NVIDIA (NVDA) Valuation & Competitive Position vs Google TPUs: Investment Context

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

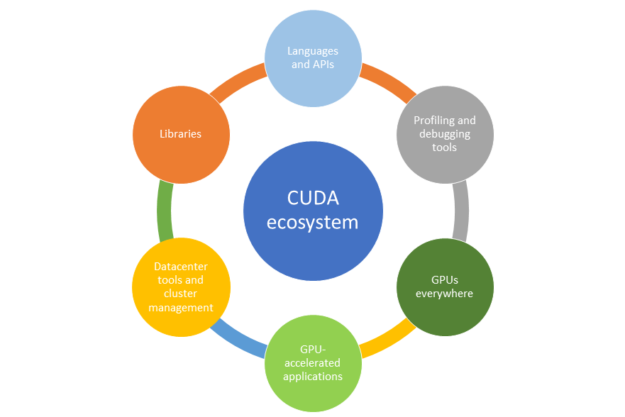

The Reddit discussion presents conflicting views on NVIDIA (NVDA)’s investment merit amid Google TPU competition [1]. Bullish arguments highlight NVDA’s ecosystem lead (CUDA) and Blackwell/Rubin chips’ cost-effectiveness (300% faster than TPUs, lower total cost for equivalent performance). Bearish points include overvaluation concerns (PE ~50x for a mature company) and margin compression risks if TPU competition reduces NVDA’s pricing power (from 80% to 30% margins). Neutral arguments note TPU’s superior power efficiency (2x per watt) and AMD’s early growth cycle as an alternative [1].

Cross-domain connections reveal NVDA’s ecosystem lock-in (CUDA) as a critical moat, but TPUs’ technical advantages (power efficiency, rack-level cost) could erode market share over time. The debate underscores tension between short-term valuation concerns and long-term competitive positioning in the AI chip market [1].

The discussion synthesizes critical data points: NVDA’s PE ratio (~50x), Blackwell’s 300% speed advantage over TPUs, TPU’s 2x power efficiency, and AMD as an alternative. No prescriptive advice is given, but decision-makers should consider technical merits and market dynamics when evaluating NVDA’s position [1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.