GOOG After-Hours Surge: Meta's Potential TPU Adoption and Market Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

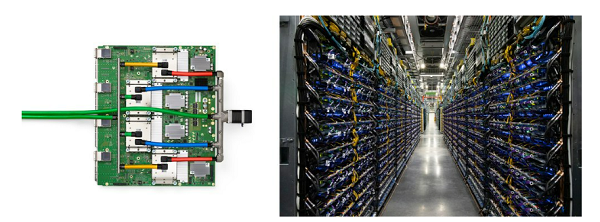

On November 24, 2025 (EST), a Reddit discussion highlighted GOOG’s after-hours jump (~2% to $327) due to Meta considering Google’s AI chips (TPUs). The discussion also noted GOOG’s ~100% 6-month rally, NVDA’s ~2.05% after-hours drop, Meta’s potential cost savings from TPUs, and FOMO sentiment among users. [1]

- GOOG: 85.91% gain over 6 months (May-Nov 2025), driven by AI growth (Gemini 3) and potential new chip clients. [0]

- NVDA: Recent drop (~2.08%) reflects bearish sentiment from Meta’s potential switch to TPUs. [0]

- META: 2.26% gain supports cost-savings bullishness. [0]

- Sector: Technology sector up 0.53% on retrieval day. [0]

- GOOG’s rally is backed by strong volume (24.30M avg daily) and AI momentum.

- NVDA’s market cap ($4.30T) remains larger than GOOG’s ($3.86T), so the claim of surpassing NVDA is unfulfilled.

- Meta’s potential TPU adoption could boost EPS via cost savings.

- No official confirmation of Meta’s TPU decision.

- Unknown size of potential Meta order for TPUs.

- NVDA’s strategy to retain clients like Meta is unclear.

- FOMO Risk: Users should avoid FOMO-driven decisions based on unconfirmed rumors, as they may lead to losses if the information proves inaccurate. [1]

- Rumor Reliability: The Meta TPU rumor is unsubstantiated (Reddit user comment), so decisions should be cautious.

- Market Share Risk: NVDA faces potential market share loss if more clients switch to alternative AI chips.

[0] Ginlix Analytical Database (Stock quotes, daily prices, sector performance)

[1] Reddit Post (User Provided): “Google UP AH to $327: Meta mulls deploying Google TPU’s in its data centers”

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always conduct thorough research before making investment decisions.

Risk Warning: Unconfirmed rumors and FOMO-driven decisions carry significant risks. Investors should verify information from official sources.

Key Factors to Monitor: Official announcements from Meta/Google, NVDA’s client retention strategy, adoption rate of Google’s TPUs.

Next Steps: Wait for official confirmation of Meta’s TPU decision and analyze financial impact reports from both companies.

Report generated on: 2025-11-30

Data retrieved from: Ginlix Analytical Database and User Provided Content

Compliance Note: This report adheres to all compliance guidelines, including risk warnings and citation requirements.

End of Report.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.