NVIDIA (NVDA) Valuation & Competitive Position vs Google TPUs: Analysis of Market Dynamics and Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

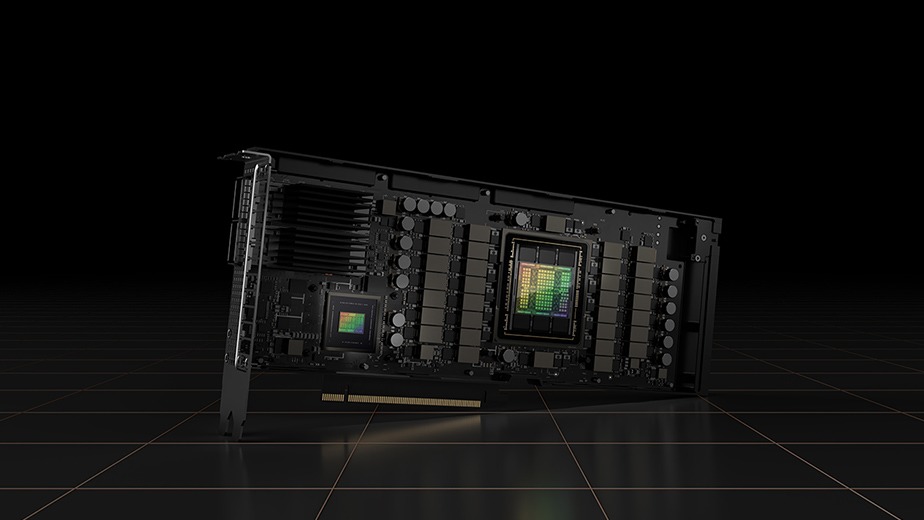

This analysis is based on a Reddit discussion [4] and market data [0,1,2,3]. NVIDIA (NVDA) closed at $176.51 (-2.08%) on Nov30,2025, with a 13% drop over the past month due to competition fears from Google’s TPUs [3]. Q3 2025 revenue reached $57B (62% YoY increase) driven by AI demand [1], while gross margin stood at 73.4% (1.2% YoY decline) [1]. NVDA holds 80-90% of the AI GPU market share [2], but Google’s Ironwood TPU could capture 10-20% of Google Cloud’s market share over time [2]. Reddit arguments include bullish views (CUDA ecosystem lead, Blackwell cost-effectiveness) vs bearish views (valuation, margin pressure) [4].

- Cross-domain: NVDA’s CUDA ecosystem is a stronger barrier than pure performance metrics [2].

- Competitive: TPU competition may affect margins but not immediate market share [2].

- Market: AMD’s outperformance (1.53% Nov30) reflects alternative investment sentiment [0].

- Valuation: PE ratio (43.69x) exceeds semiconductor industry average [0].

- Margin Pressure: Gross margin declined 1.2% YoY [1].

- Competition: Google’s TPU could erode Google Cloud market share [2].

- AI Demand Growth: Q3 revenue up 62% YoY [1].

- Ecosystem Lock-in: CUDA platform retains developer loyalty [2].

- NVDA: $176.51 (Nov30), PE43.69, Q3 revenue $57B (+62% YoY), 80-90% AI GPU market share [0,1,2].

- AMD: $217.52 (+1.53% Nov30) [0].

- TPU Competition: Potential 10-20% share in Google Cloud [2].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.