Analysis of Strong Performance of Hangyuwei (300053): Driven by Commercial Aerospace Concept and Market Prospects

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the strong stock pool information from tushare_strong_pool. Hangyuwei (300053) entered the pool with strong performance on December 1, 2025 [0]. As a commercial aerospace concept stock, the company rose by 3.19% that day, and its heat ranking climbed 13 places to 108 [0]. Regarding the market background, A-shares opened high and moved higher that day, with the Shanghai Composite Index reclaiming the 3900-point mark, and the total turnover of the two markets exceeding 1.8 trillion yuan [1]. The consumer electronics and communication sectors saw a surge of limit-up stocks [2], which boosted related concept stocks.

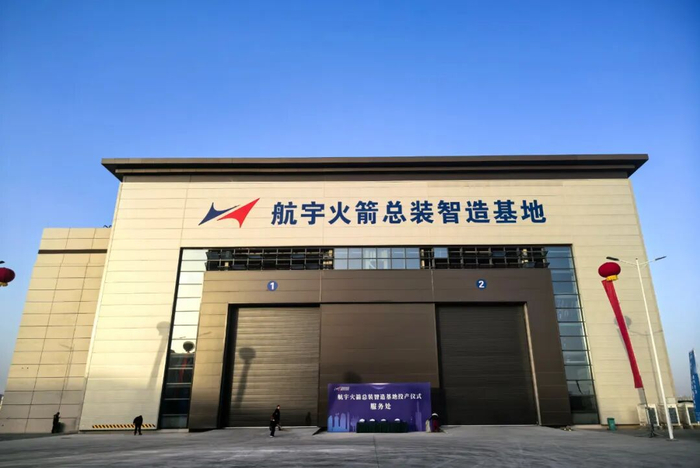

Hangyuwei’s main business covers areas such as aerospace electronics, satellite big data, artificial intelligence, and AI chips [0]. It won multiple honors including China’s Top 100 Commercial Aerospace Enterprises in 2024 [0], and occupies an important position in the commercial aerospace industry. At the industry level, commercial aerospace and satellite internet became market hotspots in 2025 [0], and policy support and technological progress drove the overall strength of the sector [2].

On December 1, 2025, Hangyuwei’s stock price rose by 3.19%, with trading volume and attention increasing simultaneously [0]. From a technical perspective, the stock benefited from the sector’s surge of limit-up stocks [2], while its own fundamental advantages (such as core technology reserves and industry qualifications) enhanced market confidence [0].

- Cross-domain Integration Advantage: Hangyuwei’s integrated application of commercial aerospace and AI technologies (such as satellite big data analysis and intelligent image recognition) gives it differentiated competitiveness [0].

- Industry Policy Sensitivity: Policy trends in the commercial aerospace field (such as the national aerospace development plan) will directly affect the company’s future performance [0].

- Market Heat Conduction: The overall strength of A-shares that day (Shanghai Composite Index reclaiming the 3900-point mark) provided a good environment for individual stock performance [1], and the sector linkage effect was significant [2].

- Industry Growth Space: The rapid development of the commercial aerospace and satellite internet industry brings long-term growth opportunities for the company [0].

- Technology Advantage Monetization: The company’s technical accumulation in embedded chips, avionics systems, and other fields is expected to be converted into market share [0].

- Market Volatility Risk: Short-term market heat may lead to stock price fluctuations; attention should be paid to the sustainability of the sector [0].

- Increased Industry Competition: The increase in participants in the commercial aerospace field may compress profit margins [0].

Hangyuwei (300053)'s strong performance stems from the combination of industry trends and its own fundamentals. Investors should pay attention to industry policy dynamics, the company’s technological progress, and changes in the overall sector market [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.