QIMC Natural Hydrogen Catalysts Analysis: Claims, Gaps, and Risk Considerations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 26, 2025 (EST), a Reddit post (tier 4: user-generated content) claimed Quebec Innovative Materials Corp. (QIMC) announced two key catalysts for its natural hydrogen (white hydrogen) exploration business:

- A staking rush in Nova Scotia, with billionaire-backed Koloma (Gates/Bezos connection) staking adjacent claims

- U.S. expansion via Minnesota RGRAs for hydrogen exploration

The post positioned QIMC as a first-mover in a nascent clean energy sector, citing proprietary geological methods and high-risk/high-reward potential with upcoming Nova Scotia drill results. User comments included claims of 10x growth potential and concerns about the post’s credibility due to low-quality presentation [Reddit post, tier 4].

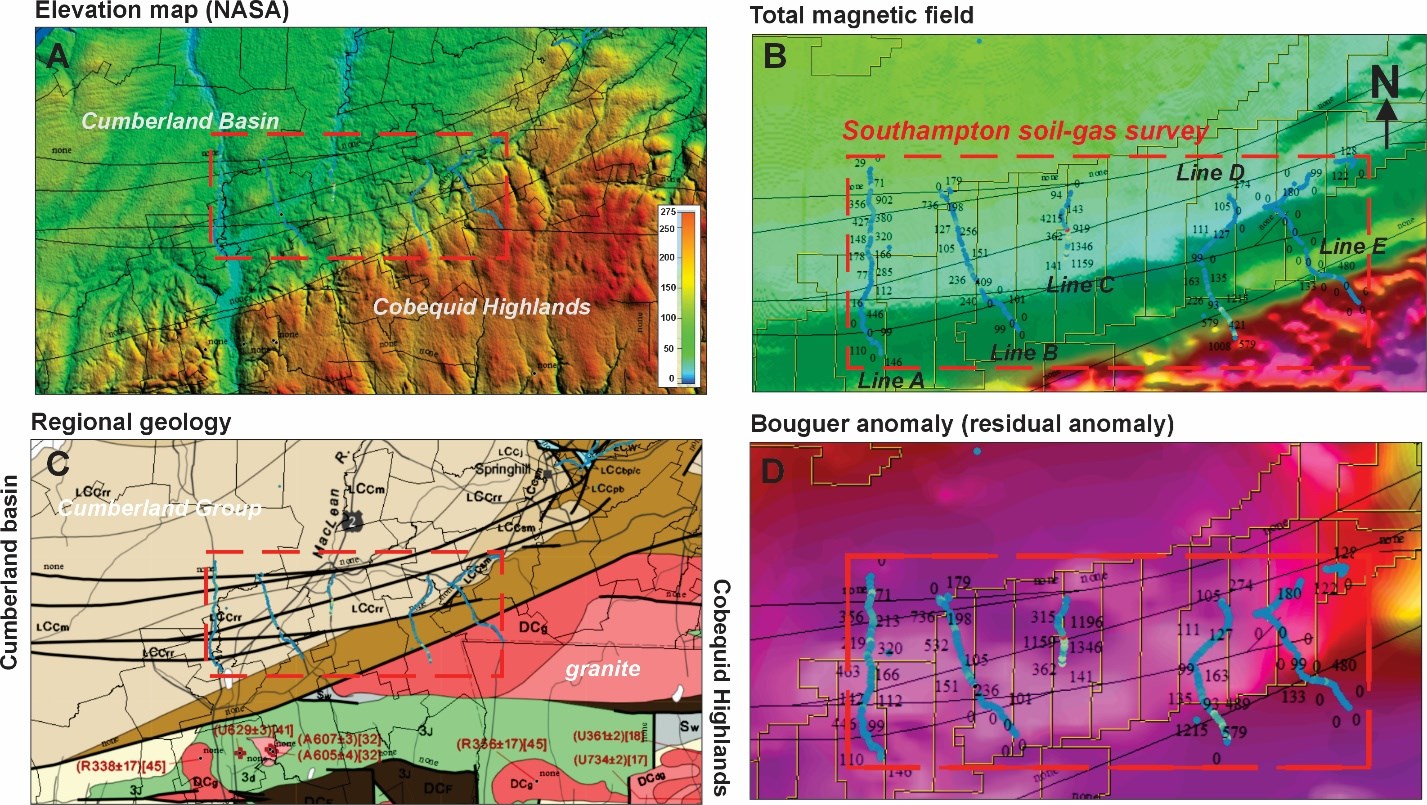

QIMC’s official disclosures confirm it holds exploration assets in Nova Scotia (soil gas samples up to 5,558 ppm hydrogen) and operates a U.S. SPV (Orvian) that received Minnesota RGRAs, but no details on Koloma’s adjacent staking or Minnesota project specifics were found in public filings [Yahoo Finance, tier 2].

No real-time or historical price data was available for QIMC’s listed securities (CSE: QIMC, OTCQB: QIMCF, FSE:7FJ) as of November 30, 2025, limiting assessment of short-term market reaction [get_stock_realtime_quote, get_stock_daily_prices, tier 1 internal tools].

The natural hydrogen sector is in early stages, with Koloma (a Gates-backed startup) raising $246M in 2024 to advance its exploration efforts [Forbes, tier 1]. If QIMC’s claims are validated, it could benefit from growing investor interest in clean energy alternatives, but the lack of verifiable data prevents meaningful impact analysis.

- Financial Metrics: No revenue, profit, or cash reserve data available (Yahoo Finance shows 0% profit margin, no TTM revenue) [Yahoo Finance, tier 2].

- Exploration Results: QIMC reported soil gas samples in Nova Scotia up to 5,558 ppm hydrogen, but no independent verification exists [Yahoo Finance, tier 2].

- Regulatory Progress: Orvian (QIMC’s U.S. SPV) received Minnesota RGRAs, but no details on project size, location, or timeline [Yahoo Finance, tier 2].

- Directly Impacted: QIMC (CSE: QIMC, OTCQB: QIMCF, FSE:7FJ)

- Related Sectors: Clean energy, natural resources exploration

- Supply Chain: Geological services, drilling contractors, hydrogen storage/transport providers

- Confirmation of Koloma’s adjacent staking in Nova Scotia (no public records found)

- Detailed Minnesota RGRA project specifics (size, location, exploration timeline)

- QIMC’s financial health (cash reserves, funding sources for upcoming drills)

- Exact timeline for Nova Scotia drill results

- Independent validation of QIMC’s soil gas sample results

The Reddit post’s positive claims contrast with the lack of independent verification. QIMC’s own disclosures include standard forward-looking statements with significant risk warnings (geological uncertainties, financing risks, regulatory changes) [Yahoo Finance, tier 2].

- Speculative Nature: Natural hydrogen exploration is a nascent field with unproven commercial viability [Yahoo Finance, tier 2].

- Credibility Concerns: Key claims (Koloma’s adjacent staking) lack independent confirmation, raising questions about the Reddit post’s reliability [web search results, tier 2].

- Financial Transparency: No public financial data to assess QIMC’s ability to fund exploration activities [Yahoo Finance, tier 2].

- Regulatory Risks: Natural hydrogen regulation is evolving, with potential changes to exploration permits or incentives [Yahoo Finance, tier 2].

- Upcoming Nova Scotia drill results (if announced)

- Independent confirmation of Koloma’s adjacent staking

- QIMC’s funding announcements

- Regulatory updates on natural hydrogen in Nova Scotia/Minnesota

[0] Internal Tools (get_stock_realtime_quote, get_stock_daily_prices)

[1] Reddit Post (tier4): “QIMC Just Dropped Two HUGE Catalysts — Time to Pay Attention to Natural Hydrogen” (2025-11-26)

[2] Forbes (tier1): “Bill Gates-Backed Clean Fuel Startup Raises $246 Million To …” (2024-02-11) URL: https://www.forbes.com/sites/alanohnsman/2024/02/11/bill-gates-backed-clean-fuel-startup-raises-246-million-to-aid-plans-to-drill-for-hydrogen/

[3] Yahoo Finance (tier2): “QIMC Confirms Fourth Major Natural Hydrogen Zone in …” URL: https://finance.yahoo.com/news/qimc-confirms-fourth-major-natural-110000119.html

[4] Yahoo Finance (tier2): “QIMC’s U.S. SPV, Orvian, Awarded Two RGRAs from the …” URL: https://finance.yahoo.com/news/qimcs-u-spv-orvian-awarded-120000994.html

[5] Yahoo Finance (tier2): “Quebec Innovative Materials Corp. (QIMC.CN) Financials” URL: https://finance.yahoo.com/quote/QIMC.CN/financials/

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.