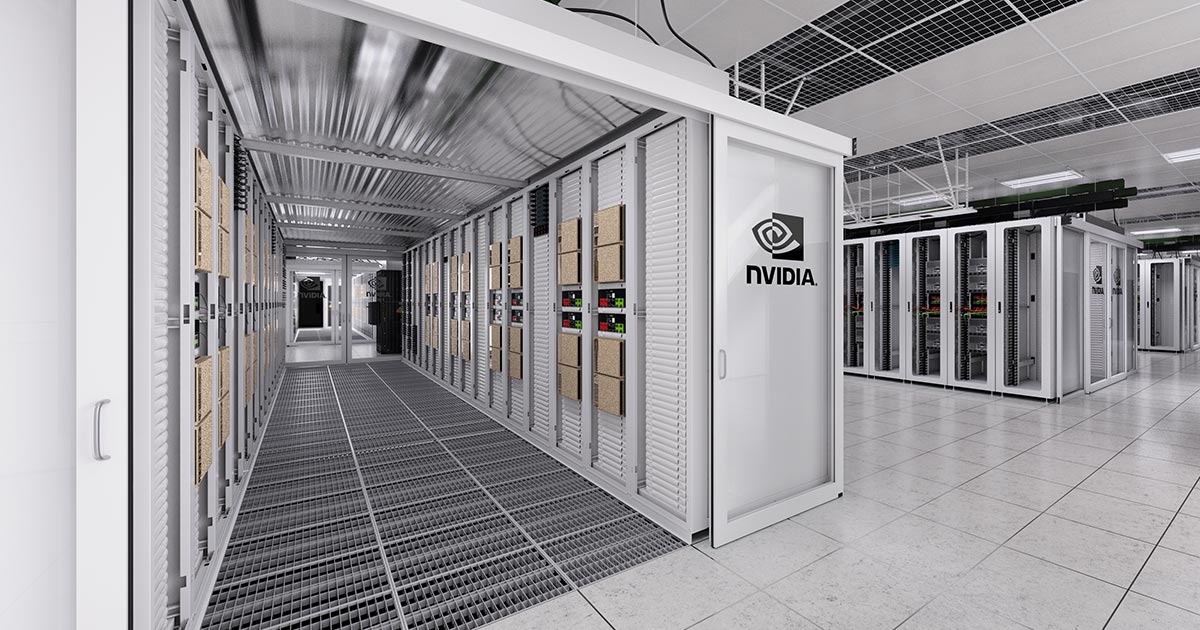

NVIDIA Valuation & TPU Competition Analysis (2025 Reddit Discussion Event)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On 2025-11-28 (EST), a Reddit discussion analyzed whether NVIDIA (NVDA) remains a buy amid competition from Google’s Tensor Processing Units (TPUs). Key arguments included:

- NVIDIA’s ecosystem lead and cost-effectiveness of Blackwell/Rubin chips vs. TPUs

- Concerns over NVDA’s ~50x PE ratio (per discussion) and margin risks from TPU competition

- TPUs’ power efficiency advantage

- AMD as an alternative due to early growth cycle

The discussion highlighted conflicting views on NVDA’s valuation and competitive position in the AI chip market [Event Source: Reddit Discussion, 2025-11-28].

NVDA’s stock price has declined 13% in the past month (to $176.51 as of 2025-11-30), reflecting market concerns over TPU competition [0]. The stock closed down 2.08% on 2025-11-30 [1].

- Competition: Google’s TPUv7 Ironwood offers a ~44% lower total cost of ownership (TCO) than NVIDIA’s GB200 server for full 3D Torus configurations, posing a threat to NVDA’s market share in cost-sensitive workloads [3, TechMeme; 4, SemiAnalysis].

- Ecosystem Moat: NVDA retains a strong advantage via its CUDA platform, which is widely adopted by AI developers [0].

- Order Backlog: NVDA has a $500B backlog for Blackwell/Rubin chips, indicating sustained demand despite competition [5, Investing.com].

Analysts maintain a

| Metric | Value | Source |

|---|---|---|

PE Ratio |

43.29x | [0] |

Market Cap |

$4.3T | [1] |

Q3 2025 Revenue |

$57B (+62% YoY) | [0] |

Data Center Revenue |

$51.2B (+66% YoY) | [0] |

Net Profit Margin |

53.01% | [0] |

Blackwell/Rubin Backlog |

$500B | [5, Investing.com] |

TPUv7 TCO Advantage |

~44% lower than GB200 server | [4, SemiAnalysis] |

Analyst Target Upside |

41.6% | [0] |

- The Reddit discussion’s PE ratio claim (~50x) is slightly overstated—actual PE is 43.29x [0].

- NVDA’s data center segment dominates revenue (88.3% of FY2025 revenue), making it the core driver of growth [0].

- TPUv7’s TCO advantage is significant, but NVDA’s large backlog suggests strong demand for its latest chips [5, Investing.com].

- Directly Impacted: NVDA (NASDAQ)

- Related Sectors: Semiconductors, AI Infrastructure

- Competitors: Google (TPUs), AMD (mentioned in discussion), Broadcom (supplies TPUs to Google)

- Supply Chain: NVDA’s upstream suppliers (e.g., TSMC for chip manufacturing) and downstream customers (hyperscalers like AWS, Azure)

- Workload-Specific Cost-Effectiveness: The Reddit discussion claimed Blackwell/Rubin chips are more cost-effective than TPUs, but SemiAnalysis data shows TPUv7 has lower TCO for certain configurations. Further analysis is needed to compare performance across training vs. inference workloads.

- AMD’s Competitive Position: The discussion mentioned AMD as an alternative, but data on AMD’s AI chip market share and growth trajectory is limited in available sources.

- Margin Impact: While NVDA currently has a 53.01% net profit margin [0], the extent to which TPU competition will erode margins remains unclear (Seeking Alpha estimates up to 10% revenue risk, but margin impact is unquantified) [6, Seeking Alpha].

- Geopolitical Risks: Underground networks smuggling NVDA chips into China (despite export controls) could lead to regulatory scrutiny [2, Webpronews].

- Long-Term Trends: Hyperscalers are investing in custom chips (TPUs, Graviton), which may reduce demand for general-purpose GPUs over time [6, Seeking Alpha].

- Margin Pressure: Google’s TPUv7 TCO advantage could force NVDA to reduce pricing or lose market share in cost-sensitive inference workloads [4, SemiAnalysis].

- Regulatory Scrutiny: Smuggling of NVDA chips into China may result in stricter export controls or fines [2, Webpronews].

- Custom Chip Competition: Hyperscalers’ custom chips (TPUs, AWS Graviton) could displace NVDA’s GPUs in long-term data center builds [6, Seeking Alpha].

- Quarterly data center revenue growth

- Blackwell/Rubin adoption rates

- Gross margin trends

- TPU market share gains

- Regulatory updates on chip exports

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.