NVIDIA (NVDA) Valuation & Competitive Position Analysis Amid TPU Competition

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

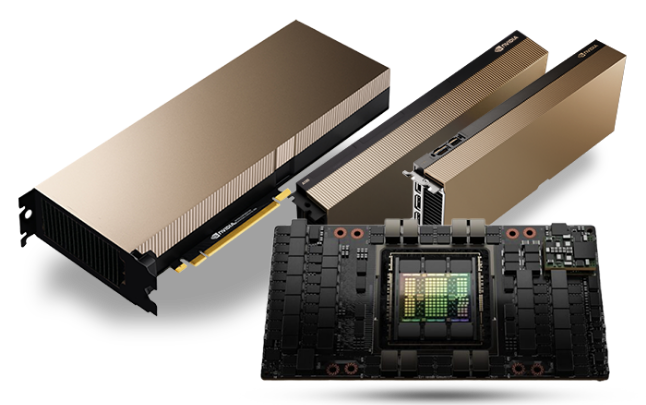

The Reddit discussion [0] highlighted bullish arguments (ecosystem lead, cost-effective Blackwell/Rubin chips) and bearish points (overvaluation, margin risks from TPUs). Market data shows NVDA’s current price at $176.51 [0], down 2.08% recently, but with a 41.6% upside from analyst consensus target of $250 [3]. Demand remains strong as evidenced by a US firm seeking a $300M loan to buy NVDA chips [2], and Elon Musk’s endorsement of NVDA as an AI leader [2]. Competitive analysis indicates TPUs have a 44% TCO advantage now [1], but NVIDIA’s Rubin chips (2026-2027 launch) aim to counter this [1].

Cross-domain insights include the tension between short-term TPU TCO pressure and long-term ecosystem strength (CUDA) that underpins NVDA’s market position. Another insight is that despite competition, demand for NVDA chips remains robust, suggesting that the ecosystem moat is still effective. Additionally, analyst consensus remains bullish (73.4% Buy ratings [3]) even with valuation concerns, indicating confidence in future growth.

Key metrics include NVDA’s $176.51 current price [0], 53.01% net profit margin [3], 88.3% data center revenue share [3], and $250 analyst consensus target [3]. Competitive data: TPUs have a TCO advantage now, but Rubin chips are in the pipeline [1]. Demand signals: $300M loan for chip purchases [2]. Expert view: Elon Musk’s endorsement [2]. This summary provides objective context for decision-making without prescriptive recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.