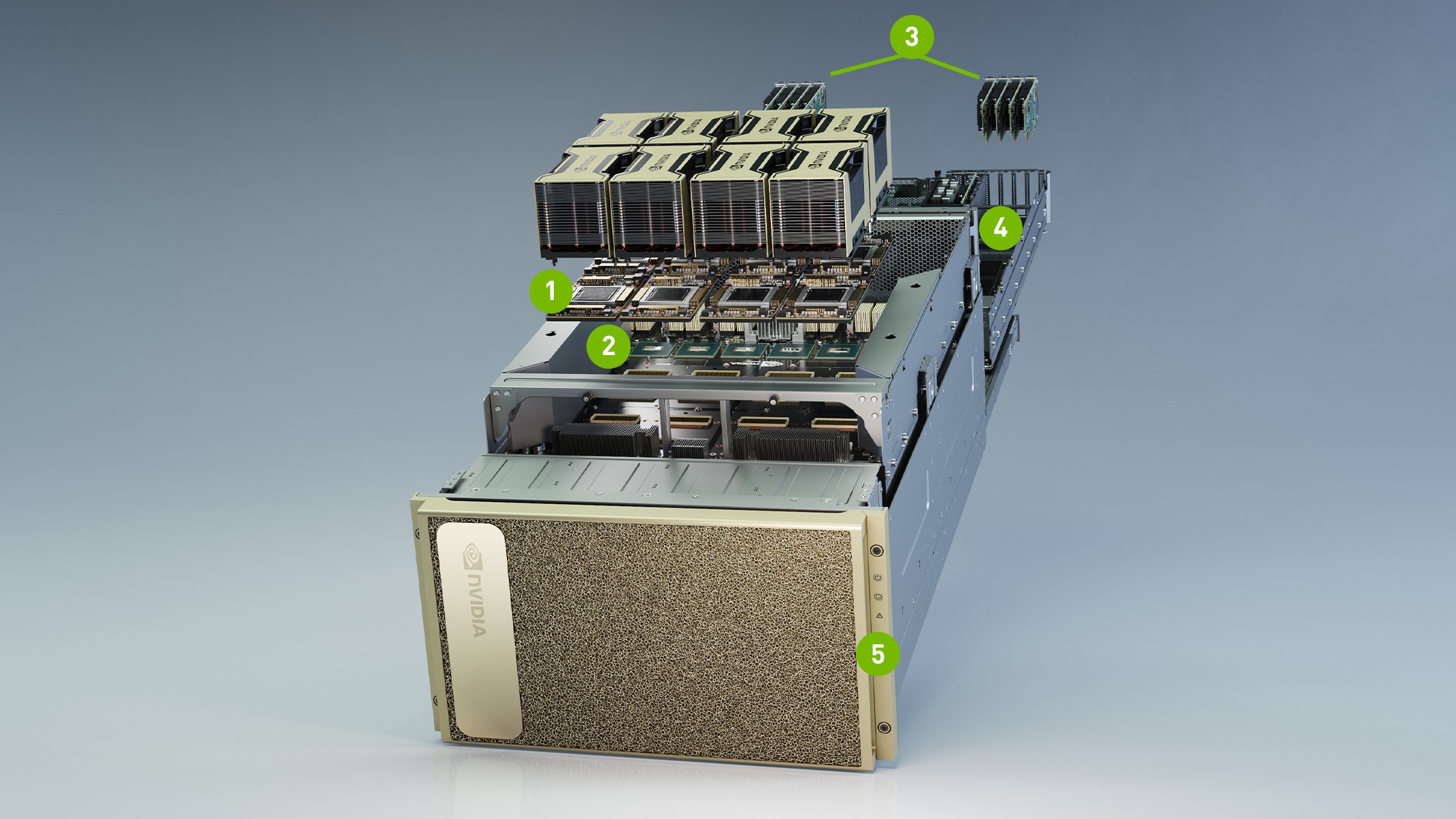

- Blackwell chips are in full production, with demand exceeding supply [1]. NVIDIA expects $500B in Blackwell/Rubin sales by end-2026 [7].

- NVIDIA’s ecosystem (CUDA platform) and product pipeline (Rubin chips in 2026/2027) will sustain its leadership [1]. However, TPUs could pose a long-term threat if they gain broader adoption among cloud providers [2].

| Metric | NVIDIA (NVDA) | AMD (AMD) | Source |

|---|---|---|---|

| Current Price | $176.51 | $217.52 | [0] |

| PE Ratio (TTM) | 43.29x | 106.98x | [0] |

| Net Profit Margin | 53.01% | 10.32% | [0] |

| Analyst Target Price | $250 (+41.6% upside) | $300 (+37.9% upside) | [0] |

| Blackwell/Rubin Sales Projection | $500B (2025-2026) | N/A | [7] |

- Directly Impacted: NVIDIA (NVDA), AMD (AMD), Google (GOOG) (TPU maker).

- Related Sectors: Semiconductors (Technology), Data Center Infrastructure, Cloud Computing.

- Upstream: TSMC (chip manufacturing), SK Hynix/Micron (HBM suppliers).

- Downstream: AWS, Azure, Google Cloud (cloud providers), OpenAI/Anthropic (AI startups).

- Need to monitor Rubin chip’s actual performance vs TPUs when launched (2026/2027) [1].

- Track Meta’s adoption rate of TPUs and its impact on NVDA’s sales [6].

- Verify NVIDIA’s gross margin recovery to mid-70s by H2 2026 [1].

- Bullish: Strong ecosystem moat; robust demand for Blackwell/Rubin; attractive valuation relative to AMD; high analyst upside [0][7].

- Bearish: TPU competition reduces market share/margins; short-term margin pressure from Blackwell ramp; regulatory risks (China export controls) [1][6].

- Users should be aware that Google’s TPUs may reduce NVIDIA’s market share and margins, as projected by Bank of America [6].

- NVIDIA’s gross margins will dip to low-70s in the short term due to Blackwell’s ramp, impacting near-term earnings [1].

- Rubin chip launch (2026/2027) and its cost-effectiveness vs TPUs [1].

- TPU adoption by major cloud providers (Meta, AWS) [6].

- NVIDIA’s gross margin trends (recovery to mid-70s by H22026) [1].

- AI demand growth and regulatory changes in semiconductor exports [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.