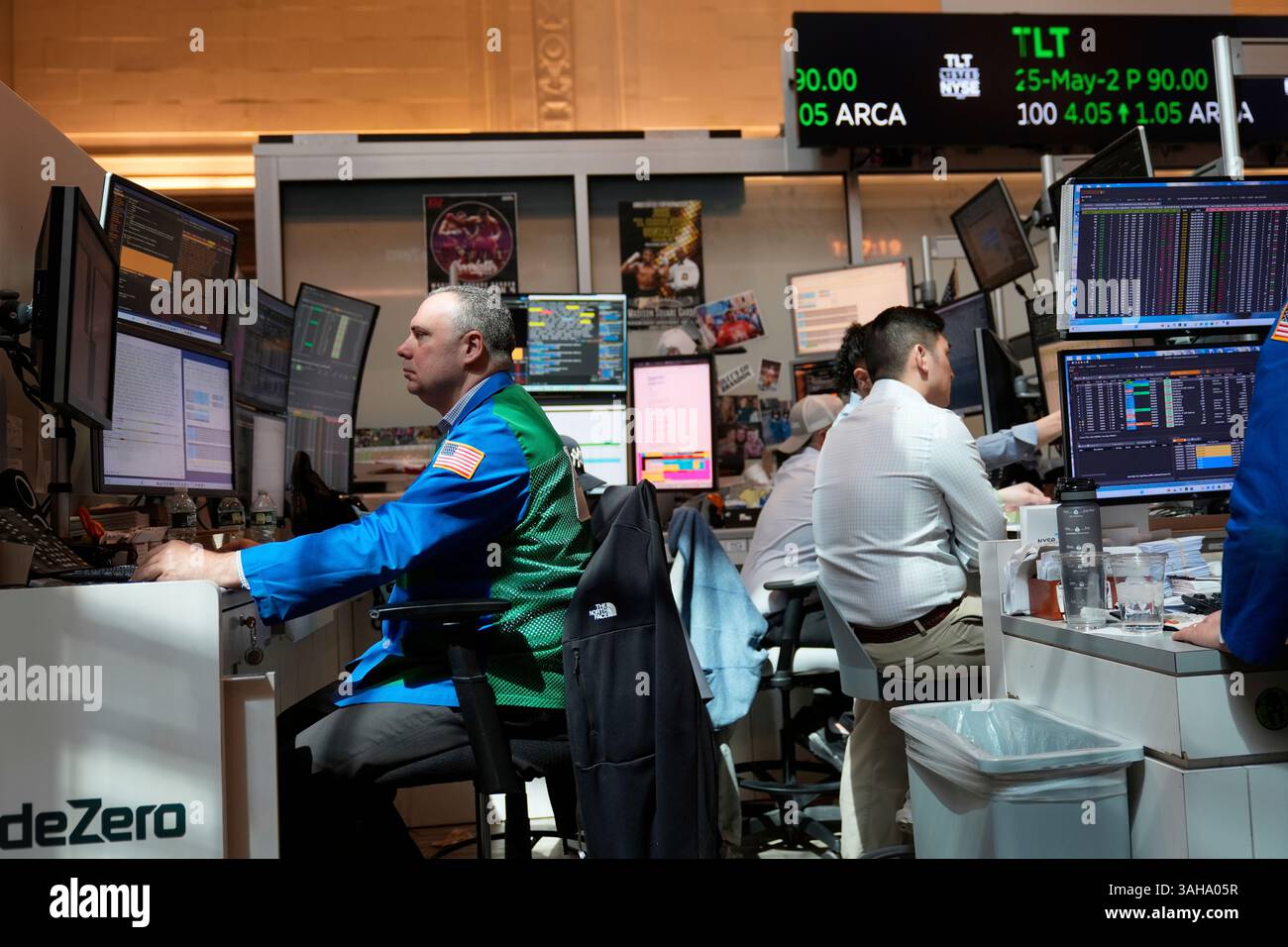

US Markets Rise on Weak Labor Data as Challenger Reports 175% Job Cut Increase

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Proactive Investors report [1] published on November 6, 2025, which covered market reactions to the Challenger job cuts data. The report revealed that US stock futures were set to open slightly higher despite concerning labor market deterioration, highlighting the complex relationship between employment data and monetary policy expectations.

- Labor Market Volatility:The accelerating pace of job cuts, particularly in technology and warehousing sectors, may significantly impact consumer spending and economic growth in coming quarters [2]. Users should be aware that the 14-year low in hiring plans suggests prolonged labor market weakness.

- Policy Uncertainty:The combination of extended government shutdown and changing Fed rate cut expectations (December rate cut probability at 67%) creates heightened uncertainty [1]. This environment could lead to increased market volatility as investors react to incomplete information.

- AI Disruption Timeline:While historical technological shifts typically created short-term job losses followed by longer-term productivity gains, the current AI transition may have different characteristics and timelines [2]. The rapid acceleration in AI-related cuts suggests this disruption could be more immediate and widespread than previous technological changes.

- Sector Rotation Potential:The strong performance in cyclical sectors despite weak labor data suggests opportunities in companies positioned to benefit from potential rate cuts and economic recovery [0].

- AI-Related Investment Themes:Companies developing AI technologies or successfully implementing AI for productivity gains may present long-term growth opportunities, while firms lagging in AI adoption could face competitive disadvantages [2].

- Data-Dependent Trading:When the government shutdown ends and official data is released, significant market movements may occur as investors adjust positions based on comprehensive economic information [1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.