NVIDIA (NVDA) Investment Analysis Amid Google TPU Competition and Valuation Debates

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

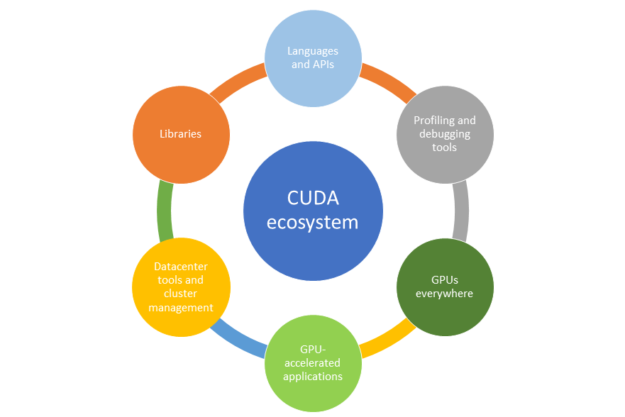

On 2025-11-28 (EST), a Reddit discussion debated NVIDIA’s investment merit amid Google TPU competition. Bullish arguments highlighted NVDA’s CUDA ecosystem lead and cost-effectiveness of Blackwell/Rubin chips, while bearish points cited high valuation (~50x PE claim) and margin compression risks from TPUs.

Market impact: NVDA’s real-time price (2025-11-30 UTC) is $176.51 (down 2.08% from close), underperforming the tech sector’s 0.53% gain. Over the past month, NVDA declined by 13%, with current price below its 20-day moving average ($188.71) indicating short-term weakness. Long-term performance remains strong (+943.20% over 3 years) driven by data center revenue (88.3% of FY2025 revenue).

Key data: PE ratio ~43.29x (lower than Reddit’s ~50x claim), net profit margin 53.01% (industry-leading), analyst consensus target of $250 (41.6% upside) with 73.4% “Buy” ratings. Bloomberg reports indicate Alphabet-Meta talks on TPU adoption, signaling growing competition. [0][1][2]

- Data Center Dependence: NVDA’s 88.3% revenue from data centers makes it vulnerable to TPU market share gains, but its high margin (53%) provides a buffer.

- Valuation vs Consensus: Despite elevated PE (~43x), analyst consensus remains bullish, suggesting confidence in long-term growth.

- Ecosystem vs Competition: The CUDA ecosystem is a key moat, but TPUs’ power efficiency and adoption by major players (like Meta) pose a medium-term threat.

- Competition: Google TPUs and AMD’s AI chips may erode market share and margins. Monitor TPU adoption by key customers. [1]

- Valuation: High PE ratio leaves NVDA vulnerable to earnings misses or sentiment shifts.

- Technical Weakness: Price below 20-day MA signals short-term downward momentum.

- Margin Compression: Price competition could reduce NVDA’s 53% net margin.

- Analyst Upside: Consensus target of $250 implies significant long-term upside if competition risks are mitigated.

- Ecosystem Lead: CUDA’s dominance among developers may slow TPU adoption.

NVDA’s current price ($176.51) is below its 20-day MA, with recent monthly decline (13%). It has a high PE (~43x) but industry-leading margin (53%) and strong analyst support. Competition from TPUs (Meta-Alphabet talks) is a key risk, but the data center segment’s growth and CUDA ecosystem are strengths. No investment recommendations are provided—this is for informational purposes only.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.