QIMC Catalysts Analysis: Nova Scotia Staking Rush & Minnesota Permits in Natural Hydrogen Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

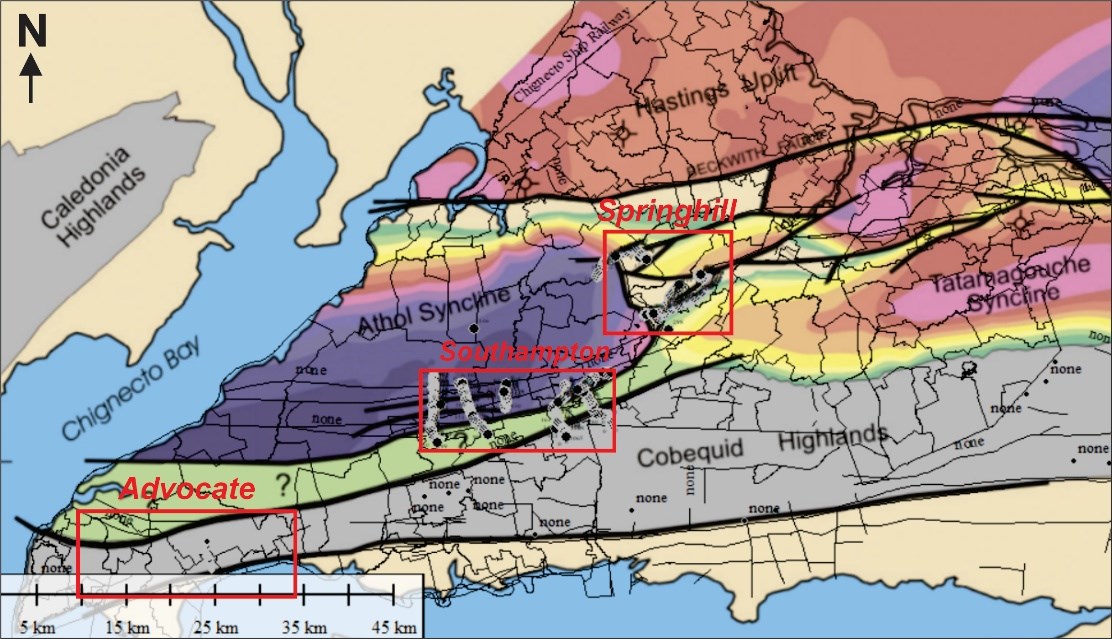

QIMC (Quebec Innovative Materials Corp.) revealed two critical catalysts on November 26, 2025: a Nova Scotia staking rush validating land claims (with billionaire-backed Koloma staking adjacent claims) and Minnesota Resource Grant Rights Agreements (RGRAs) for U.S. hydrogen exploration [1][3]. These developments drove a 12.09% stock surge, aligning with the Energy sector’s +1.135% gain that day [0]. As a first-mover in natural hydrogen using proprietary geological methods, QIMC positions itself in a nascent clean energy sector projected to grow at an 11.24% CAGR from 2025-2034 [4].

- Billionaire Validation: Koloma’s adjacent staking (backed by Gates/Bezos) signals growing sector credibility, potentially attracting additional investment [1].

- Regulatory Tailwinds: Minnesota’s RGRAs reflect U.S. policy support for natural hydrogen, opening expansion opportunities [3].

- Data Gaps: Critical information (financial health, drill timeline, market cap) remains unavailable, limiting comprehensive assessment.

- Opportunities: First-mover advantage in natural hydrogen, sector growth potential, validation from well-funded peers, regulatory support.

- Risks: Nascent sector with no large-scale commercial projects, exploration risk (drill results pending), Reddit credibility concerns, conflict of interest in NIA report [1].

QIMC’s recent catalysts include Nova Scotia staking rush (with Koloma’s adjacent claims) and Minnesota permits, driving a 12.09% surge. The natural hydrogen market is projected to grow at 11.24% CAGR, but the company faces significant risks from exploration uncertainty and nascent sector challenges. Key gaps include financial metrics and drill result timelines, requiring independent verification.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.