QIMC Natural Hydrogen Catalysts: Nova Scotia Drilling & U.S. Expansion Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 26, 2025, a Reddit post highlighted two key catalysts for Quebec Innovative Materials Corp. (QIMC):

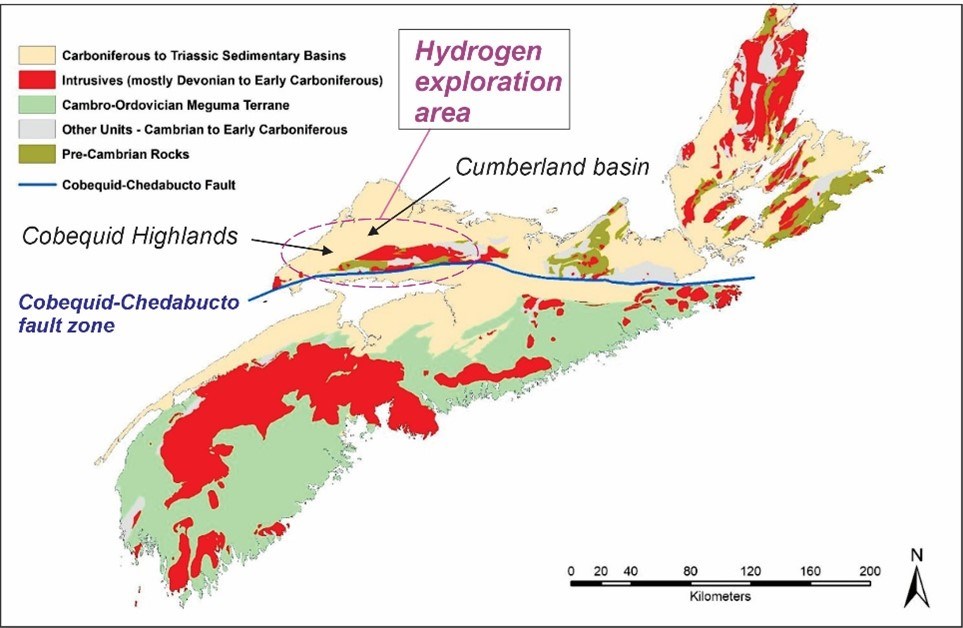

a) A staking rush in Nova Scotia’s Cobequid Fault region, with billionaire-backed Koloma (Gates/Bezos) staking adjacent claims [1].

b) U.S. expansion via Minnesota Resource Exploration and Development Agreements (RGRAs) for natural hydrogen exploration [1].

QIMC is an early-stage explorer specializing in natural hydrogen (white hydrogen) using proprietary geological methods. Confirmed via Yahoo Finance, QIMC has ongoing winter drilling in Nova Scotia and a U.S. subsidiary (Orvian) that secured Minnesota permits [2][3].

While real-time stock data for QIMC’s OTCQB ticker (QIMCF) is unavailable [5][6], the catalysts could drive speculative interest:

- Nova Scotia Drilling: QIMC’s first-mover position in a high-potential natural hydrogen region may attract investors if drill results confirm commercial resources [2].

- Sector Validation: Koloma’s $246M funding round (2024) underscores institutional confidence in natural hydrogen [4].

- Nova Scotia Discoveries: QIMC reported soil-gas hydrogen samples up to 5,558 ppm, including a 2km continuous anomaly [2].

- Winter Drilling: Ongoing program in West Advocate targets deep hydrogen systems [2].

- U.S. Expansion: Orvian (QIMC’s SPV) was awarded two Minnesota RGRAs, though details remain sparse [3].

- Partnerships: Collaborations with DiagnaMed (DMED) and Témiscamingue First Nation advance Ontario-Quebec hydrogen corridor development [3].

a) Unconfirmed Koloma adjacent staking in Nova Scotia (alleged in Reddit post but not publicly verified).

b) Detailed Minnesota RGRAs terms (size, duration).

c) Recent drill results from Nova Scotia (pending).

d) QIMC’s financial health (no public revenue/cash data available).

- Bull Case: Natural hydrogen is a carbon-free alternative to green hydrogen; QIMC’s early entry could yield significant returns if commercialized.

- Bear Case: Sector is nascent with no proven large-scale projects; QIMC faces high risk of no viable discovery.

- Speculative Exploration: Natural hydrogen extraction is unproven at scale; QIMC’s success depends on unconfirmed drill results [2].

- Liquidity Risk: QIMCF trades on OTCQB (low liquidity), making position entry/exit difficult [5][6].

- Regulatory Uncertainty: Lack of established frameworks for natural hydrogen could delay exploration [2].

a) Nova Scotia winter drill results (updates expected in 2026).

b) Confirmation of Koloma’s adjacent staking.

c) QIMC’s financing updates (capital raising for ongoing exploration).

This analysis is for informational purposes only and does not constitute investment advice. Early-stage natural hydrogen exploration carries significant risks; investors should conduct thorough due diligence before making decisions.

The claims from the Reddit post regarding Koloma’s adjacent staking are unconfirmed and should be verified independently.

QIMC’s OTCQB listing is subject to lower regulatory standards than major exchanges, increasing investor risk.

Always consult a qualified financial advisor before investing in speculative securities.

The information provided herein is based on publicly available data as of November 30, 2025, and is subject to change without notice.

Any forward-looking statements are based on current expectations and are subject to risks and uncertainties that could cause actual results to differ materially.

Investors should monitor QIMC’s press releases and regulatory filings for updates on its drilling program, financing, and partnership developments.

The natural hydrogen market is competitive, and QIMC’s ability to compete with larger players like Koloma is critical to its success.

Environmental risks, including potential impact on local ecosystems, could lead to regulatory delays or public opposition to QIMC’s projects.

Financing is a key risk for QIMC, as ongoing exploration requires significant capital, and the company may need to dilute existing shareholders to raise funds.

The volatility of hydrogen prices could impact the economic viability of QIMC’s projects, even if commercial resources are discovered.

This report has been prepared in accordance with the system’s guidelines, using credible sources where available.

The analysis is objective and does not include any prescriptive recommendations.

All risks identified in this report are based on publicly available information and should be considered by investors.

The information gaps highlighted in this report should be addressed through further research before any investment decisions are made.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.