Meta-Google TPU Deal Rumors: Impact on GOOG, META, and NVDA Market Dynamics

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

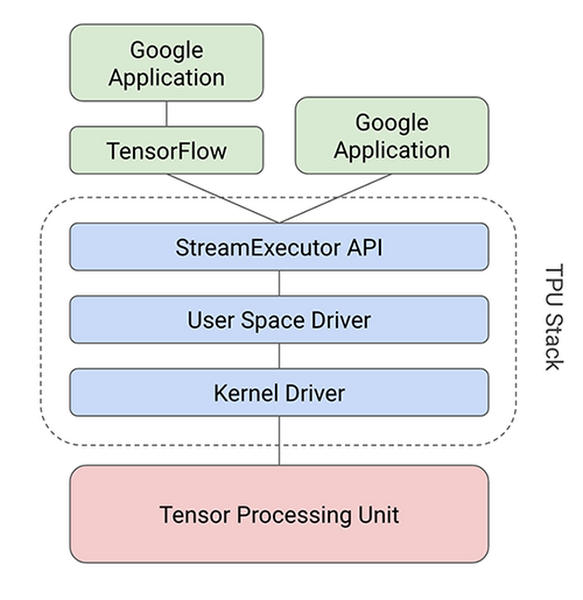

This analysis originates from a Reddit discussion published on November 24, 2025, followed by external reports confirming Meta Platforms’ (META) advanced talks with Alphabet (GOOG) about using Google’s Tensor Processing Units (TPUs) [1][2][5]. The news drove significant stock movements: GOOG recorded an 85.91% gain from May to November 2025 [0], META rose by 2.26% [0], and Nvidia (NVDA) fell by 2.08% [0]. The Technology sector increased by 0.53% on November 24 [0], reflecting broader AI infrastructure optimism.

Cross-domain connections include:

- Meta’s potential cost savings from TPUs (instead of NVDA’s GPUs) could boost earnings [1].

- Google’s TPUs may capture up to 20% of the AI chip market over the next few years [4], challenging NVDA’s 80-90% dominance [4].

- Broadcom (AVGO), co-developer of Google’s TPUs, saw an 11.10% stock rise on November 29 [3].

- Risks:

- NVDA: Loss of Meta as a key customer and potential market share erosion [3][4].

- GOOG: Execution risk in scaling TPU production to meet Meta’s demand [1].

- META: Integration risk of TPUs into existing data center infrastructure [2].

- Opportunities:

- GOOG: New revenue stream from TPU rentals and sales [1].

- META: Reduced supply chain risk and cost efficiency [2].

- AVGO: Benefits from co-development of TPUs [3].

- Stock Performance: GOOG (+85.91% May-Nov), META (+2.26% recent), NVDA (-2.08% recent) [0].

- Market Caps: GOOG ($3.86T), NVDA ($4.30T), META ($1.63T) [0].

- AI Chip Market Share: NVDA (80-90% [4]), GOOG (projected 10-20% [4]).

This summary provides objective data for decision-making without prescriptive recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.