NVIDIA (NVDA) Investment Case: TPU Competition, Valuation, and Market Dynamics

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

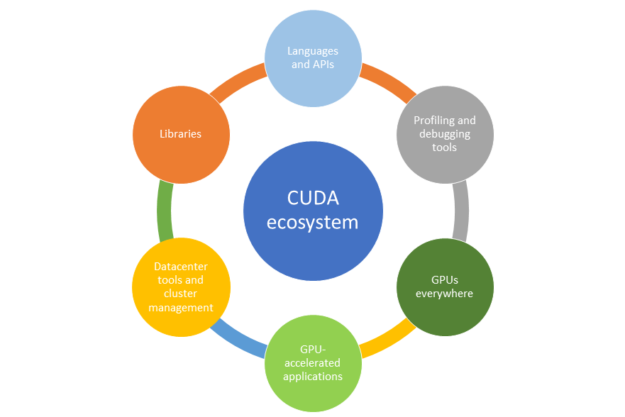

This analysis combines insights from a Reddit discussion [4] and internal market data [0][1][3]. NVIDIA’s current price is $176.51 (down 2.08% daily and -1.76% over 30 days [1]). Its PE ratio is ~43.69 (lower than Reddit’s claimed ~50 [0]). Reddit debates highlight bullish factors like CUDA ecosystem lock-in (making TPU replacement infeasible [4]) and Blackwell/Rubin chips’ claimed cost-effectiveness vs TPUs, while bearish points include high valuation and TPU competition risks. Market data shows short-term momentum is negative (trading below the 20-day MA of $188.71 [1]), but long-term demand remains strong (AI firms seeking loans for NVDA chips [3]).

- Ecosystem Moat: CUDA’s dominance is a critical competitive advantage beyond raw performance—replacing NVIDIA with TPUs is currently not feasible [4].

- Valuation Context: The PE ratio (~43.69) is lower than Reddit’s claim but still high; justification depends on sustained AI growth.

- Demand vs Momentum: Strong long-term demand (chip loan requests [3]) contrasts with weak short-term momentum (below 20-day MA [1]).

- Valuation Risk: High PE ratio (~43.69) leaves little room for growth disappointment [0].

- Competition Risk: TPUs could reduce NVIDIA’s pricing power and margins [4].

- Short-Term Momentum: Trading below the 20-day MA indicates potential near-term downside [1].

- Strong Demand: AI firms seeking loans for NVDA chips signal robust market need [3].

- Ecosystem Lead: CUDA lock-in provides long-term competitive stability [4].

- Innovation Potential: Blackwell/Rubin chips’ claimed cost-effectiveness could strengthen market position [4].

- Core Metrics: $176.51 price, ~43.69 PE ratio, -1.76% 30-day change, 20-day MA $188.71.

- Debate Highlights: Bullish (CUDA lead, Blackwell/Rubin cost-effectiveness); Bearish (high PE, competition risks).

- Information Gaps: Financial indicators (failed retrieval [2]), independent verification of chip performance claims.

This analysis is for informational purposes only and not investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.