Analysis of Reddit Post on Proprietary Data as AI Defensibility Moat and Mentioned Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

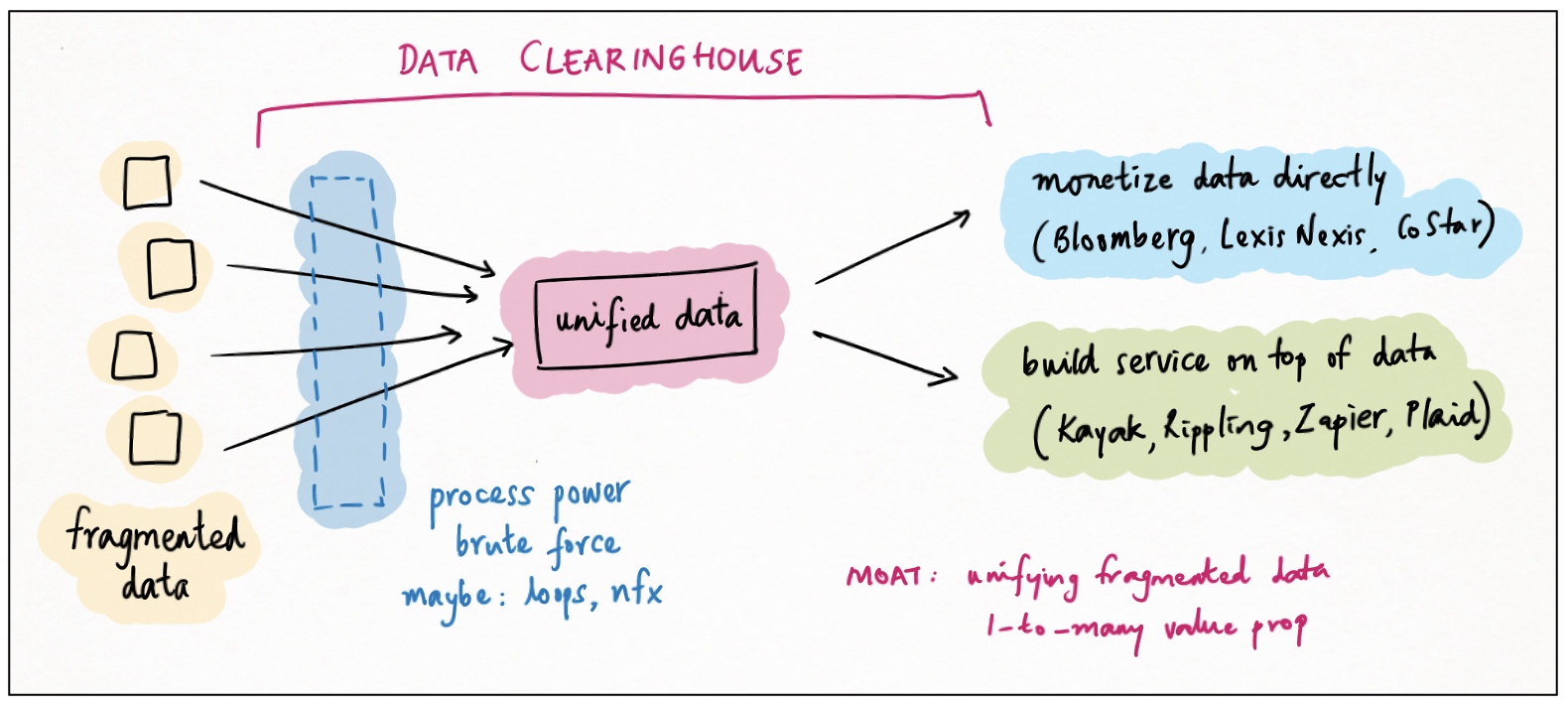

This analysis is based on a Reddit post [1] published on 2025-11-28 UTC, which argues AI defensibility depends on proprietary non-scrapable data (e.g., DUOL’s learning data, ADBE’s creative data, FIG’s collaboration data). Comments discuss Reddit’s data monetization gap, valuation of mentioned stocks, synthetic vs real data, and AI manipulation risks.

The OP’s argument aligns with industry consensus [4] that proprietary real-time/unstructured data is a key differentiator for AI-native vertical SaaS. For example:

- DUOL’s adaptive learning data supports AI personalization, reflected in its $191.65 price and 24.17 P/E ratio [0].

- ADBE’s creative data enhances AI features like Firefly, contributing to its $320.12 price and $134B market cap [0].

- FIG’s collaboration data is a core asset, though it has negative EPS (-3.54) [2].

Reddit’s data licensing revenue ($35M Q22025) is small compared to ads ($465M) [3], indicating under-monetization of its data (the #1 most-cited source in AI models [3]). FIG’s price ($36.57) is down from its $142.92 peak [2], but analysts target $67.63 (+87% upside) [2]. DUOL’s higher P/E ratio vs ADBE suggests faster growth expectations [0].

- Cross-domain Correlation: Proprietary data as AI defensibility moat affects tech companies (DUOL/ADBE/FIG) and platforms like Reddit.

- Ethical Implications: Comments on AI manipulation via data [1] highlight concerns about data-driven power imbalances, potentially leading to stricter regulations.

- Reddit’s Opportunity: Its unique dataset presents high-margin growth in data licensing [3].

- AI manipulation risks via data-driven prediction [1]

- Data quality debates (synthetic vs real data [1])

- FIG’s negative EPS (-3.54) [2]

- Reddit’s data monetization expansion [3]

- DUOL/ADBE’s data-driven growth [0]

- FIG’s long-term potential (analyst target +87% upside [2])

- FIG: $36.57 price, $17.81B market cap, -3.54 EPS [2]

- DUOL: $191.65 price, 24.17 P/E ratio [0]

- ADBE: $320.12 price, $134B market cap [0]

- Reddit: Q22025 ad revenue ($465M, +84% YoY), data licensing ($35M, +24% YoY) [3]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.