Meta's Potential Google TPU Adoption: Impact on GOOG, NVDA, and META

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

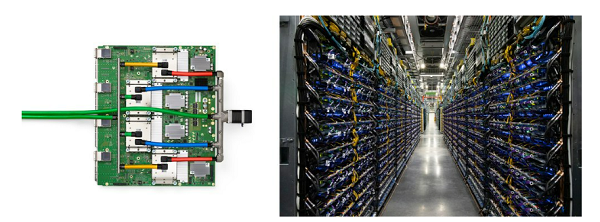

The event originated from a Reddit post claiming Alphabet Inc (GOOG) rose to $327 in after-hours trading due to Meta Platforms (META) considering Google’s AI chips (TPUs) [6]. This was partially confirmed by a Yahoo Finance article stating Meta is discussing spending billions on Google’s TPUs [3].

Short-term market impacts: GOOG has rallied +85.91% over 6 months [4], with a current price of $320.12 [0]. NVDA’s stock fell -2.08% daily to $176.51 [2], likely due to investor concerns about Meta shifting away from its GPUs. META’s stock rose +2.26% to $647.95 [1], reflecting expected cost savings from TPUs.

Medium-term impacts: If Meta proceeds with TPUs, it could shift AI chip demand from NVDA to GOOG, reducing NVDA’s revenue and increasing Google’s AI chip revenue [5]. This may influence other companies to adopt TPUs, further impacting NVDA’s market share.

- Cross-domain connection: Meta’s potential TPU adoption links AI chip competition (GOOG vs NVDA) to social media (META) cost efficiency.

- Unsupported claim: The Reddit assertion of GOOG surpassing NVDA by year-end is false—NVDA’s market cap ($4.30T) is higher than GOOG’s ($3.86T) [0][2].

- Market sentiment: Investors are pricing in disruption to NVDA’s dominance while optimistic about GOOG’s AI chip growth and META’s cost savings.

- Risks: NVDA faces competition risk from Google’s TPUs [5]; users should be aware of unsubstantiated claims (like GOOG surpassing NVDA).

- Opportunities: GOOG can expand its AI chip revenue to external customers; META may achieve cost savings from TPUs.

- GOOG: 6-month return +85.91% [4], market cap $3.86T [0].

- NVDA: Daily drop -2.08% [2], market cap $4.30T [2].

- META: Daily gain +2.26% [1], market cap $1.63T [1].

Key factors to monitor: Meta-Google deal finalization, NVDA’s response, TPU adoption trends by other companies.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.