QIMC Natural Hydrogen Catalysts Analysis: Nova Scotia Drilling & Minnesota Expansion

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

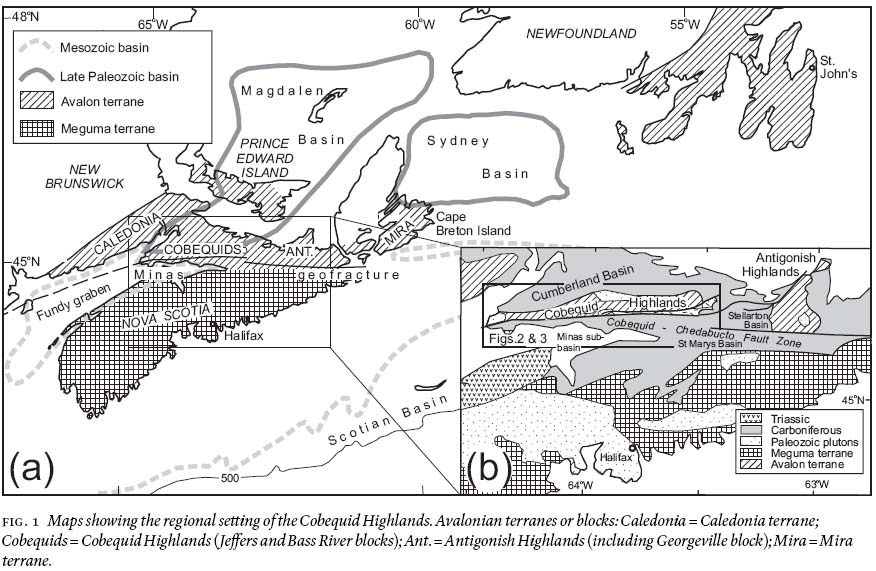

QIMC (Québec Innovative Materials Corp.) has announced two key catalysts for its natural hydrogen (white hydrogen) exploration efforts: a winter drilling program in Nova Scotia’s Cobequid Fault region with hydrogen concentrations up to 4,300 ppm [1], and expansion into Minnesota via two Resource Exploration and Development Agreements (RGRAs) covering ~72 square miles [2]. The company positions itself as a first-mover in the nascent natural hydrogen sector, using proprietary geological methods [1].

Billionaire-backed Koloma Inc. (supported by Bill Gates’ Breakthrough Energy Ventures and Amazon [3]) has raised over $350 million for natural hydrogen exploration [4], validating the sector’s potential. However, the claim that Koloma staked adjacent to QIMC’s Nova Scotia land remains unconfirmed [0].

QIMC’s market cap is approximately CAD 67.88 million (CSE: QIMC.CN) [5]. The natural hydrogen sector is seen as a high-risk, high-reward clean energy opportunity, with QIMC’s upcoming drill results in Nova Scotia expected to be a critical milestone [0].

- First-Mover Advantage: QIMC’s early entry into natural hydrogen exploration aligns with global clean energy demand, potentially positioning it for leadership if its methodology proves successful [0].

- Sector Validation: Koloma’s significant funding and billionaire backing signal institutional confidence in natural hydrogen as a viable clean fuel source [3,4].

- Data Gaps: Critical gaps include QIMC’s financial health (no recent revenue or cash burn data), confirmation of Koloma’s adjacent staking, and stock price reaction to the catalysts [0].

- Speculative Sector: Natural hydrogen exploration is in early stages, with unproven geological models [0].

- Unconfirmed Claims: The Reddit post’s assertion about Koloma’s adjacent staking lacks independent verification [0].

- Financial Transparency: No recent financial disclosures make it difficult to assess QIMC’s sustainability [0].

- Regulatory Uncertainty: Evolving regulations for clean energy exploration could impact QIMC’s operations [0].

- Clean Energy Demand: Global shift toward decarbonization may drive demand for natural hydrogen [0].

- First-Mover Position: If QIMC’s drilling results are positive, it could capture significant market share [1].

QIMC’s key metrics include:

- Nova Scotia hydrogen concentrations: up to 4,300 ppm [1].

- Minnesota RGRAs: ~72 square miles [2].

- Koloma’s funding: over $350 million [4].

- QIMC market cap: ~CAD 67.88 million [5].

Decision-makers should monitor QIMC’s upcoming drill results, financial disclosures, and regulatory updates in the natural hydrogen sector [0].

This analysis provides factual context and is not investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.