GOOG After-Hours Surge Analysis: Meta Mulls Google TPU Deployment Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

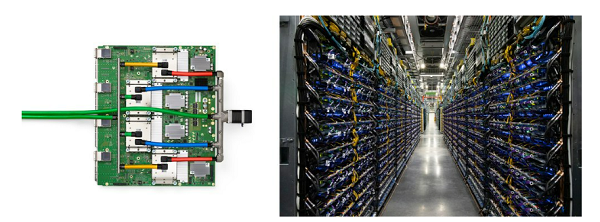

Alphabet Inc. (GOOG) experienced a ~2% after-hours surge to $327 on November 24, 2025, driven by unconfirmed reports that Meta Platforms (META) is in talks to deploy Google’s Tensor Processing Units (TPUs) in its data centers [1]. This development positions Google as a direct competitor to NVIDIA (NVDA) in the AI chip market, a segment where NVDA currently holds significant dominance [0].

GOOG has rallied ~52% since mid-September, fueled by positive reception of its Gemini 3 AI model [0]. Conversely, NVDA shares fell ~2.05% in after-hours trading, reflecting investor concerns over potential market share loss [0]. META’s potential adoption of TPUs could lead to substantial cost savings, as indicated by user discussions highlighting EPS benefits from reduced GPU procurement costs [1].

- AI Chip Competition: Google’s TPUs are emerging as a viable alternative to NVDA’s GPUs, signaling increased competition in the AI infrastructure space [0].

- Revenue Diversification: For GOOG, expanding TPU sales beyond internal use diversifies its revenue streams, reducing reliance on advertising [0].

- Cost Optimization: META’s consideration of TPUs underscores the growing focus on cost efficiency in AI infrastructure, a trend that may reshape supplier dynamics [1].

- Risks:

- Unconfirmed reports: The original source (Reddit) is a tier-3 source, so the talks may not materialize [1].

- Overvaluation: GOOG’s ~52% rally since mid-September raises concerns about potential overvaluation if the TPU deployment does not scale as expected [0].

- Competitive response: NVDA may counter with price cuts or new product launches to retain market share [0].

- Opportunities:

- For GOOG: Capturing a share of Meta’s AI chip demand could boost long-term revenue [0].

- For META: Cost savings from TPUs may improve margins and EPS [1].

- GOOG: After-hours rise of ~2% to $327; 52% rally since mid-September; market cap of $3.86T [0].

- NVDA: After-hours drop of ~2.05%; current market cap of $4.30T (larger than GOOG) [0].

- META: Potential cost savings from TPU adoption; positive sentiment in after-hours [0].

- Key Notes: The claim that GOOG will surpass NVDA by year-end is unsupported by current market cap data [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.