AI-Driven Memory Shortage: Strategic Investment Opportunities and Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

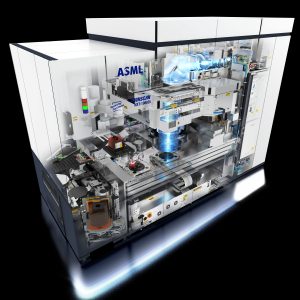

The AI-driven memory shortage has created a complex landscape for investors, blending structural growth opportunities with cyclical risks. According to TechInsights [2], HBM demand is projected to grow 70% YoY in 2025, driven by AI workloads’ memory intensity. This structural shift has led to a 172% YoY surge in DRAM prices [3], benefiting established memory producers like Micron (MU), Samsung, and SK Hynix—who control ~95% of the DRAM market [1]. Equipment suppliers such as ASML and Applied Materials (AMAT) also stand to gain indirectly, as their machines are essential for new fab builds [1].

- Structural vs Cyclical Demand: While AI-driven demand for HBM represents a long-term structural shift, the current price surge may be cyclical, as historical trends show memory prices tend to reverse once new capacity comes online [3].

- Cartel-Like Behavior: Allegations of coordinated production cuts and pricing by the big three memory producers [1] suggest potential for sustained profitability, though this also raises regulatory scrutiny risks [3].

- Equipment Suppliers’ Resilience: Companies like ASML and AMAT benefit from both memory and semiconductor production expansions, making them more resilient to cyclical swings than pure memory producers [1].

- Risks: Cyclical price reversals (once new capacity is added), regulatory scrutiny on cartel-like practices [3], supply chain constraints (e.g., power infrastructure for new fabs [2]).

- Opportunities: Long-term investments in established memory producers (MU) and equipment suppliers (ASML, AMAT) [1], indirect exposure to AI growth via equipment makers.

The AI-driven memory shortage presents both opportunities and risks. Established memory producers and equipment suppliers are positioned for long-term growth, while speculative plays carry significant cyclical risks. The market’s cyclical nature and potential regulatory scrutiny should be considered when evaluating investment options.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.