Altimmune (ALT) Valuation Debate & Catalyst Analysis: Upcoming 48-Week Data, Short Interest, and Acquisition Potential

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

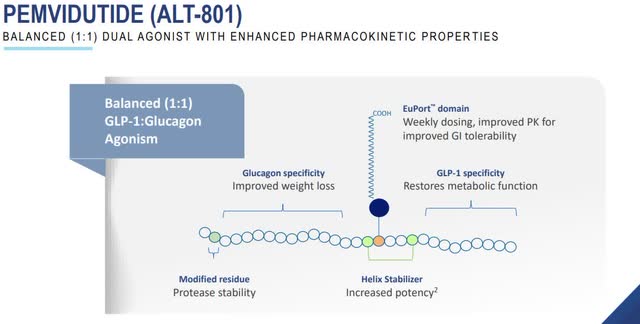

Altimmune (ALT) is a biotech firm at a critical juncture, with market sentiments divided over its valuation and upcoming catalysts [0]. The bullish case centers on pemvidutide, its lead GLP-1/glucagon agonist, which delivered strong phase IIb MASH results (52-58% of patients meeting primary endpoints) [1], positioning the company for a $1B+ opportunity [1]. Key upcoming catalysts include the Q4 2025 final 48-week IMPACT trial data readout and an End of Phase 2 FDA meeting [0]. A 21% short interest could amplify upside if positive news emerges [0].

Bearish perspectives argue that comparing ALT to peers acquired for billions is premature without peer-reviewed 48-week data confirming sustained benefit [0]. Neutral views highlight the company’s transparency, as seen in the recent Lancet publication of phase II data (with an 180-page supplement, exceeding typical lengths) [0].

Business dynamics include expansion into alcohol use disorder (AUD) and alcohol-related liver disease (ALD) studies, fueling acquisition rumors [2]. Q3 2025 results show a strong cash position supporting ongoing R&D [4,5], while 51% retail ownership may contribute to volatility [7].

Cross-domain connections link clinical progress (biotech) to market dynamics (short interest, acquisition rumors) and investor behavior (retail dominance). Positive phase IIb results have already sparked acquisition speculation [2], and pending 48-week data will be pivotal for clinical validation and valuation [0]. The combination of 21% short interest and 51% retail ownership suggests potential for sharp price movements on catalyst outcomes [0,7].

Deeper implications include big pharma’s patent cliffs, increasing demand for innovative MASH treatments like pemvidutide [0]. A positive 48-week readout could attract strategic partnerships or acquisitions [1,2].

Altimmune (ALT) has a lead MASH drug with promising phase IIb results. Upcoming Q4 2025 catalysts (48-week data, FDA meeting) and 21% short interest drive discussion. The company exhibits high transparency (Lancet publication) and cash reserves, but faces risks from pending data and premature valuation claims. Analyst projections suggest significant upside if catalysts are met, though retail dominance (51%) may add volatility. This summary provides objective context for market dynamics surrounding ALT without prescriptive recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.